Account Receivable Finance

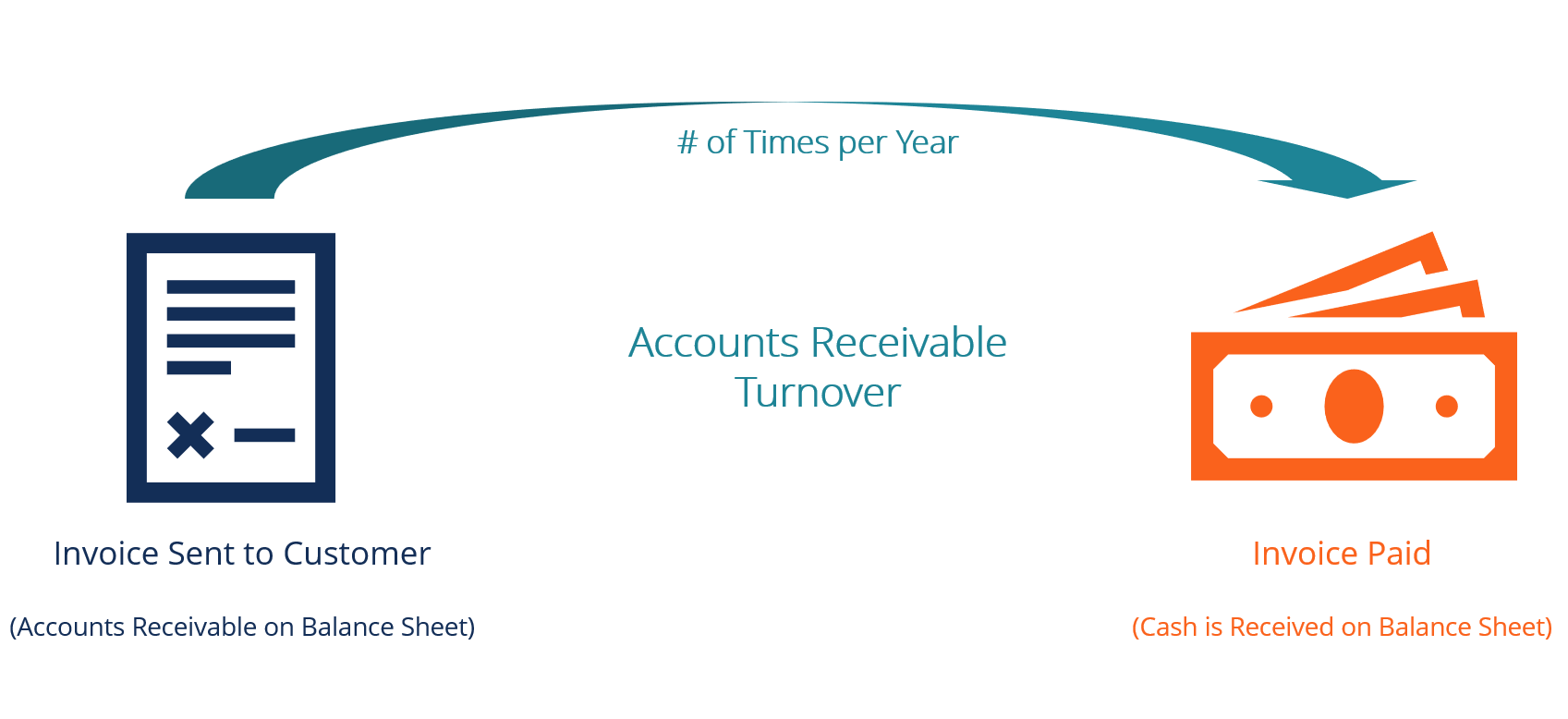

What is the accounts receivable turnover ratio.

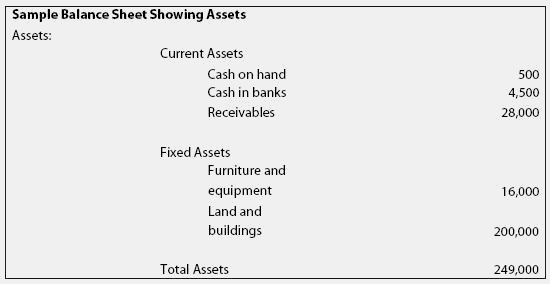

Account receivable finance. Additionally selective receivables finance enables companies to secure advanced payment for the full amount of each receivable. Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short term. What does net 30 mean on an invoice. Accounts receivable are current assets for a company and are expected to be paid within a short amount of time often 10 30 or 90 days.

In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. Accounts receivable financing factoring. Flexible finance for your business accounts receivable financing including invoice factoring is a popular alternative to bank financing for start ups growing businesses and more mature companies looking for maximum flexibility. Accounts receivable financing is a type of financing arrangement in which a company receives financing capital in relation to its receivable balances.

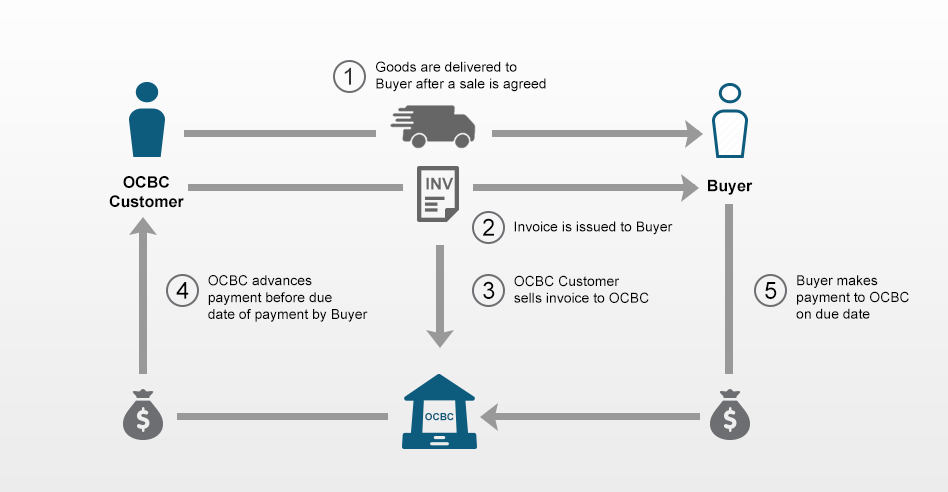

Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing. Accounts receivable billing and collections training guide page 88. The factoring company assumes the risks on the receivable and in return issue your business. Accounts receivable purchase arp is an arrangement whereby ocbc purchases invoices from our customers to unlock working capital for them.

The accounts receivable turnover ratio also known as the debtor s turnover ratio is an efficiency ratio financial ratios financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company. Arizona financial information system. Texas comptroller of public accounts. The numbers found on a company s financial statements balance sheet income.

A key for any business to run smoothly and successfully. Accounts receivables are created when a company lets a buyer purchase their. Selective accounts receivables finance allows companies to pick and choose which receivables to advance for early payment. This helps to improve customers cash flow.

The two types of accounts are very similar in the way they are recorded but it is important to differentiate between accounts payable vs accounts receivable because one of them is an asset account and the other is a.