Best Car Title Loan

Car title loans also known as auto title loans work a little bit differently.

Best car title loan. A car title loan gives you the cash advance to be spent at your discretion by using your vehicle value to determine how much money you can borrow rather than only solely reviewing your financial history as a prospective borrower. Car loan interest rates today you can utilize our auto loan calculator to see which alternative produces the ideal outcome for your needs. Car title loans tend to range from 100 to 5 500 an amount typically equal to 25 to 50 of the car s value. Car title loan rates can range anywhere from 52 apr to 300 apr with an average apr of 96 across borrowers.

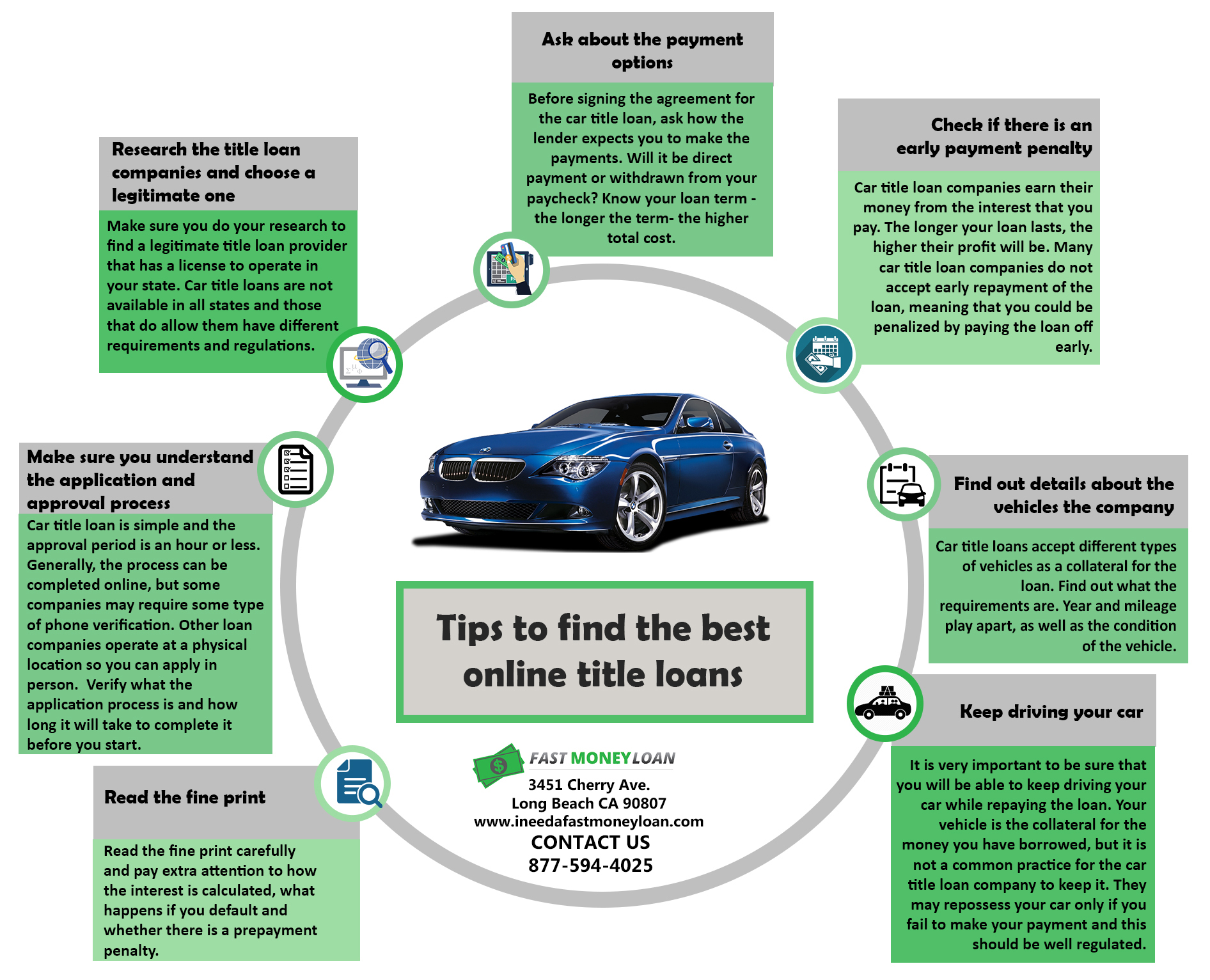

Cars and truck loans in singapore commonly bill level rates of interest suggesting rate of interest payment is a consistent amount every month over the life of a loan. As with most car title loans the rates offered through max cash s lender partners are high compared with other types of personal loans. If you obtain a loan with a term that is more than 30 days long it will very likely come with an early repayment penalty attached to it. When it comes to car title loans there are times when paying off your loan early is a bad thing.

The loan term is short usually just 15 or 30 days. With our accessible title loans you can get quick cash in your pocket by using your vehicle as collateral. A title loan is an expensive short term loan that s available when you pledge your vehicle as collateral. Here at loancenter we believe that past mistakes should not determine the rest of your financial life.

/car-title-loans-315534_final3-b0f2fb2887e34dbcb867271107c24390.png)