Account Receivables Funding

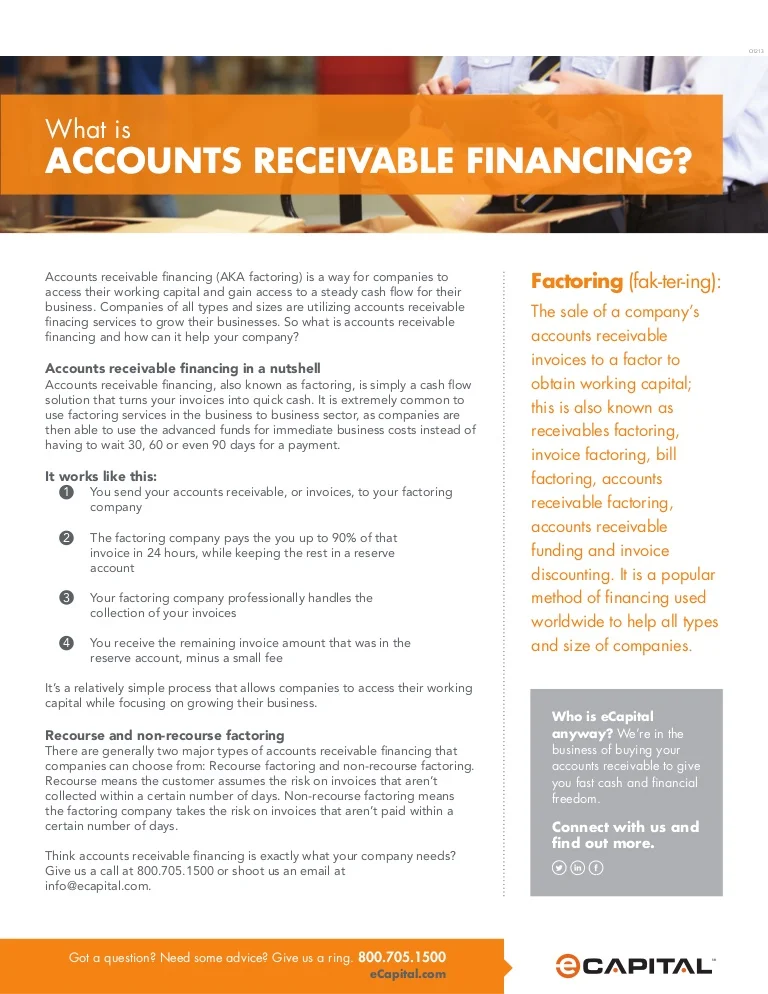

A payroll funding only relationship that involves only accounts receivable funding will be less expensive strictly on a cost basis than a relationship that involves back or front office administrative support.

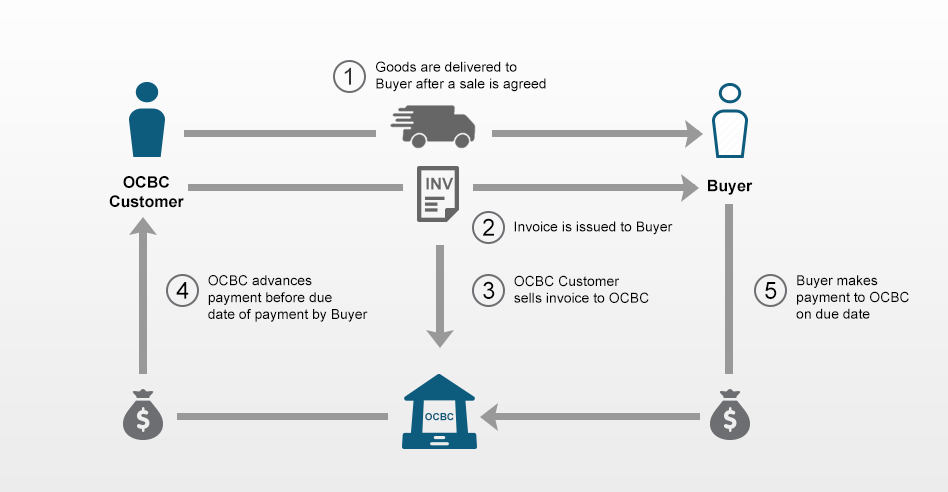

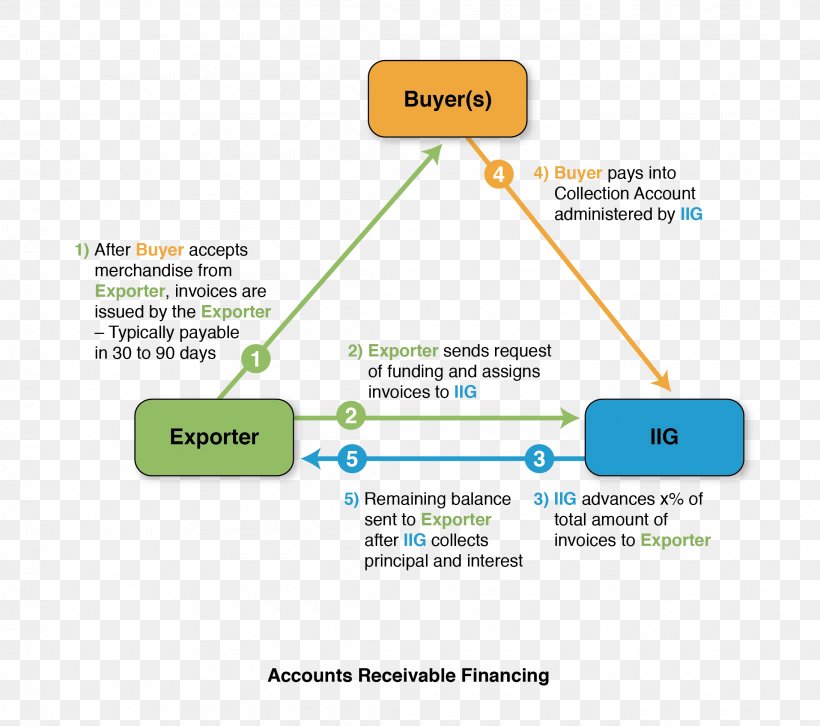

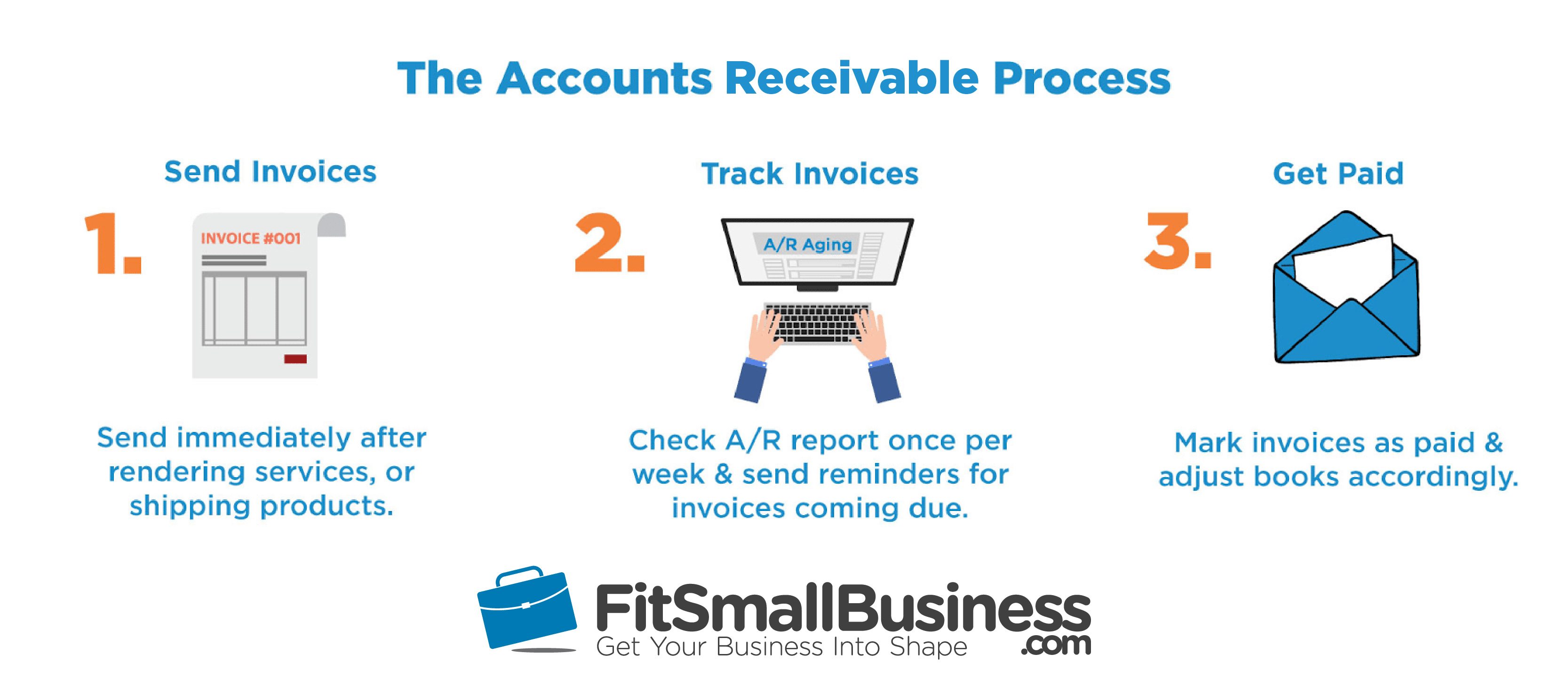

Account receivables funding. Unlike other options selective receivables finance allows companies to incorporate multiple funders into a program. This reduces the risks inherent in relying on a single financial institution including when a bank will restrict liquidity due to changes in their own circumstances. Let s say you sold 20 000 of outstanding receivables. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing.

Is based only on the accounts receivable. In terms of the cost of an abl each relationship is different. A client s ability to raise cash by receivables funding is based on the total accounts receivable rather than on traditional measures of financial strength and stability provides continuing cash flow without the requirement of periodic payments read more. So when you sell your accounts receivables to a third party factoring company the discounted purchase price gets calculated using what s known as a factor rate.

Today across the u s we re providing clients with access to debt free working capital by converting accounts receivables into ready cash. Accounts receivable financing is an agreement that involves capital principal in relation to a company s accounts receivables. Accounts receivable funding offers invoice factoring to various companies that depend on accounts receivable funding to drive their success. And let s say the factor rate is 3.

An example of accounts receivables factoring. The factoring company assumes the risks on the receivable and in return issue your business. Ability to tap into multiple funding sources.

:max_bytes(150000):strip_icc()/dotdash_Final_How_should_investors_interpret_accounts_receivable_information_on_a_companys_balance_sheet_Apr_2020-01-93d387c085e04ab4bf99fa38dcdfd48d.jpg)