Can I Write Off Cell Phone For Business

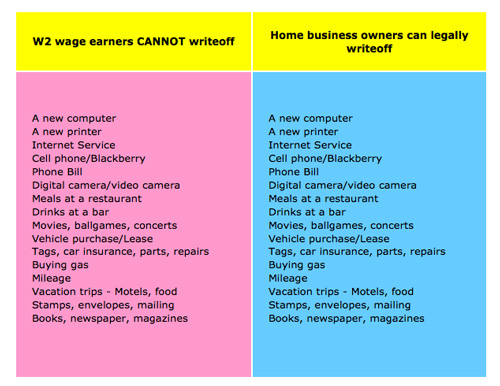

What this means is that you can write off 100 of your cell phone correlated devices and service as long as you meet certain criteria.

Can i write off cell phone for business. You calculated that you used your phone 30 of the time for business and 70 of the time for personal. If you use your cell phone exclusively for business then the cost of the phone equipment and the cost of the monthly service are both tax deductible. 100 deductible if you use it just for business otherwise you can deduct the business use percentage. Generally you cannot deduct personal living or family expenses.

You can also deduct any other uber related business expenses you incurred. So 500 00 multiplied by 30 150 00. To manage your business finances it s important to track your income and expenses and file accurate tax returns. Similar to the internet expense if you also use your cell phone for personal use you can only deduct the direct business expenses i e business apps and the percentage of time the phone is used for business reasons.

Tax write offs for uber drivers. Can i deduct the full purchase price of a cell phone that is used for more than 50 business purposes under sec 179 depreciation rules. If you don t. Computers laptops notebooks.

You can elect to deduct or amortize certain business start up costs. You can also deduct your business related cell phone expenses. However if you have an expense for something that is used partly for business and partly for personal purposes divide the total cost between the. As the link points out you may be able to deduct the business percentage of the cell phone not the entire cost.

You cannot however deduct donations made to a political organization or a political candidate. Personal versus business expenses. Water candies gum and other items you provide your passengers. The cost of your cell phone.

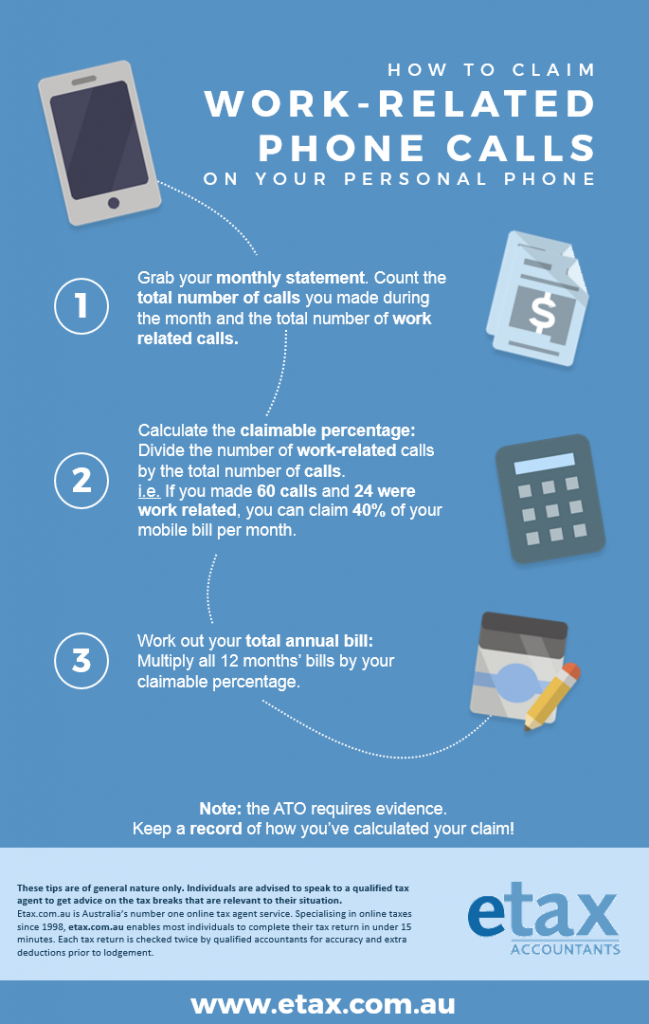

If 60 percent of your calls are business related you can deduct 60 percent of your cell bill for that month. You can t use your phone to make a few work related calls each day then write off your entire bill for the month. The strategy for your cell phone in the small business jobs act of 2011 congress removed the cell phone from the listed property list. Business use of your phone is tax deductible but only business use.

If you use the phone partly for business well you can do the math. Any expenses you incur to lobby the government or pay a group to lobby on your behalf aren t deductible either. Refer to chapters 7 and 8 of publication 535 business expenses. It doesn t matter if you re not self employed.

Use it 50 for business and 50 for personal you can deduct half of the costs. How to write off my cellphone as a business expense on my tax forms.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/businessman-talking-on-cell-phone-pushing-bicycle-in-city-534572579-576c55325f9b585875847f25.jpg)

:max_bytes(150000):strip_icc()/450771111-edit-56a0f21b5f9b58eba4b570eb.jpg)