35 Year Term Life Insurance

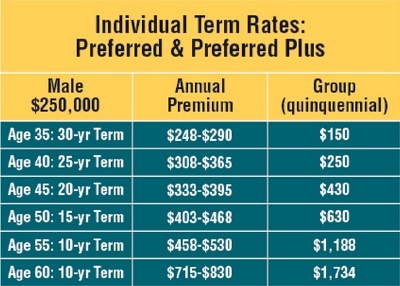

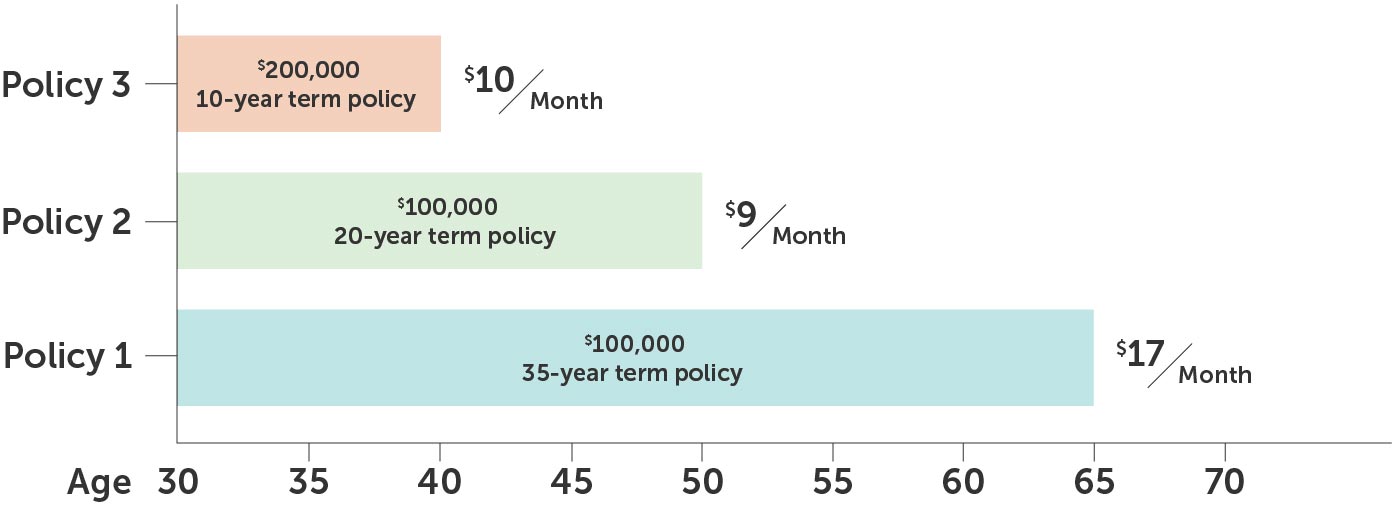

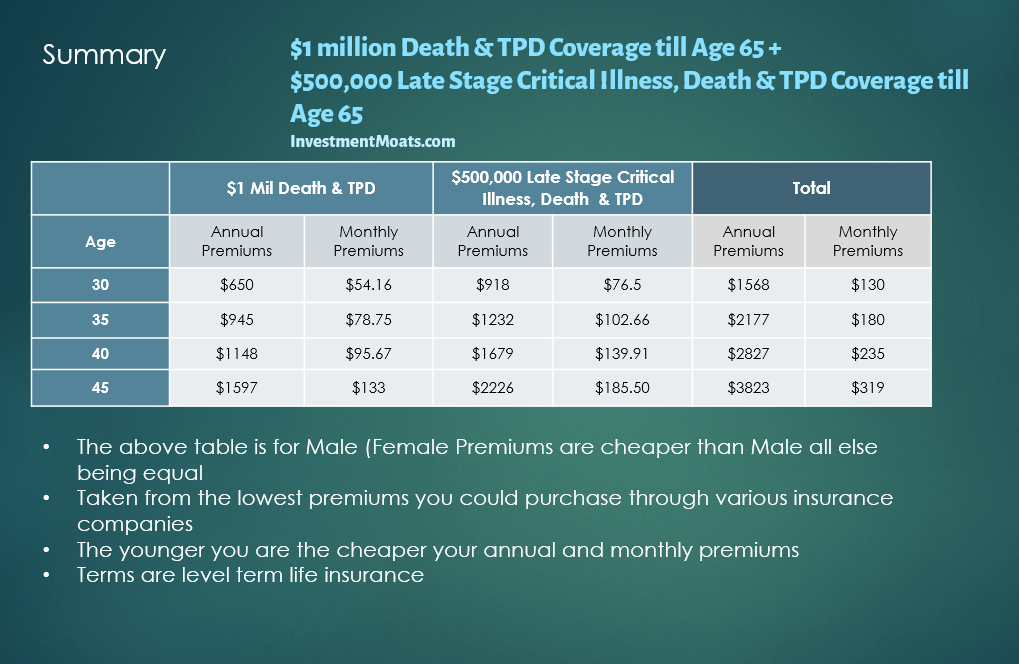

When you choose straight term life insurance you will select the number of years the policy protects you for typically 10 20 and 30 years are the most common with many companies also offering 15 and 25 year options.

35 year term life insurance. Life insurance companies will use age as a determinant for life insurance premiums. You can now buy term life insurance with a term period of 35 years from american general life insurance company. Yes you read that right. Until now the longest term period available was 30 years.

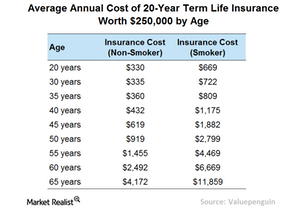

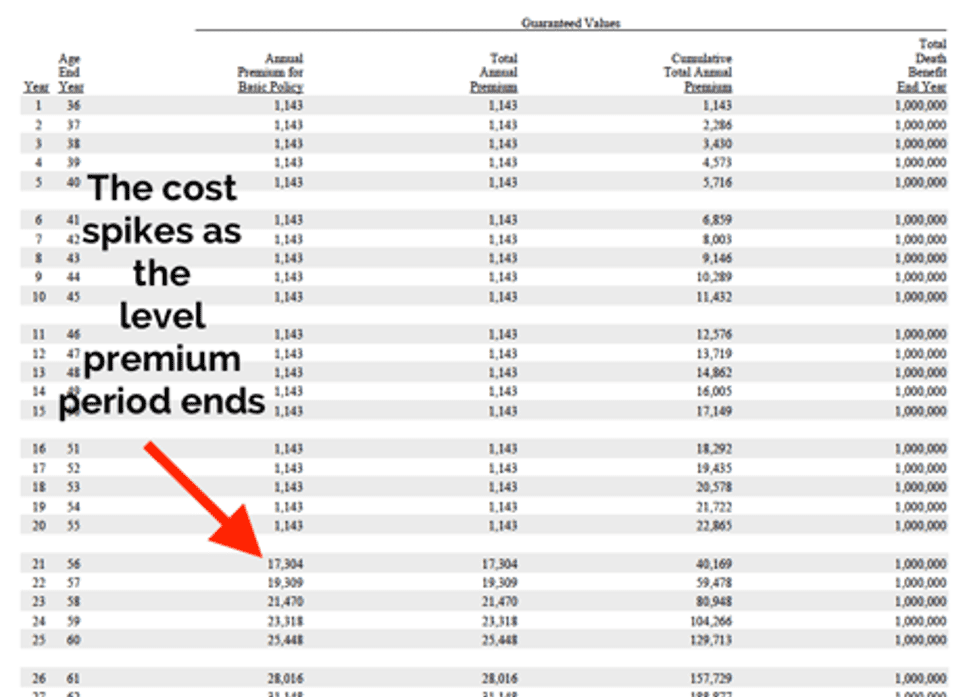

35 yr term life insurance. As long as you continue to make the premium payments the life insurance carrier is entering into a contract promising to pay the death benefit to your designated beneficiary. A 40 year fixed premium contract is significantly out of the norm for term life insurance. Rates will continue to increase as you age due to a decrease in your total life expectancy.

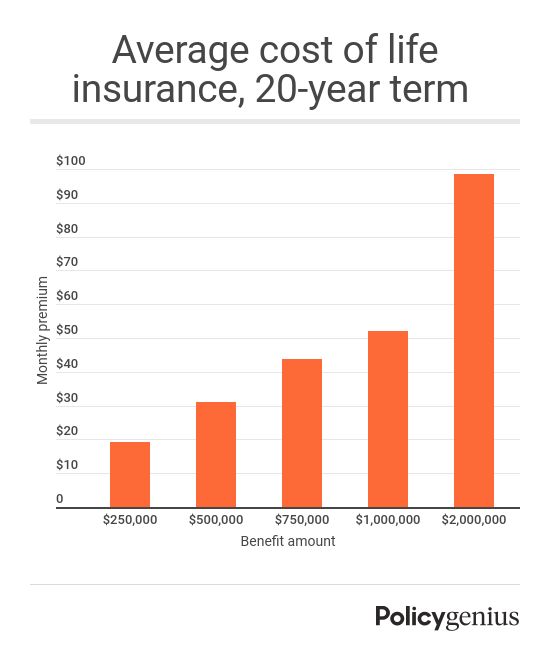

The term life insurance quotes below are for a 20 year term life insurance policy with a death benefit of 500 000. But with the new term length you can lock in a low rate up to age 45 and keep it until you are 80 years old. 10 year term life insurance length 10 years of fixed premiums. Like traditional term policies banner s opterm offers a fixed death benefit with guaranteed rates for set number of years.

A 40 year term life insurance policy is a new and exciting product in the life insurance industry. Term life insurance comes in 10 15 20 25 and 30 contracts making it one of the most flexible types of life insurance you can buy. You will find that most companies who offer term life insurance will have a maximum policy of 30 years. The banner life william penn company is an a rated life insurance provider that offers a variety term lengths including a 35 and 40 year level term.

A 20 year 500 000 term life insurance policy will cost about 100 more per year. When considering a term life insurance policy one of the most important decisions will be deciding on a term life insurance length. Is there 40 year term life insurance. Let s use a 35 year old nonsmoking woman as an example.

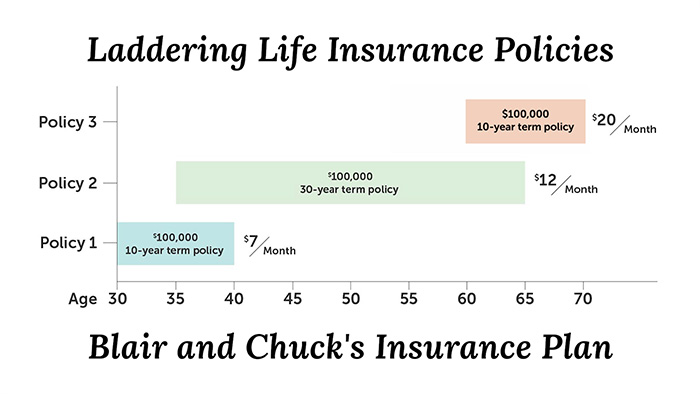

By waiting 20 years until age 50 rates for a 20 year 500 000 term life policy will more than triple. At 35 the difference between a quarter and a half million dollars of coverage for a 20 year term life policy comes down to a few dollars. Term life insurance offers level premiums for a specific period of time generally 10 20 or 30 years. Let s say you have a house with a 30 year mortgage a 48 month auto loan and a college fund you ll start using in 10 years.

Term life insurance rate quote for a 35 year old 500 000 20 year level term with sbli 23 month.