Account Receivable Loans

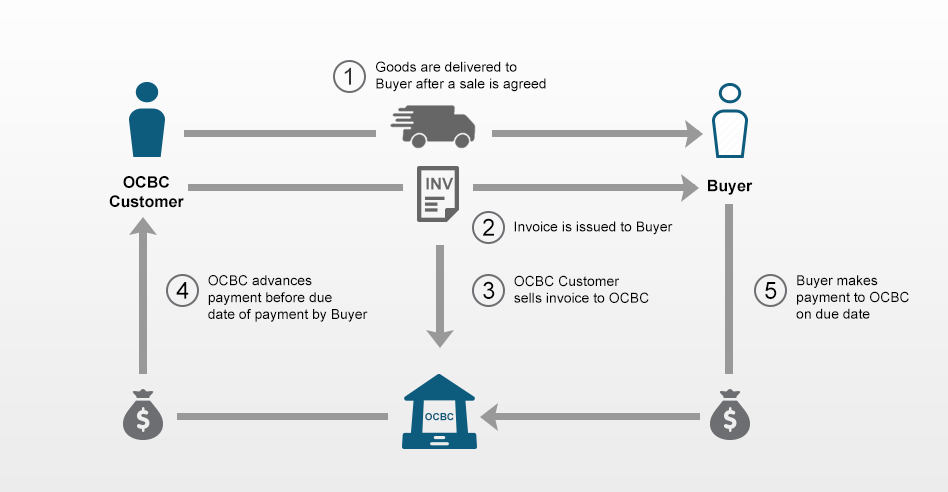

Accounts receivable financing allows companies to receive early payment on their outstanding invoices.

Account receivable loans. Funding term up to 24 months. This note can also include lines of credit. This is a liability account. Loans receivable is an accounting term that refers to the manner in which lenders classify the outstanding money owed them by debtors.

A company may owe money to the bank or even another business at any time during the company s history. For a loan receivable accounting example assume your bank lends 150 000 to your company depositing it in its checking account. Loans can be structured in various ways based on the financier. Accounts payable is a liability since it s money owed to creditors and is listed under current liabilities on the balance sheet.

One of the biggest advantages of a loan is that accounts. This solution allows the business to receive payment sooner. Accounts receivable financing is defined as a loan a business owner takes out against unpaid invoices. Accounts receivable loans are a solution meant for businesses that experience a long lapse in the time between when a service is rendered and the bill is finally paid.

Demand deposits are available whenever the customer wants them. Current liabilities are short term liabilities of a company typically less than 90 days. One of the methods for the calculation of loans receivable is by the attribution of different due dates for the outstanding loans. If you are the company loaning the money then the loans.

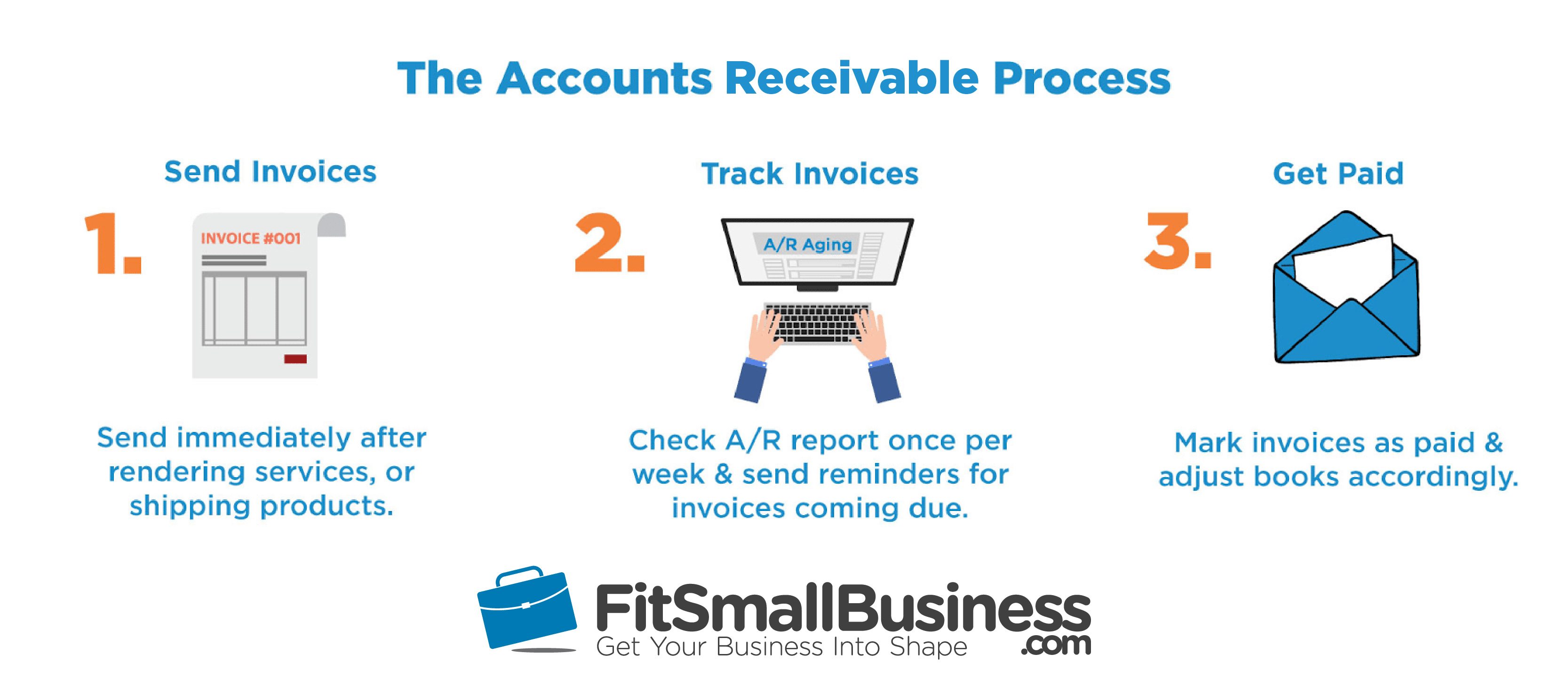

What is accounts receivable financing. The balance in the accounts receivable account is comprised of all unpaid receivables. Accounts receivable financing can also be structured as a loan agreement. In these types of agreements a receivables financing company will advance you a percentage of your invoice s face value.

If on the other hand you received a loan from a bank the amount payable is treated as a liability which could be short or a long term. Receivables or accounts receivable are debts owed to a company by its customers for goods or services that have been delivered but not yet paid for. You enter 150 000 in the account labeled loan receivable as a current asset and in the current liability account customer demand deposits. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee.

Funding amount 50k 10m. This is an asset account. Once your customer pays their debt the invoice financing company will forward you the remaining balance minus their fee. Accounting treatment for loan payable.

:max_bytes(150000):strip_icc()/Exxon-265fb0cef5f04c359ca78ad24048d312.jpg)