401k To Traditional Ira

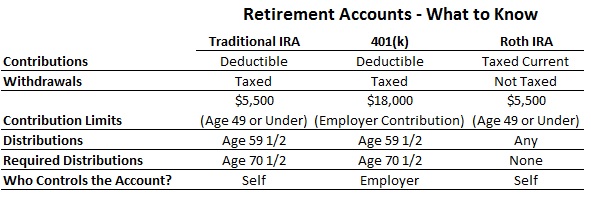

Iras and 401 k s both have tax benefits for retirement savers.

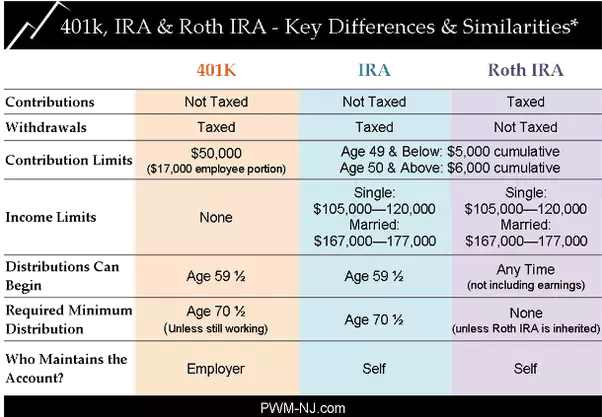

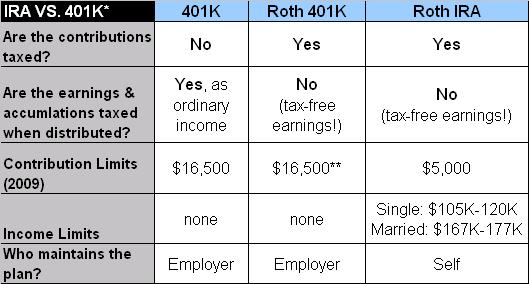

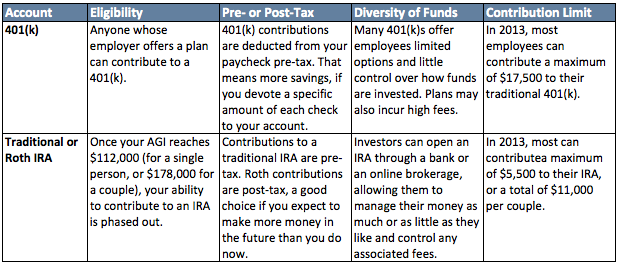

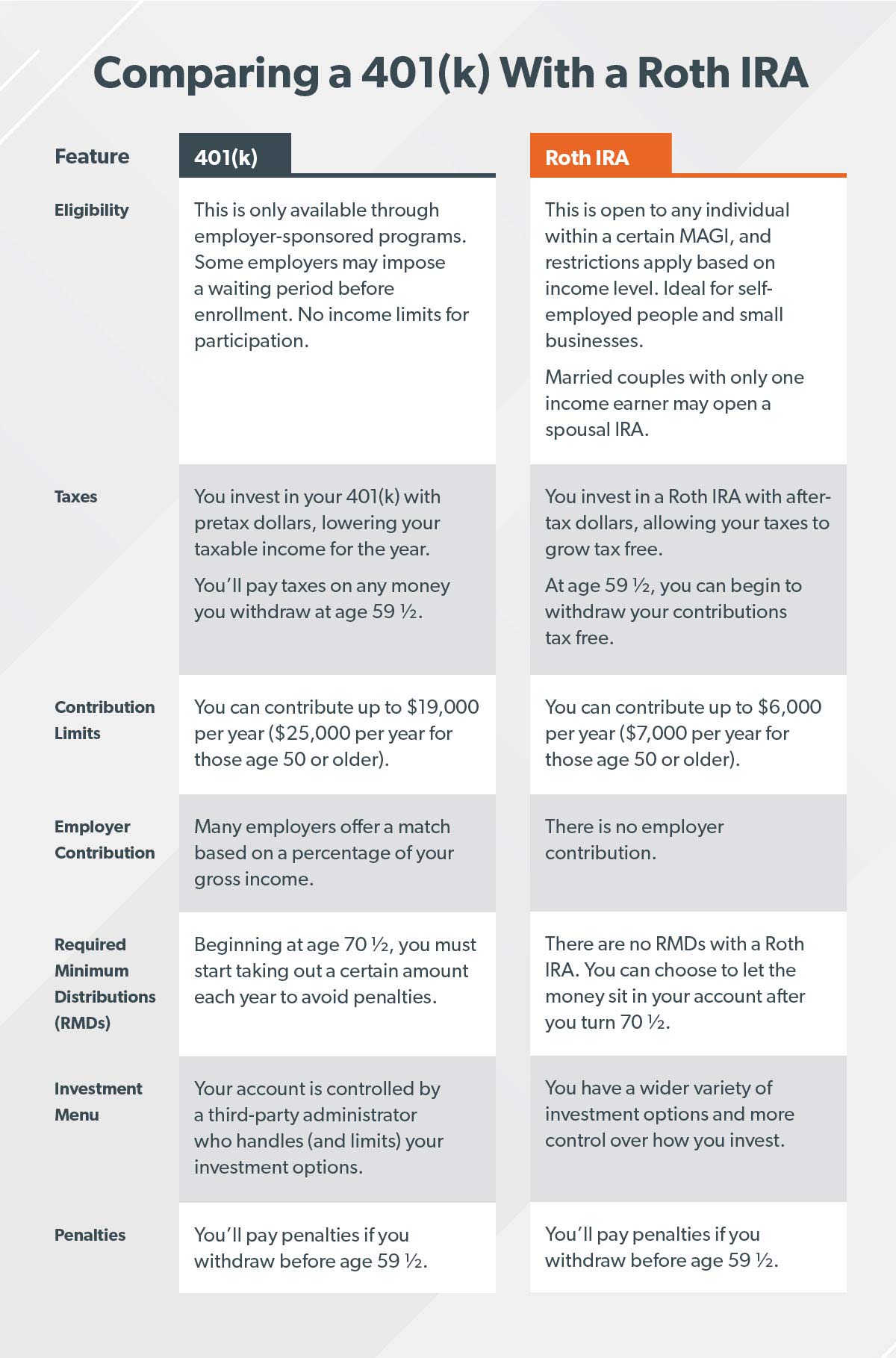

401k to traditional ira. For the self employed. A 401k is a type of employer pension plan. If you re debating between a 401 k or ira the first thing to know is that you don t have to choose. For a traditional ira for 2019 full deductibility of a contribution is available to active participants whose 2019 modified adjusted gross income magi is 103 000 or less joint and 64 000 or less single.

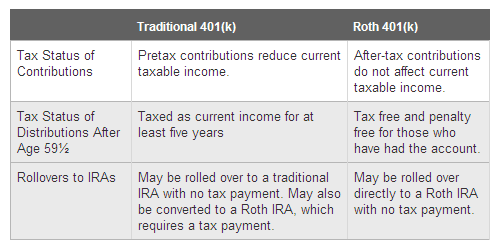

No matter the type of retirement. Partial deductibility for magi up to 123 000 joint and 74 000 single. If you have a traditional 401 k plan that means you didn t pay taxes on the money when you contributed it to your account. Each plan is administered under different rules.

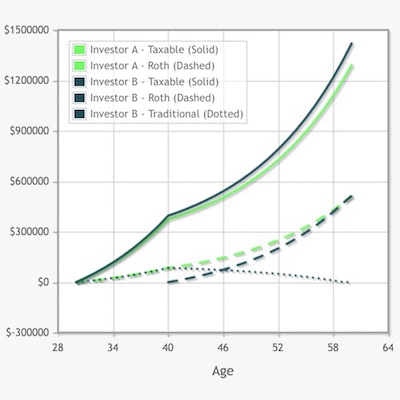

While both plans provide income in retirement. The one exception in 2019 is that those over age 70 1 2 aren t allowed to contribute in a traditional ira. While the opportunity to contribute to a 401 k is for the most part limited to people employed by companies that offer such plans anyone can contribute to a traditional ira individual retirement account. The contribution limits for both traditional and roth iras are 6 000 per year plus a 1 000 catch up contribution for those 50 and older for both tax.

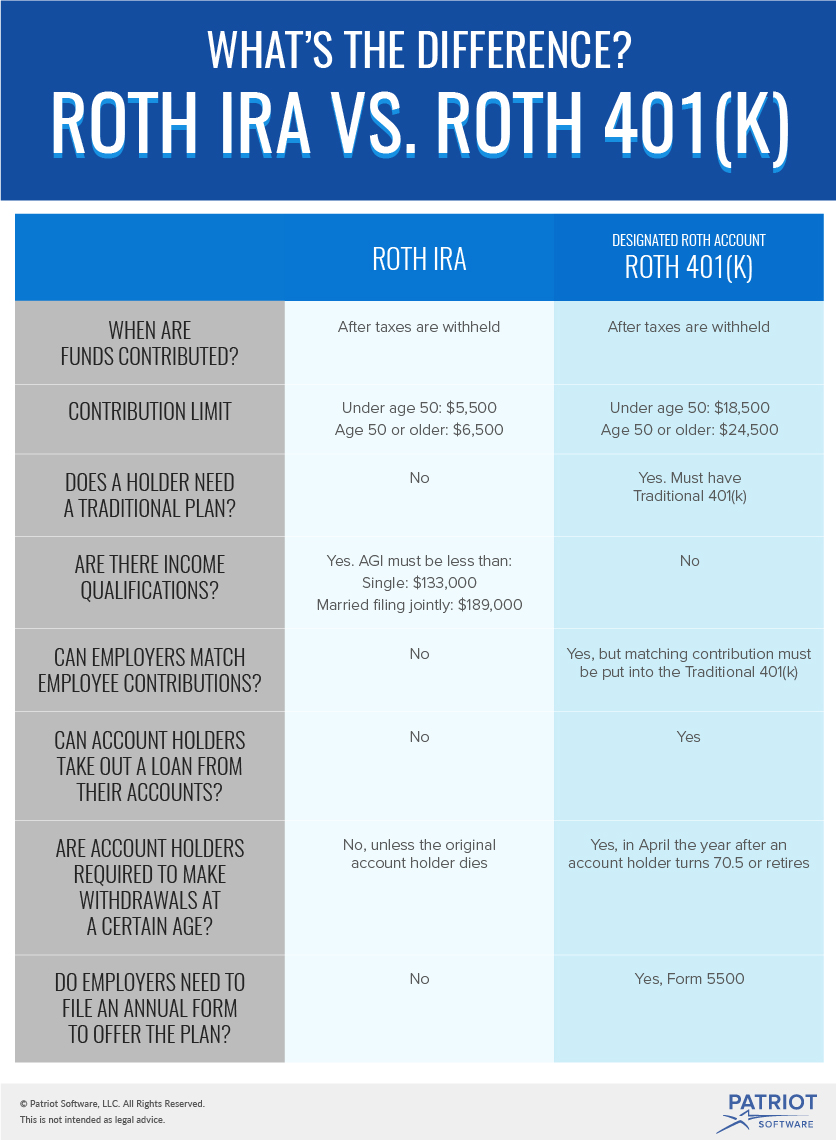

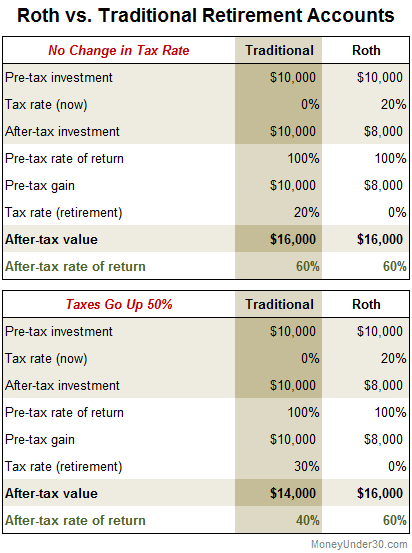

With a roth 401 k you can take advantage of the company match on your contributions if your employer offers one just like a traditional 401 k. Conversions and rollovers upon termination of employment or in some plans even while in service can be rolled to ira or roth ira. Taxes with 401k or traditional iras. When rolled to a roth ira taxes need to be paid during the year of the conversion.

If you want to move that money into a roth ira you ll have to pay taxes on it. There is a difference between 401k and traditional ira accounts. An ira is an individual retirement account. Individuals can open a roth or traditional ira separately from an employer but only have access to a 401 k sep ira or simple ira when offered by an employer.

The roth 401 k was introduced in 2006 and was designed to combine features from the traditional 401 k and the roth ira. However traditional iras have income limits if the. Same goes for a roth 401 k to roth ira rollover. You can rollover from a traditional 401 k into a traditional ira tax free.

Get your 401 k match then max out your ira.