Can Ira Accounts Be Put In A Trust

The trust must also.

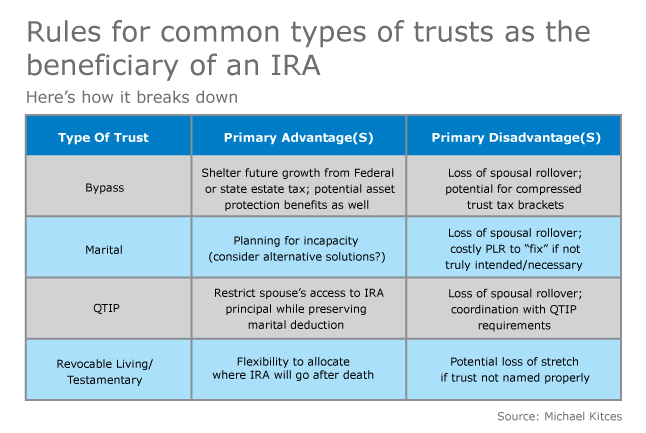

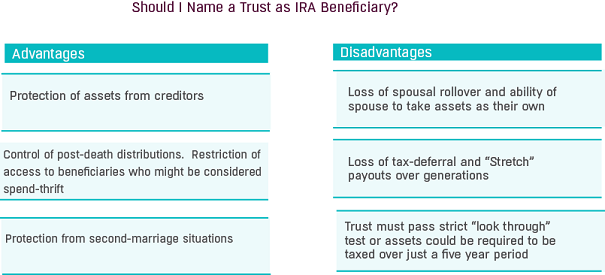

Can ira accounts be put in a trust. The ira custodian or 401 k plan administrator will hopefully stop you in your tracks if you attempt to retitle your plan into the name of your revocable living trust. This is a question that comes up frequently during the funding stage of the trust account with a client. While you face legal problems assigning your ira or 401 k accounts to a trust since you own them individually in your own name you can name a trust as the beneficiary. The answer is no.

Because ira withdrawals are. Should you put your ira or 401 k into your trust. Iras and 401 k accounts. While it is theoretically possible to put an individual ira or 401 k into a medicaid asset protection trust mapt it is not generally suggested as a medicaid planning strategy.

That means all the money in a traditional ira must be withdrawn within five years of the ira account owner s death. This is because in order to transfer a retirement savings account into a mapt it must be cashed out which can cause serious tax consequences. Consider this before you put an ira in a trust.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1022898262-5c0ab204c9e77c00016745ba.jpg)

/175427861-56aa10c03df78cf772ac3880.jpg)