403b To 401k Rollover

Roll over your 403 b into your new employer s 403 b or 401 k plan.

403b to 401k rollover. If you need more room for information use a copy of the relevant page. These plans also tend to vest quicker than 401. Individuals may have access to both a 401 k and a 403 b plan although this is rare. Roll over your 403 b into an individual retirement account ira.

Since many people work for several employers during their working years it is fairly common for people to have several retirement plans including 401 k s and 403 b s they need to roll over. The 20 percent withholding is why most people choose to make direct rollovers which occurs with the 403b plan administrator executes the 403b rollover on your behalf into another qualifying retirement account. It also applies to rollover of 403b frs tsp 457 drop and other employer retirement plans. With a direct transfer the money moves automatically from your 401k plan to your 403b plan.

There can be good reasons to not roll over an old 401 k or 403 b to an ira. Notably 403 b plans may also offer matching contributions. You can move money from your 401k plan to your 403b plan either through a rollover or through a direct transfer. Creating a rule for yourself to always rollover your 401 k or 403 b will ensure you take care of your retirement as you grow your career.

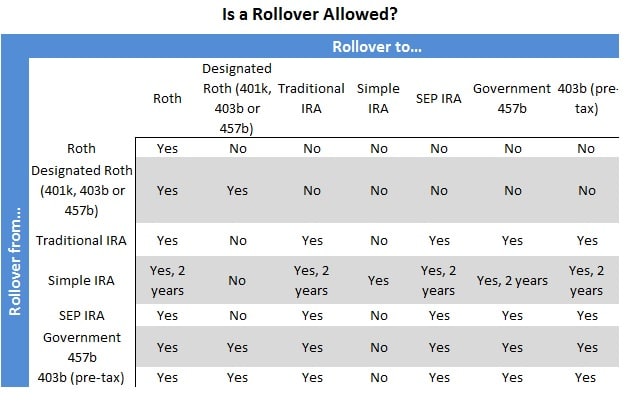

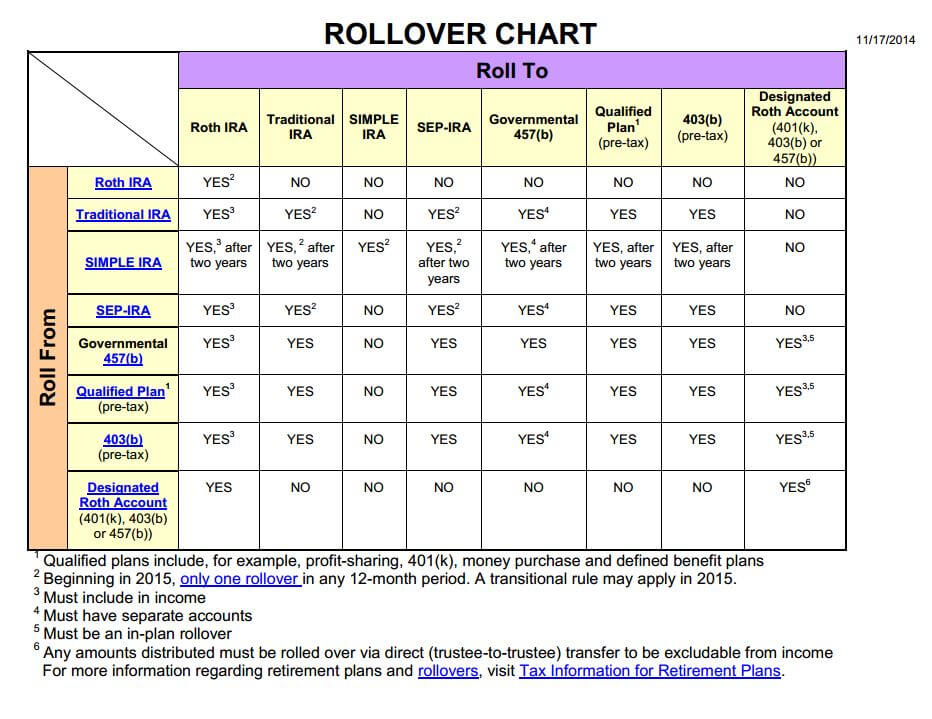

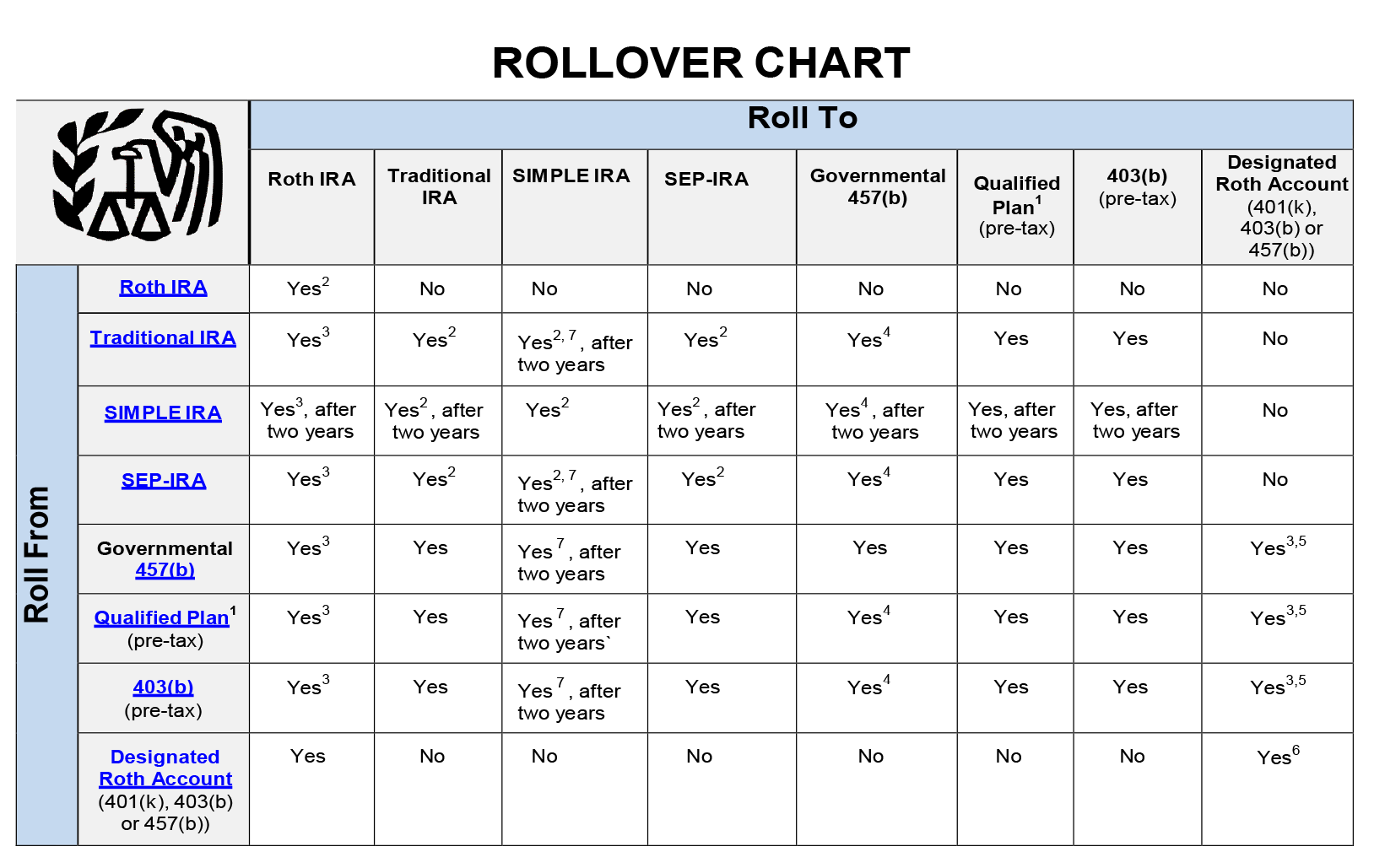

When not to roll over your retirement account. Bill can request a direct rollover of some or all of the account into a traditional ira a 401 k another 403 b or a government eligible 457 plan with no tax consequences. Distribution rollover use this form to request a rollover distribution from your 401 a 401 k 403 b or 457 b governmental employer plan. Roll to roth ira traditional ira simple ira sep ira governmental 457 b qualified plan1 pre tax 403 b pre tax designated roth account 401 k.

With a rollover the money is paid to you first and then you have up to 60 days to redeposit the money into the 403b plan. Rolling over your 403 b into an ira can be a good choice because it gives you more control over your investment options tends to have lower fees and can ultimately hold funds from all of your previous work retirement accounts. Fill in by hand using capital letters and black ink or on screen if pdf.

/senior-man-using-laptop-and-drinking-coffee-in-living-room-1089094638-45de4a48cc2947b2b1b48f71bbfa26b0.jpg)