Basic Life Insurance Coverage

Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder.

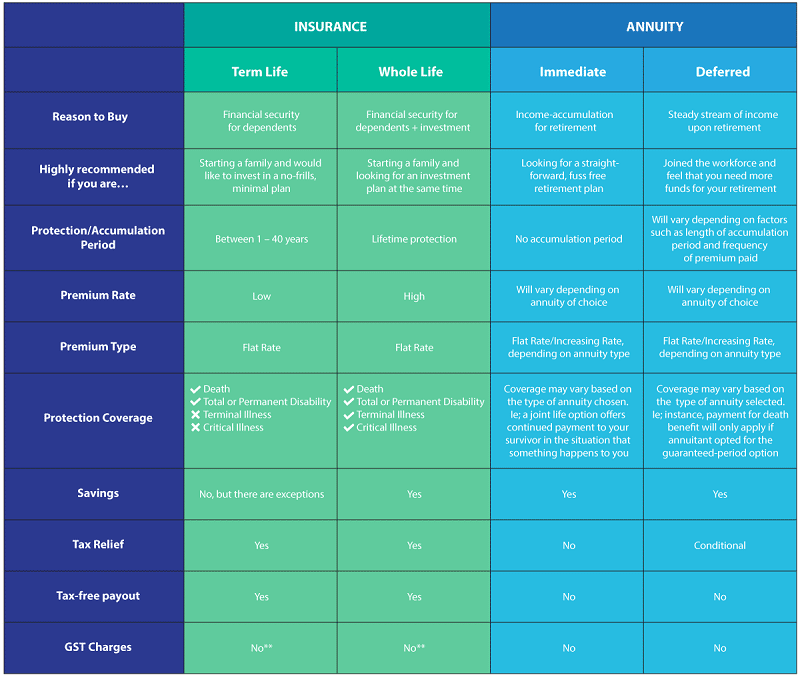

Basic life insurance coverage. Depending on the contract other events such as terminal illness. What makes it a basic policy is that it is simple in the fact that you pay for a specific amount of coverage for a certain amount of time. Payment options you choose the payment option or length of time that meets your needs. A life insurance policy can cover any child care expenses you re currently shouldering including daycare after school programs in home aides and more.

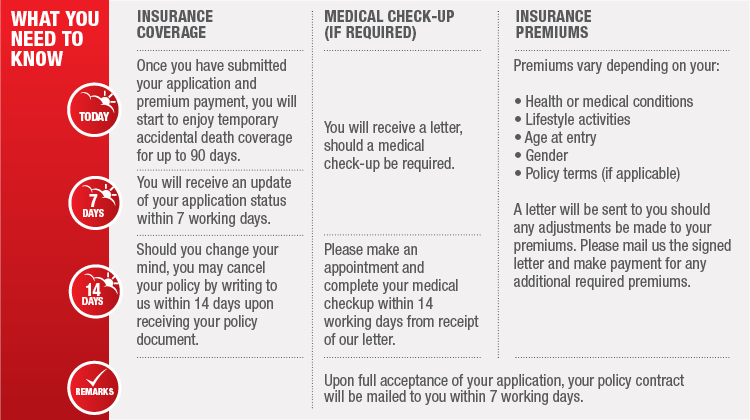

Basic life coverage can be seen as the purest form of a life policy and that is a traditional term life insurance policy. You pay a monthly premium for this additional coverage. In exchange for premium payments the insurance company provides a lump sum payment known as a death benefit to beneficiaries upon the insured s death. Basic life insurance coverage increases immediately when an increase in your base pay places you in a higher 1 000 bracket.

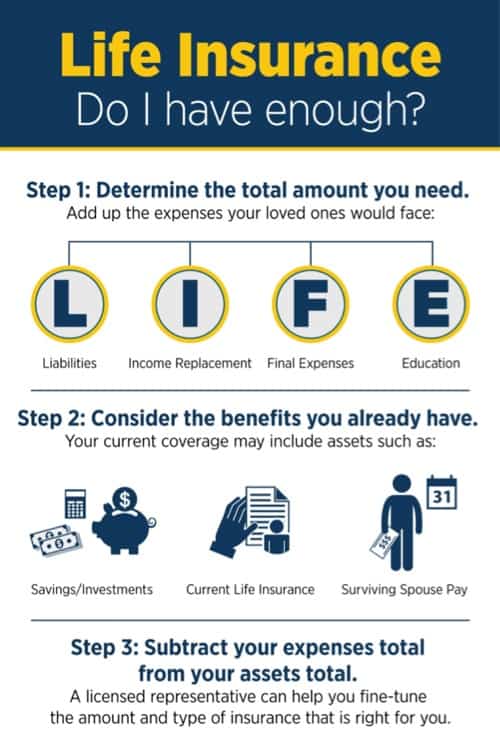

If you enroll in health insurance as the head of contract your life insurance coverage automatically increases based on your salary to a maximum of 50 000 for basic term life insurance and 100 000 for basic accidental death dismemberment insurance. 10 15 20 life pay and level for life. If a sole breadwinner dies a spouse who is caring for the kids would likely have to return to work. A wool growers floater is a type of inland marine.

10 15 and 20 pay plans mean. Renewable term plans increase in cost after the first term ends and renew for another term equal to the one you originally selected. The basic life insurance benefit is paid in addition to any benefits payable through the ad d benefit group universal life gul insurance program and or the occupational accidental death oad plan. A type of insurance policy that provides coverage for sheep owners and to warehouse owners who store and transport wool.

Typically life insurance is chosen based on the needs and goals of the owner. These costs are important to consider whether or not you re currently reliant on them. To 90 percent of your basic life insurance coverage or up to a maximum of 500 000 when combined with any optional life insurance if you become terminally ill have a life expectancy of less than 12 months and meet other eligibility requirements including having a minimum of 10 000 in life insurance.