100 Va Refinance Cash Out

If you want to take cash out of your home equity or refinance a non va loan into a va backed loan a va backed cash out refinance loan may be right for you.

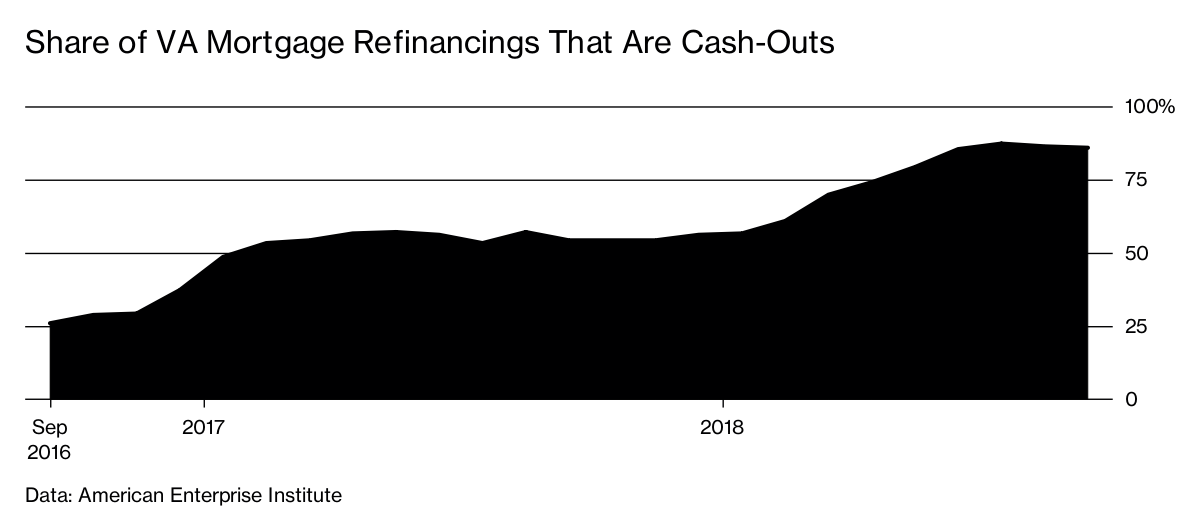

100 va refinance cash out. Talk to a lender. Here are a few things to keep in mind. A va refinance transaction involves repayment of your current real estate debt from the proceeds of your new va mortgage that has the same borrower s using the same property. Under new 2020 rules for va loans veterans can now use the va cash out loan to refinance up to 100 of the home s value.

Guidelines and requirements can vary by lender and other factors. The short answer is yes however it does depend on the lender. With regard to a cash out refinance the maximum loan amount can represent no more than 100 percent of the property s value. The va cash out refinance is the only loan that allows you to refinance up to 100 of the value of your home.

Until recently quicken loans clients had to leave 10 equity in their homes when doing a va cash out refinance. The va cash out refinance allows homeowners to tap into their home equity up to 100 of the current value. Since 1944 va and private industry partners have helped deliver the dream of homeownership to generations of veterans servicemembers and eligible surviving spouses. The process for getting a va cash out refinance is similar to the process for a typical va purchase loan including credit underwriting an appraisal and more.

Many lenders have overlays capping the refinance at a maximum ltv loan to value of 90 or less on a va refinance. This value is determined by reviewing a new appraisal on the property. Purchase cash out refinance home loans in their own words what home means. A va backed cash out refinance loan lets you replace your current loan with a new one under different terms.

That means va homeowners can use the cash out refinance to tap all of. If you re eligible for a va loan and looking to utilize your home equity to take cash out for any reason you can now get a loan for up to the 100 of the appraised value of your house in many cases. Check current rates and 2019 guidelines. If you do not currently have a va loan you must meet at least one of the following criteria to be eligible.

Cash out refinances must be used only for a primary residence.