Best General Liability Insurance

Commercial general liability cgl is a form of comprehensive insurance that offers coverage in case of damage or injury caused by a business s operations or products or on its premises.

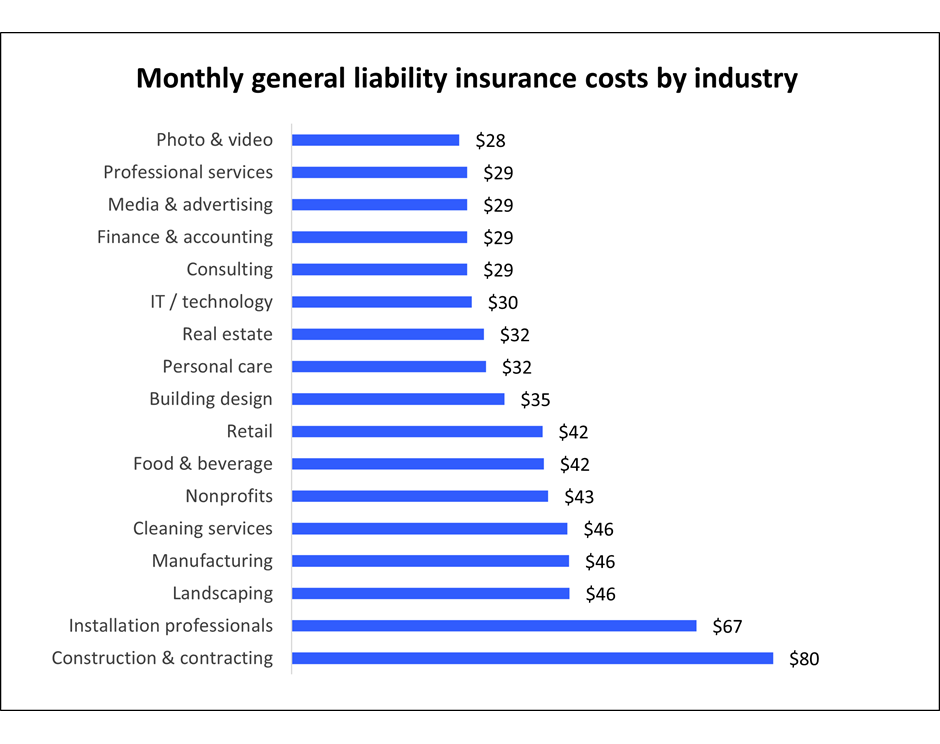

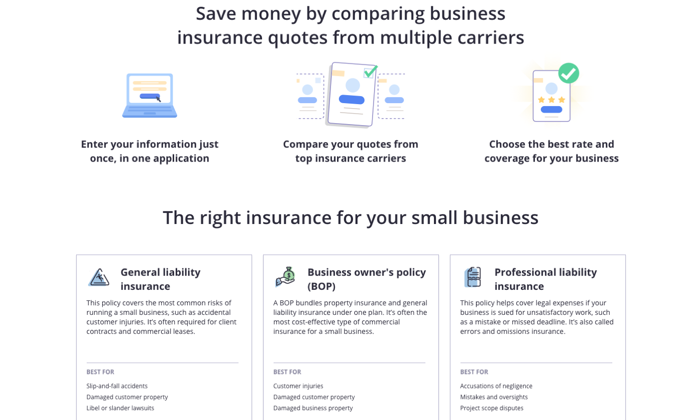

Best general liability insurance. Best for budget conscious businesses. Professional liability insurance covers disputes over the quality of professional services. A quote for an accountant who works at home full time showed a 500 annual rate for general liability insurance only with 1 million in coverage 2 million aggregate. But businesses that provide professional services need added protection from mistakes and unhappy clients.

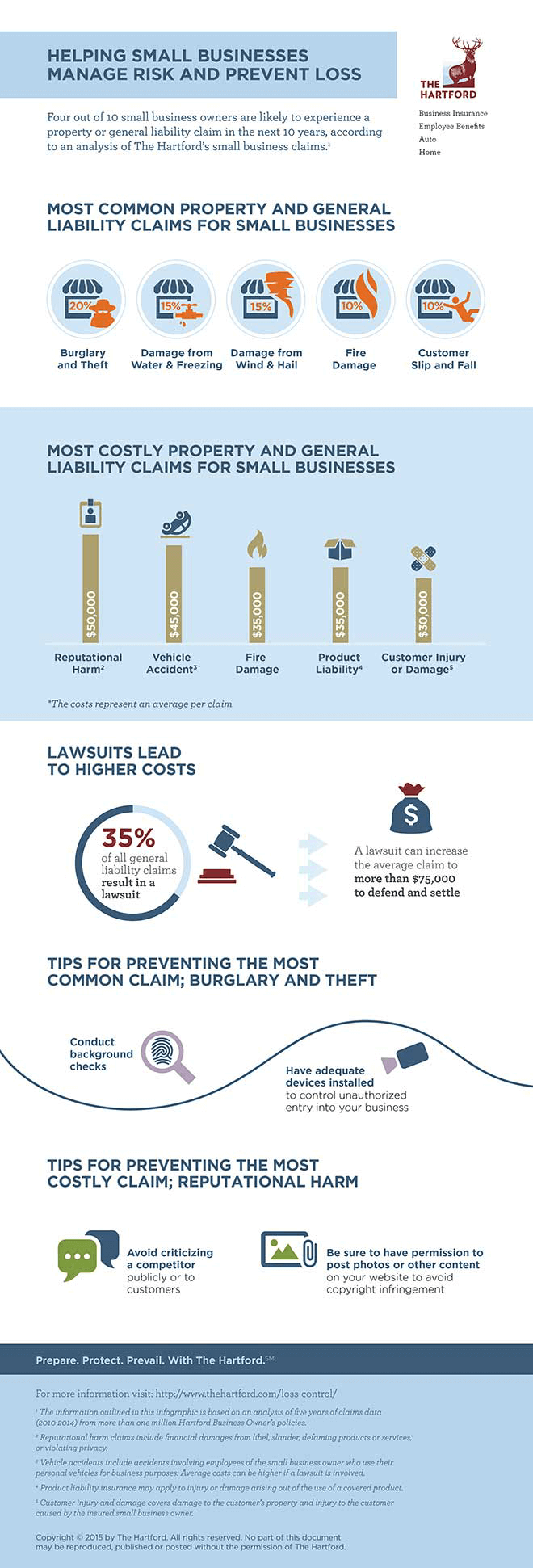

Business or general liability insurance helps protect businesses from claims that happen as a result of normal business operations. Liberty mutual offers full general liability insurance protection for businesses of all stripes whether you are a small firm or a major. Top small business insurance companies which insurance carrier is. General liability gl insurance typically provides insurance coverage to small businesses for among other things third party bodily injuries medical payments and advertising injuries.

General liability insurance gl often referred to as business liability insurance is coverage that can protect you from a variety of claims including bodily injury property damage personal injury and others that can arise from your business operations. Below we ve assembled our picks for this year s best general liability insurance companies for small businesses. Our approach we looked at 30 of the biggest and most promising small business insurance carriers and spent over 60 hours researching the details of their general liability policies. Almost all businesses need general liability insurance.

With its general liability insurance coverage of up to 2 million for a single incident and 4 million for all incidents is available. We compared more than 20 carriers on criteria such as costs policy options and online availability to come up with the nine best general liability insurance companies. Small business owners want to work with general liability insurance companies that are reliable and can offer quality coverage at an affordable rate. General liability covers customer injuries customer property damage and advertising injuries.

Top general liability insurance companies. The best small business insurance companies offer core policie like general liability plus a broad range of additional coverages that most small business owners need. Called cna connect this policy combines general liability insurance with other types of coverage small businesses may need including property business income and equipment breakdown insurance.