Application For Small Business Loans

The government guarantees 80 of the finance to the lender and pays interest and.

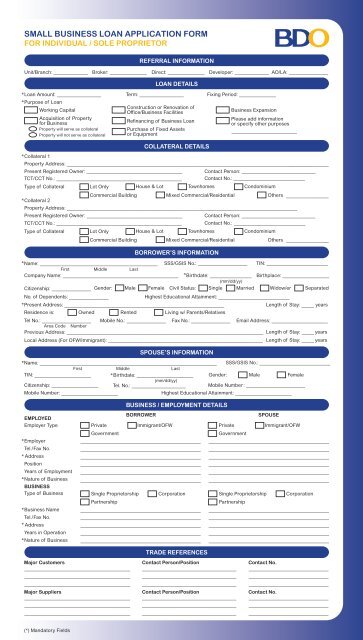

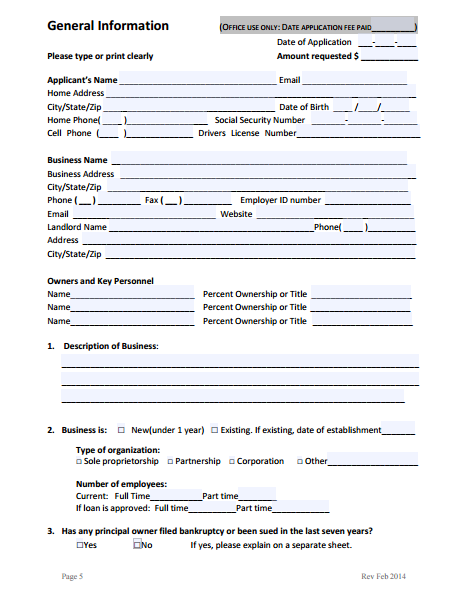

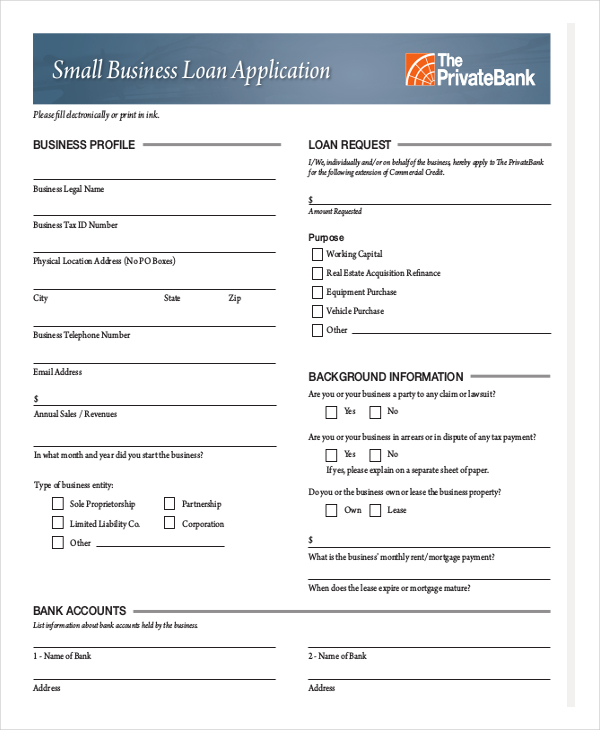

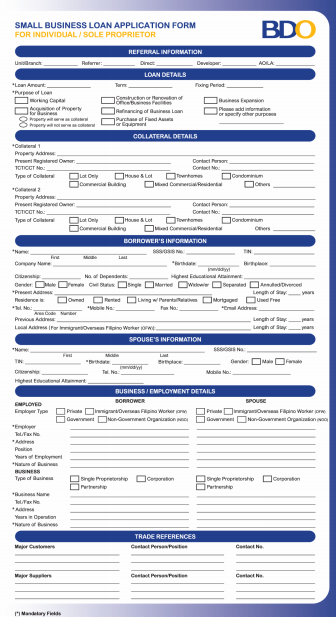

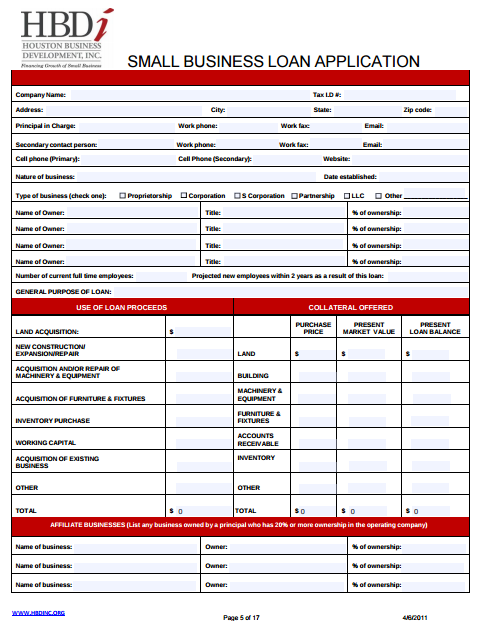

Application for small business loans. We just need some basic details about you and your business and aim to get you approved in minutes. Loan terms collateral and documentation requirements apply. Signed into law by president trump on friday the package authorizes the small business administration to offer 100 guarantees for up to 349 billion in loans for small businesses that need to. Use lender match to find lenders that offer loans for your business.

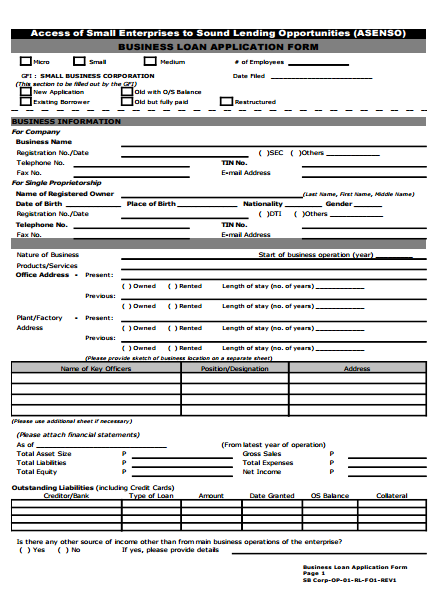

The small business cashflow loan scheme has been extended until the end of 2020. Apply for a government backed start up loan of 500 to 25 000 to start or grow your business. Small business guidance loan resources. This program is aimed at providing a simpler and more streamlined 7 a process to acquire loans for businesses operating in the rural areas.

Apply online for free. Subject to credit approval. Unlike a business loan this is an unsecured personal loan. Small business administration sba financing is subject to approval through the sba 504 and sba 7 a programs.

Organisations and small to medium businesses including sole traders and the self employed may be eligible for a one off loan with a term of 5 years if they have been adversely affected by covid 19. Applications opened on 12 may 2020 and can now be submitted up to and including 31 december 2020. Small businesses are encouraged to do their part to keep their employees customers and themselves healthy. The scheme helps small and medium sized businesses to access loans and other kinds of finance up to 5 million.

Start or expand your business with loans guaranteed by the small business administration. Some restrictions may apply. Small business administration sba financing is subject to approval through the sba 504 and sba 7 a programs. Microloan program if you are in need of small short term loans then the microloan program is just the right deal for you.

You ll get free support and guidance. The sba s economic injury disaster loan provides vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing as a result of the covid 19 pandemic.