403 B Defined Contribution Plan

While a pension and or social security may go a long way they are unlikely to be enough.

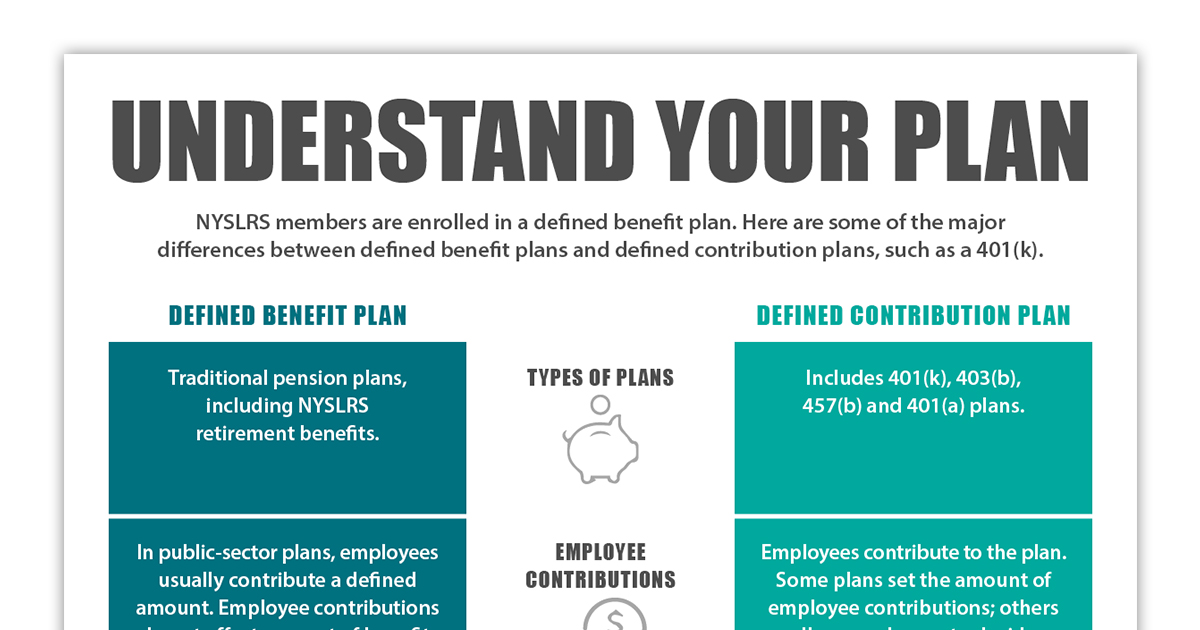

403 b defined contribution plan. A tda plan is an employer sponsored defined contribution retirement plan to which you can contribute a percentage of your base salary. Plan sponsors now have until june 30 2020 to update their pre approved and individually designed 403 b plan documents. Employees can elect to have a portion of their paycheck withheld and deposited directly into the plan before they are taxed. You may participate in a 403 b plan and a 457 deferred compensation plan.

A 403 b plan is a type of defined contribution plan designed specifically for tax exempt organizations public school employees and ministers. Employers have the option but not the obligation to contribute to the plan on behalf of employees. Find out more about our defined contribution plan and consider joining our community of participating schools. A close look at erisa 403 b plans 2016 403 b plans offer employees a wide variety of investment options.

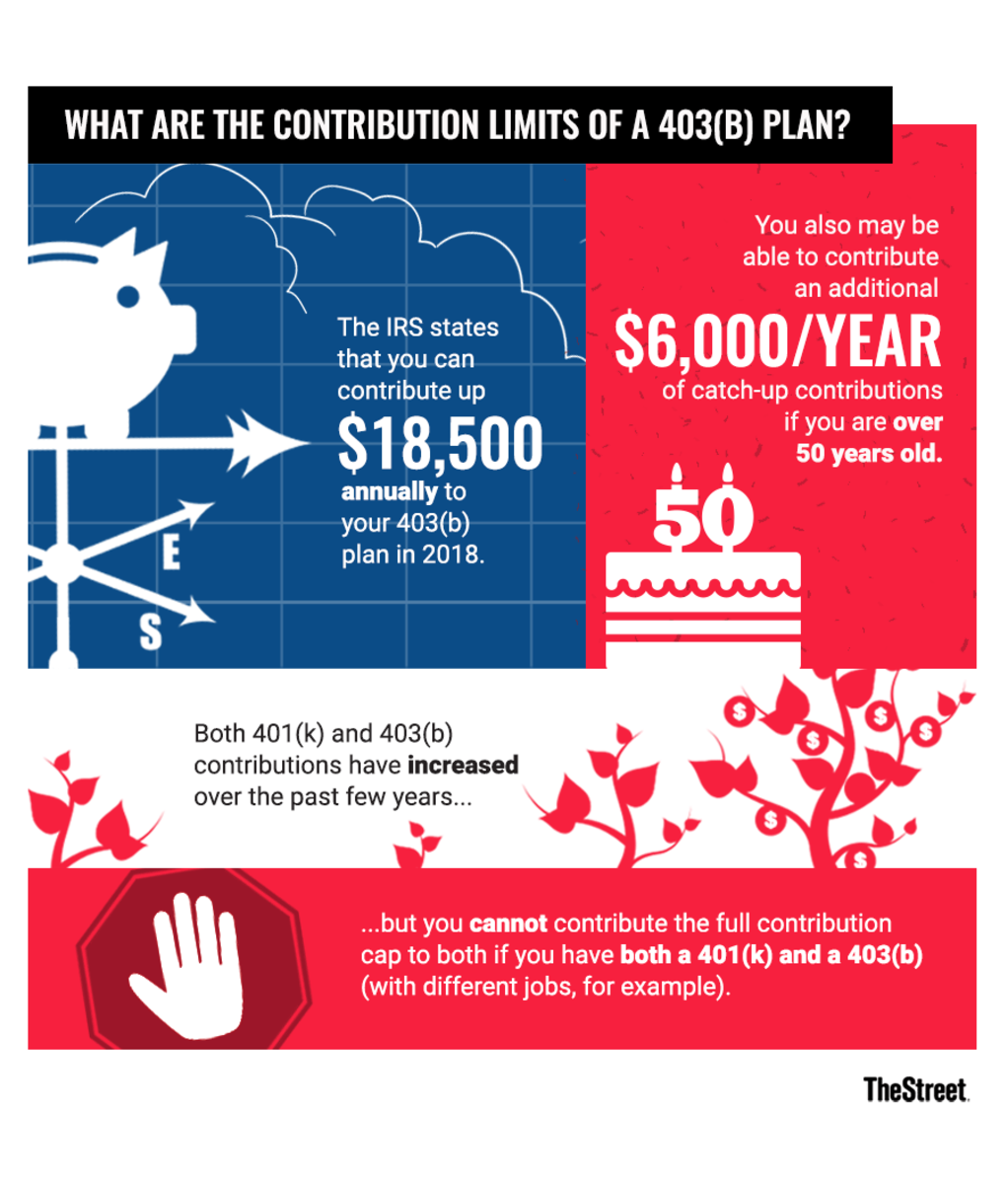

The irs is extending the last day of the initial remedial amendment period for section 403 b plans from march 31 2020 to june 30 2020. 8 the brightscope ici defined contribution plan profile. Sometimes a tda plan is also referred to as a voluntary savings plan a supplemental plan a tax sheltered annuity tsa or simply a 403 b plan. The average large erisa 403 b plan offered 25 core investment options in 2016 of those about 11 were equity funds three were bond funds and nine were target date funds.

Both have the same basic contribution limits 19 500 in 2020. Csi 403 b retirement savings plan the christian schools international 403 b retirement savings plan is available for member schools in the us. 401 k plan is a defined contribution plan where an employee can make contributions from his or her paycheck either before or after tax depending on the options offered in the plan. The features and advantages of a 403 b plan are largely similar to those found in a 401 k plan.

Saving to your 403 b plan can help you maintain your desired standard of living. The contributions go into a 401 k account with the employee often choosing the investments based on options provided under the plan. A 403 b plan is designed to supplement your retirement income.