401k Rollover After Retirement

Depending on your age at retirement and the rules of your company you may elect to.

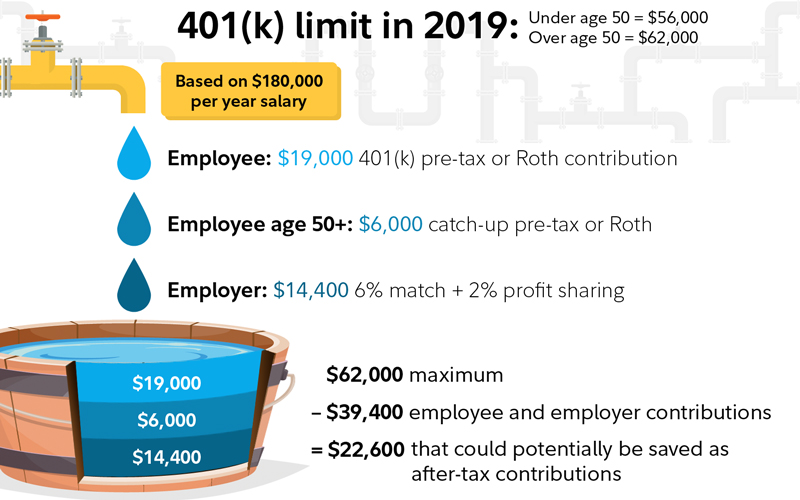

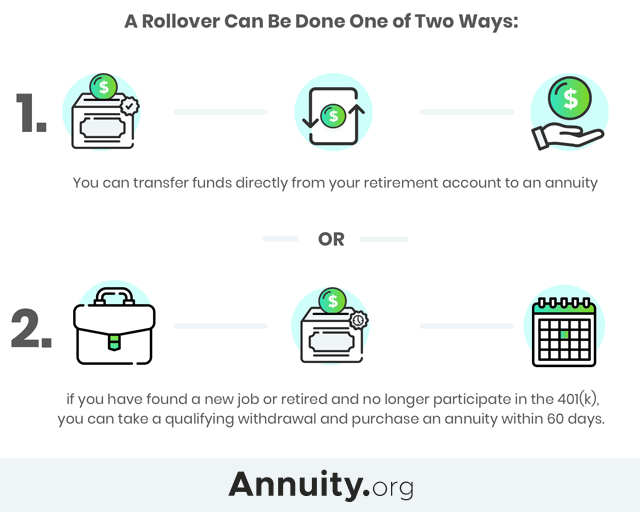

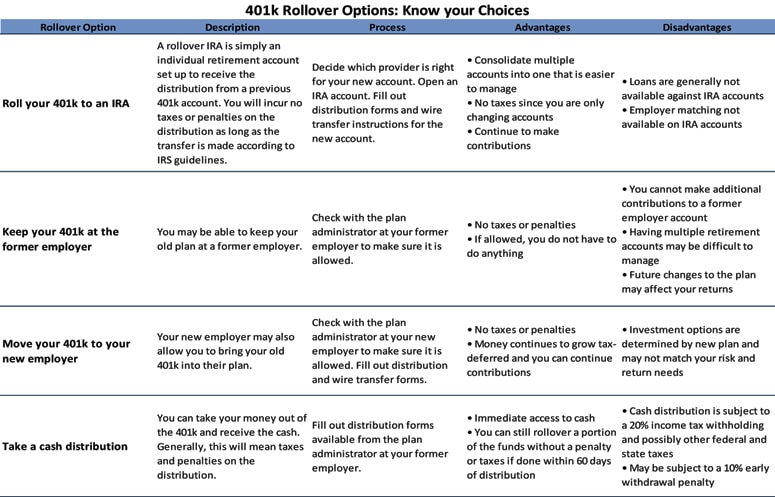

401k rollover after retirement. Post retirement 401 k options. However you may want to leave the money in your 401 k plan if you will need to take withdrawals in your late 50s. Best 401k rollover after retirement developing a savvy strategy to pull money out your retirement accounts without paying any more in taxes and penalties than is absolutely necessary depends on the guidance of an adviser who adheres to a high fiduciary standard and has the credentials and expertise to turn your years of sacrifice into a lifetime of financial security. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days.

After you leave your job there are several options for your 401 k. Roth 401 k contributions are made with after tax dollars so if you move the money to an after tax roth ira there won t be taxes due on the rollover. Ira withdrawals before age 59 1 2 trigger a 10 early withdrawal penalty in. 9 ways to avoid 401 k fees and.

You may be able to leave your account where it is. Alternatively you may roll over the money from the old 401 k into a new. For those who don t think they ll end up in another 401 k plan but still want to save more for retirement it might make sense to do a 401 k to ira rollover. Remember even though you still have your account at your old company s 401 k you won t have the ability to make more contributions.

With a roth 401 k you ll likely be more interested in a roth ira so that you can. The irs gives you 60 days from the date you receive an ira or retirement plan. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution. If you roll over your 401 k into an ira you ll also want to consider the kind of rollover you need.

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png)

/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)