Business Tax Help

Report the tax on form 2290 for additional information see the instructions for form 2290.

Business tax help. As a business owner it s important to understand your federal state and local tax requirements. Includes corporation tax capital gains tax construction industry scheme cis and vat business finance and support finding finance business support writing a business plan. Llcs help separate personal assets and liabilities from business ones reducing your personal risk if your business is unable to pay its bills. Call backs between 6 00pm 8 00pm aest monday thursday except national public holidays.

Typical costs to set up a business include business insurance office space real estate office supplies business cards business assets professional fees i e. Access tax forms including form schedule c form 941 publications elearning resources and more for small businesses with assets under 10 million. Offer period march 1 25 2018 at participating offices only. There are further restrictions for auckland based businesses.

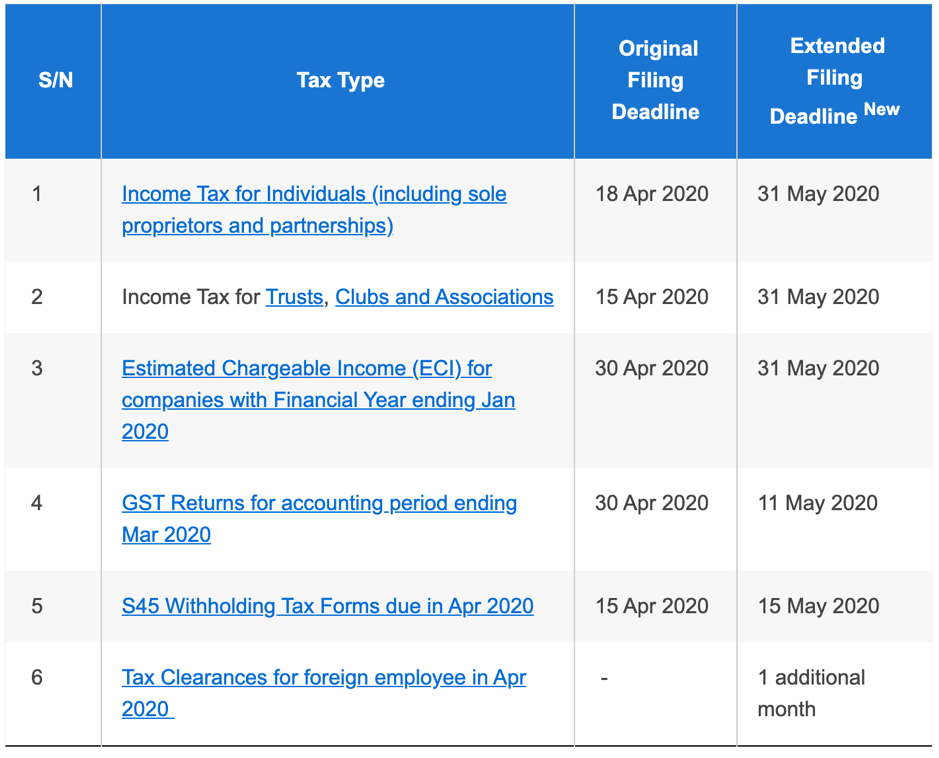

Form 2290 there is a federal excise tax on certain trucks truck tractors and buses used on public highways. Find out what support is available including boosting cash flow instant asset write off the backing business incentive and jobkeeper payments for your employees. Information about ato measures and tailored support during covid 19 novel coronavirus. Small business after hours call back.

Form 730 if you are in the business of accepting wagers or conducting a wagering pool or lottery you may. The tax applies to vehicles having a taxable gross weight of 55 000 pounds or more. Valid receipt for 2016 tax preparation fees from a tax preparer other than h r block must be presented prior to completion of initial tax office interview. May not be combined with other offers.

Small business superannuation clearing house sbsch 1300 660 048. 13 28 66 or use the small business assist online booking form external link. Hiring accountants and small business loan fees. The business structure you choose when starting a business will determine what taxes you ll pay and how you pay them.

In an llc your profits and losses can pass through to your personal income without facing corporate taxes but members of an llc are considered self employed and must pay self employment taxes. All businesses can operate provided they can meet the rules to operate safely. Limited liability company llc. This will help you file your taxes accurately and make payments on time.