Accounts Receivables Funding

Accounts receivable are assets equal to the outstanding balances of.

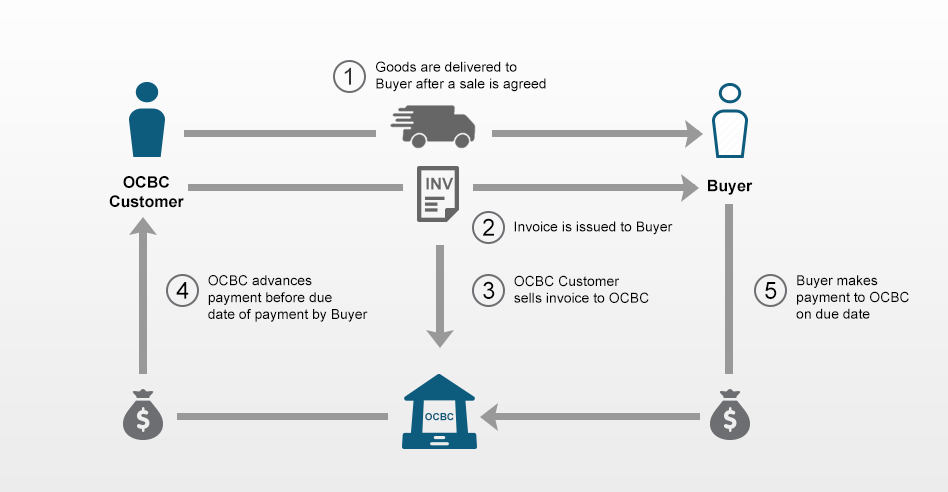

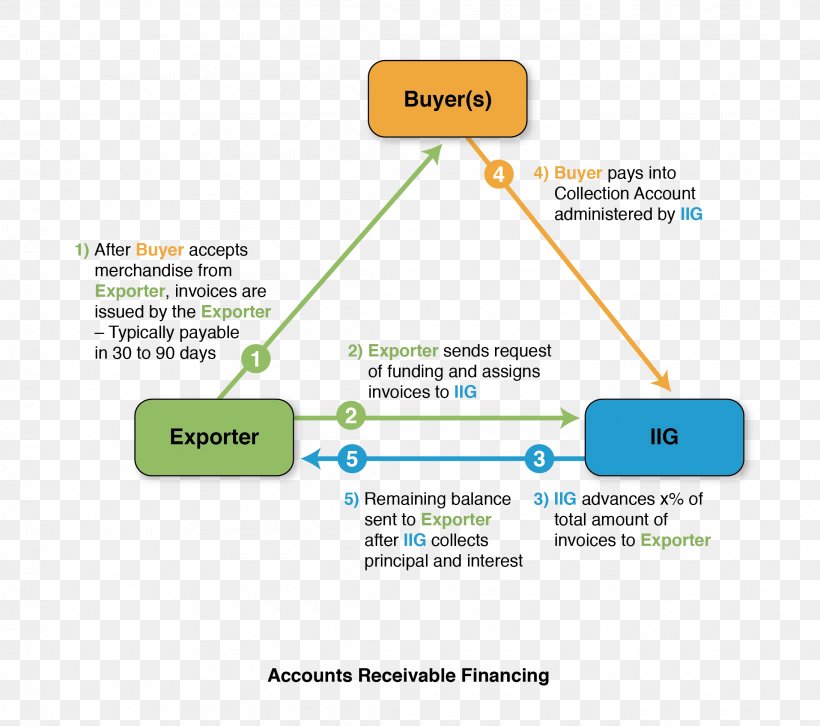

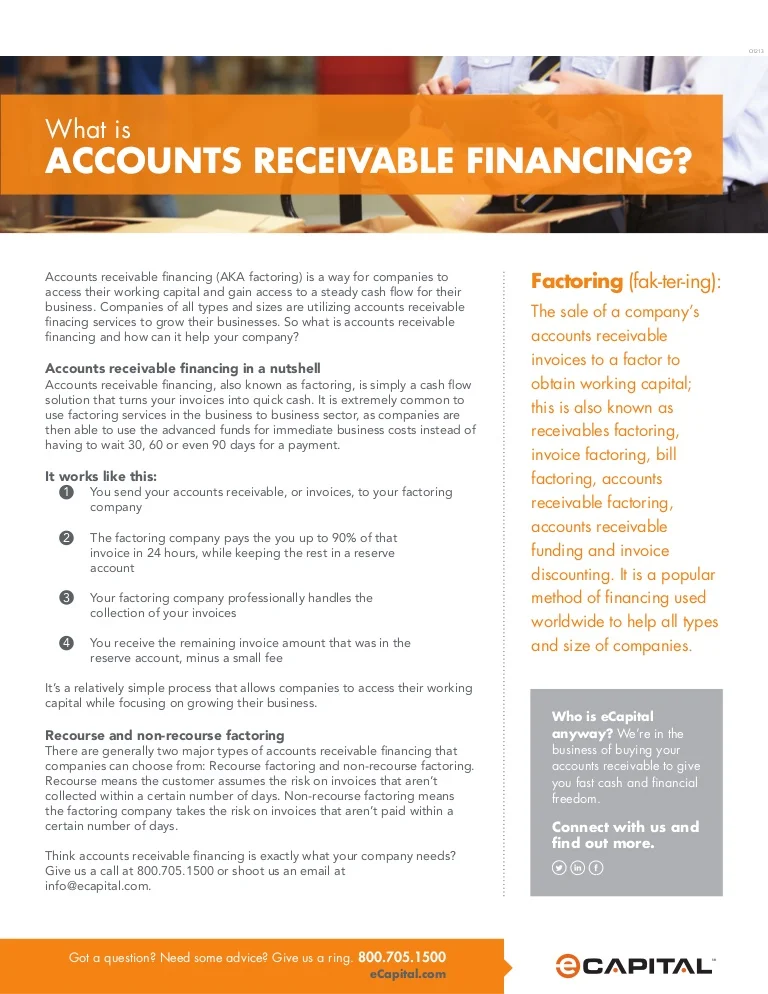

Accounts receivables funding. Factoring is a financial transaction in which a company sells its receivables to a financial company called a factor. Let s say you sold 20 000 of outstanding receivables. In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing.

Accounts receivable loans are a source of short term funding where the borrower can use their accounts receivables as collateral to raise funds from a bank. This reduces the risks inherent in relying on a single financial institution including when a bank will restrict liquidity due to changes in their own circumstances. Unlike other options selective receivables finance allows companies to incorporate multiple funders into a program. The factor collects payment on the receivables from the company s.

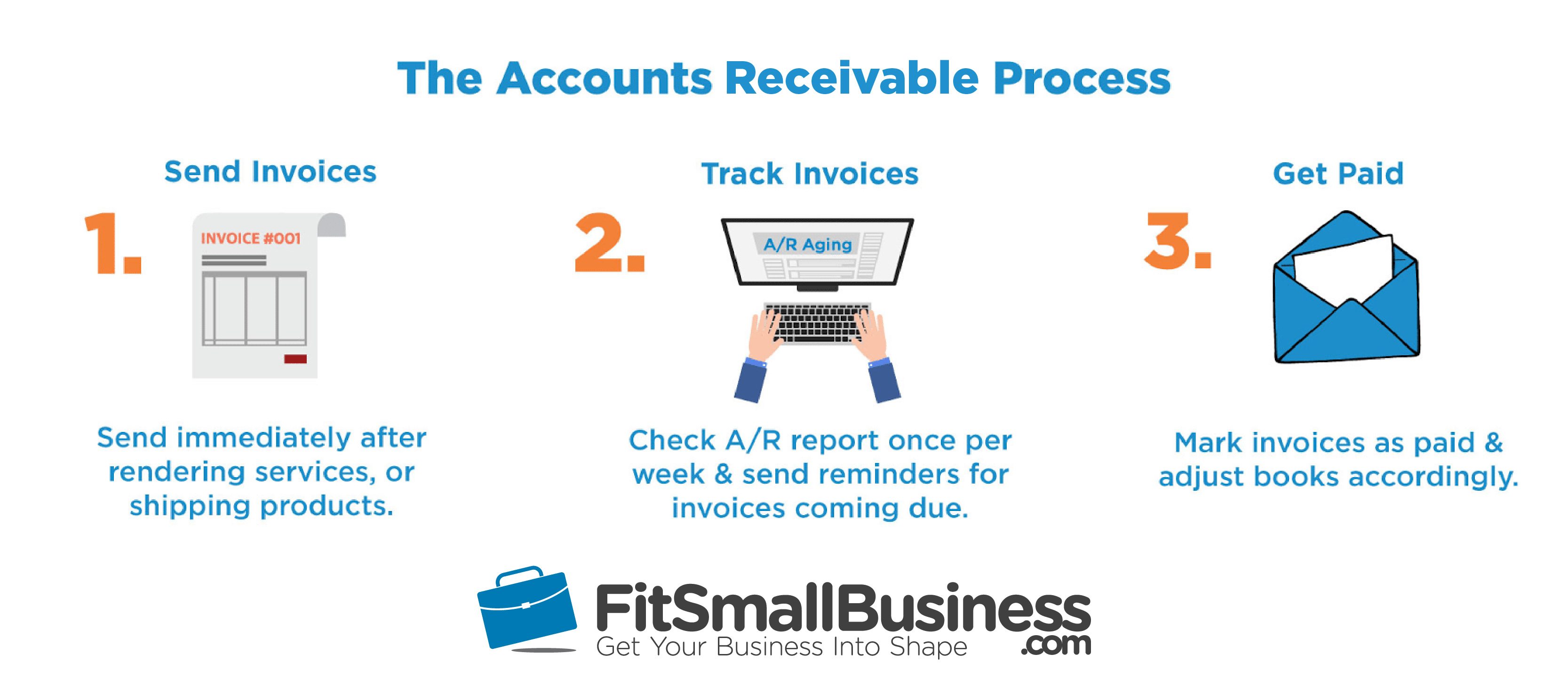

A r financing can increase or decrease based on your current business size and needs allows you to gain administrative support to manage your receivables without additional staff and gives you access to cash when you request it based on your eligible accounts receivable. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. An example of accounts receivables factoring.

Accounts receivable financing is an agreement that involves capital principal in relation to a company s accounts receivables. Ability to tap into multiple funding sources. The factoring company assumes the risks on the receivable and in return issue your business.