401k Employer Tax Benefits

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

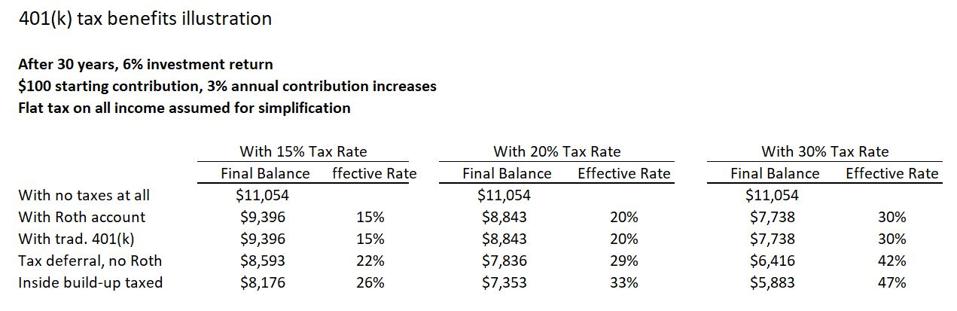

As mentioned earlier 401k plans are tax deductible for employers.

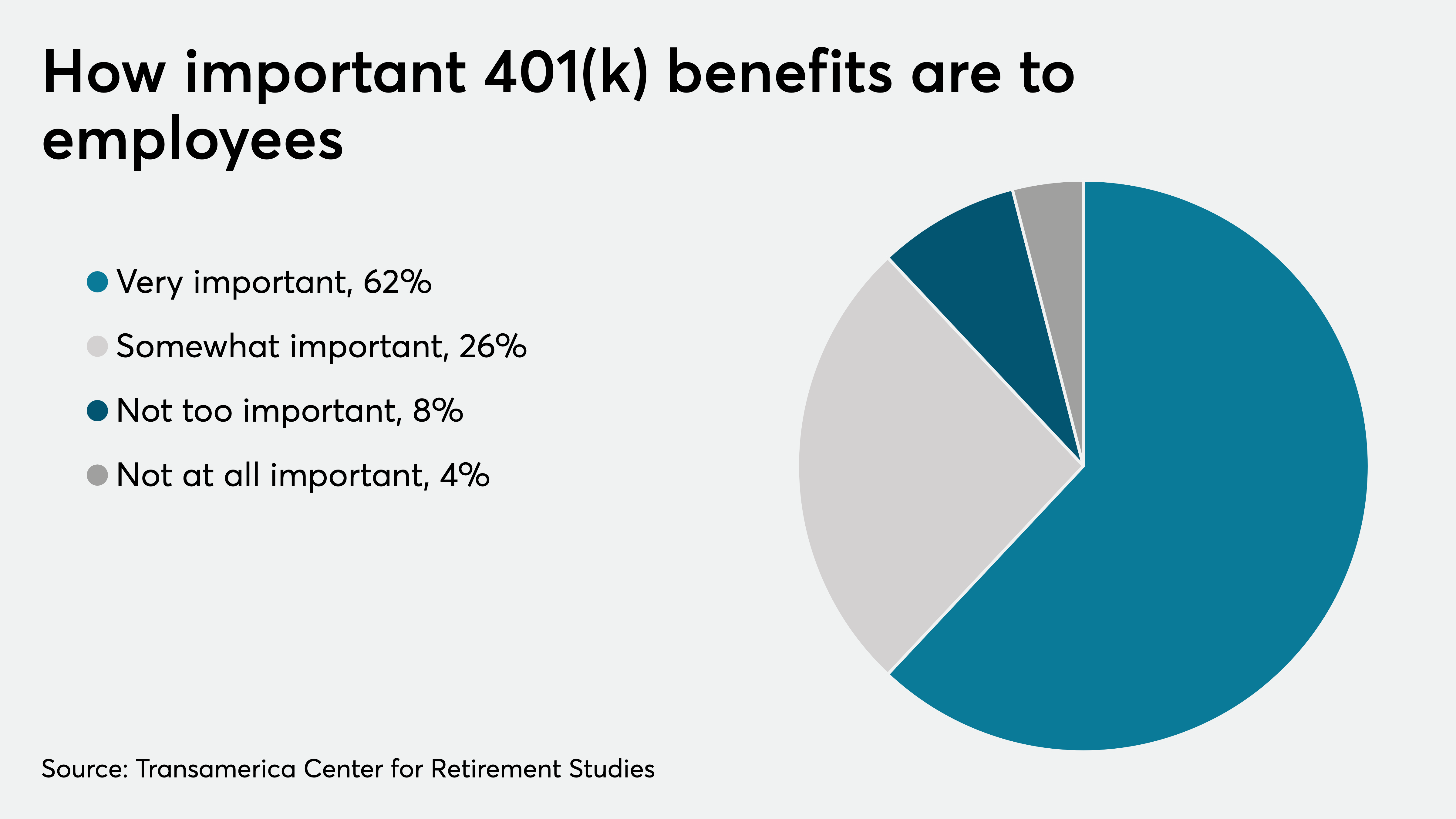

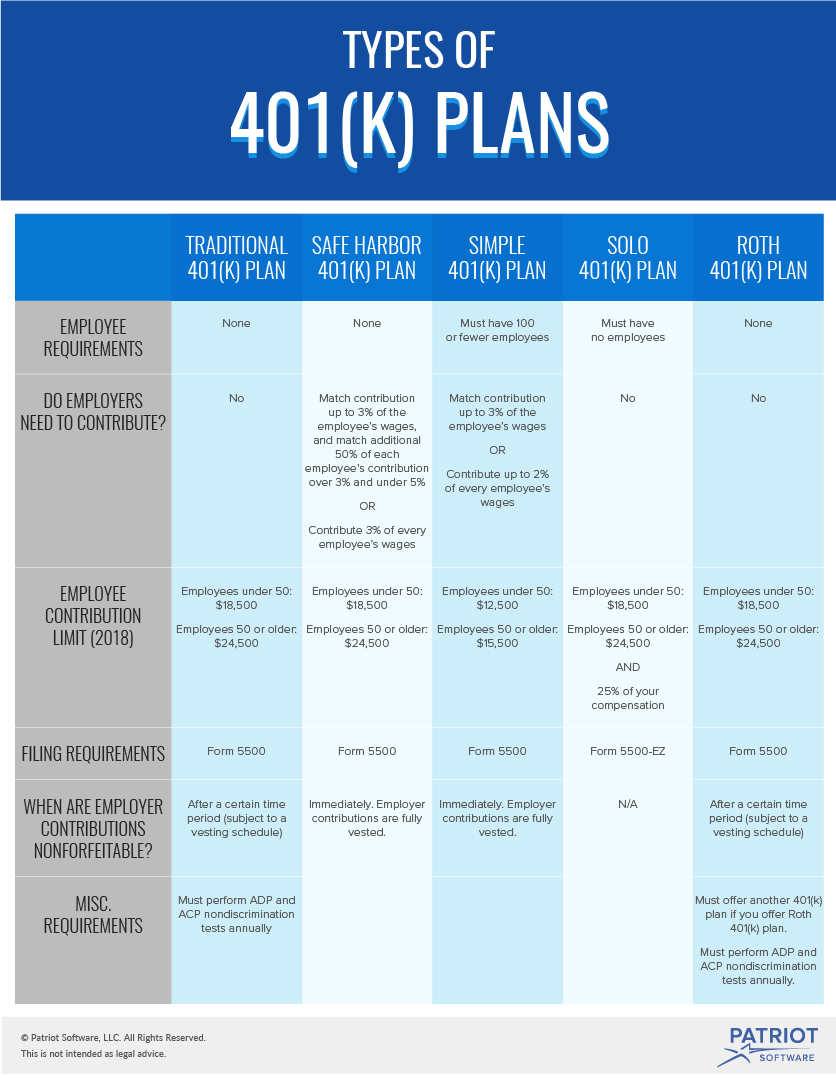

401k employer tax benefits. A 401k has flexible plan features that allow business owners to tailor a plan to their specific business objectives e g offering a retirement savings vehicle for minimal cost rewarding long term employees maximizing the tax benefits for plan contributions. Understanding the true benefits of a 401 k for both employers and employees can help you set up the best plan as possible. The irs highlights two tax advantages of a 401 k plan sponsored by employers. The traditional 401 k popular with companies that have large workforces.

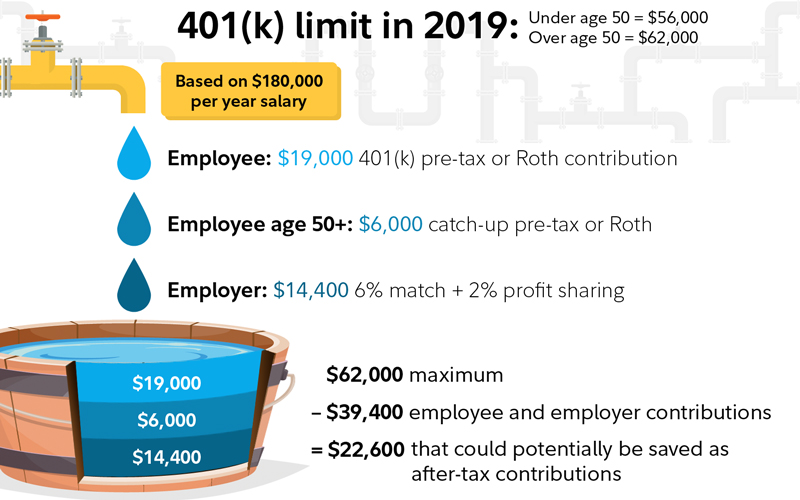

Are 401k contributions tax deductible for employers. Employer benefits of 401 k plans. Because 401k plans have several tax benefits they are usually less expensive to offer than defined benefit plans. Employers can receive tax benefits for contributing to 401 k plans too the tax code wants to encourage saving for retirement so employers are offered tax incentives to contribute in order to trigger a 401 k tax deduction as well as to offset the cost of setting up retirement plans.

Business owners choose to establish a 401k plan for many reasons. Here are some of the top benefits of 401 k plans. Stay up to date on 401 k tax benefits with employee fiduciary s employer resources from our free 401 k help center. Learn how a 401 k works about 401 k benefits and what is a roth 401 k.

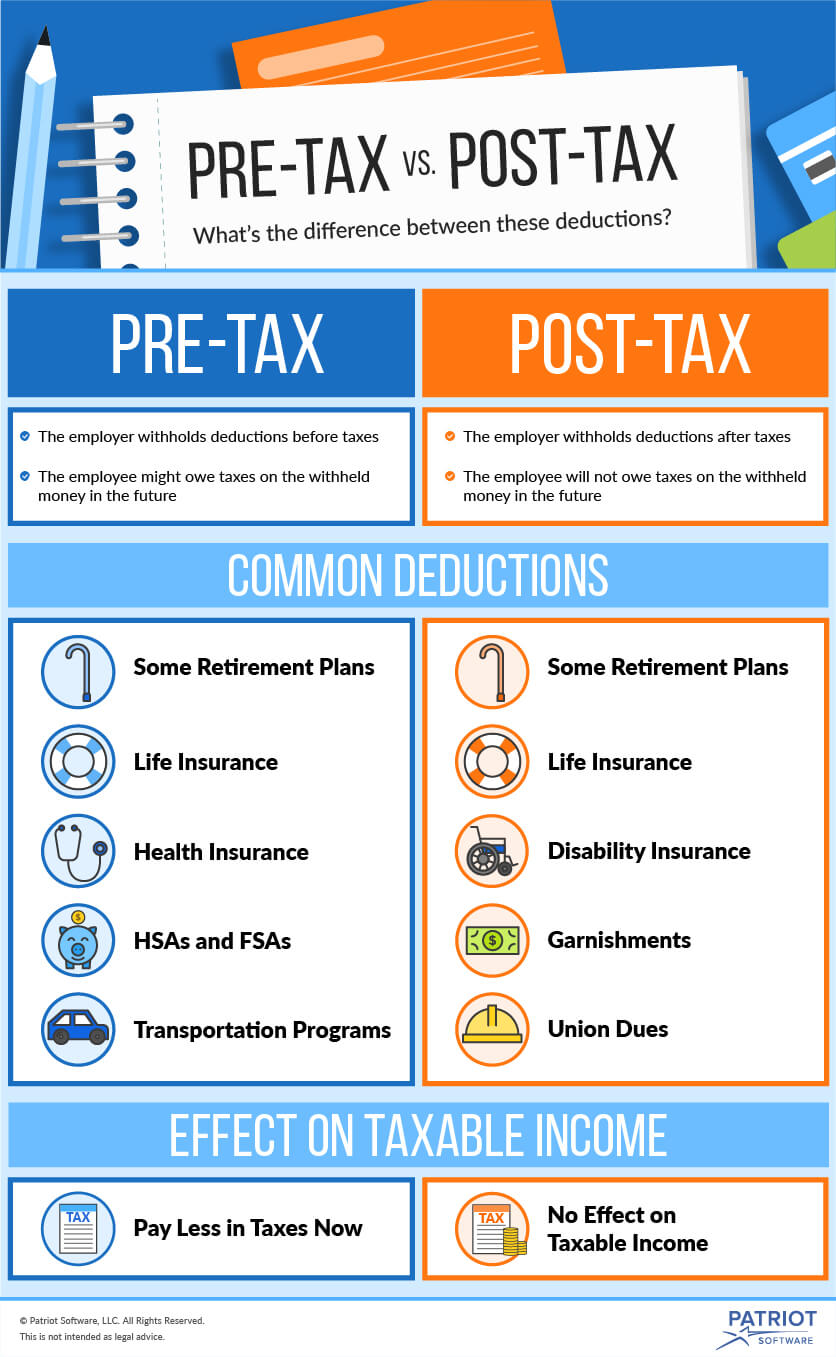

The safe harbor 401 k in which employees always own 100 of any money their employer contributes. Traditional tax deferred 401 k s used by self employed savers. A traditional 401 k plan allows eligible employees i e employees eligible to participate in the plan to make pre tax elective deferrals through payroll deductions. The employer may match a.

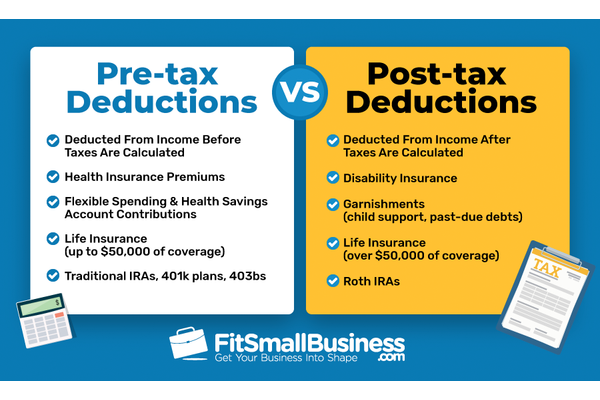

From tax breaks to the 401 k employer match there s a long list of 401 k benefits. The simple 401 k for businesses employing fewer than 100 people. Tax deferred 401 k s reduce taxable income. A 401 k is a type of qualified retirement plan offered by many employers that allows an employee to deposit pre tax dollars from each paycheck into a retirement account.

The good news is that usually every dollar a company contributes to a staff member s 401k is a write off. This can offset some of the costs of offering a retirement benefit. Employer benefits of having a 401k. Several variations of tax deferred 401 k s exist.

/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)