Accounts Receivable Factoring Company

Discover accounts receivable factoring companies.

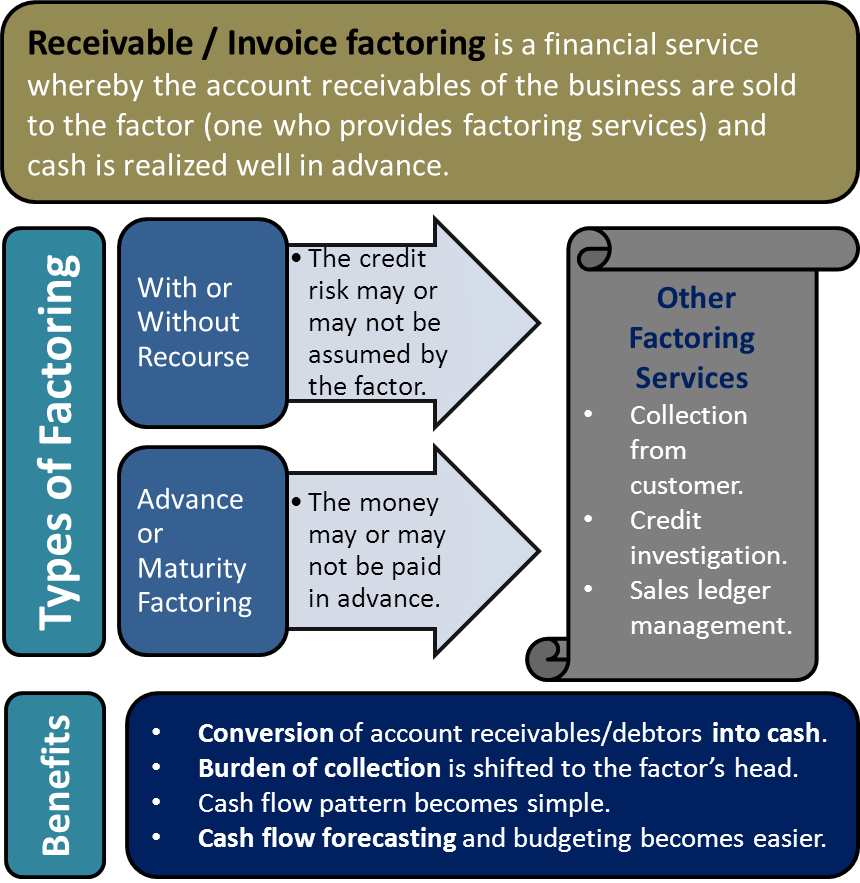

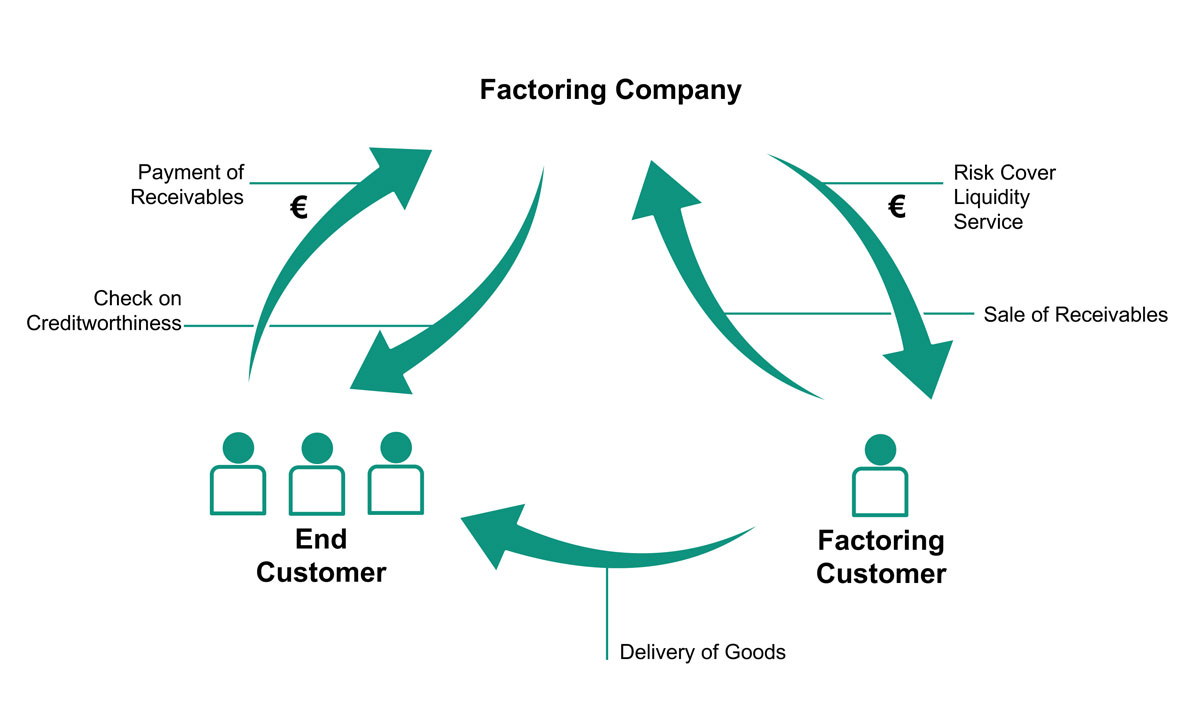

Accounts receivable factoring company. Accounts receivable factoring also known as factoring is a financial transaction in which a company sells its accounts receivable accounts receivable accounts receivable ar represents the credit sales of a business which are not yet fully paid by its customers a current asset on the balance sheet. Instead of waiting for weeks or months for customers to pay their invoices accounts receivable financing lets business owners get an advance on those invoices and use the cash for pressing business needs instead of waiting for weeks or months for customers to pay their invoices. Here s how it works. If you re just starting up or growing quickly and could benefit from some extra capital factoring companies provide a simple and straightforward financing solution.

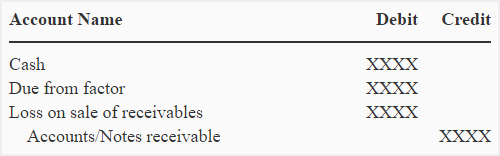

What is accounts receivable factoring. Send your invoices to your factoring company. Factoring accounts receivable means selling receivables both accounts receivable and notes receivable to a financial institution at a discount. Also known as accounts receivable financing factoring is a transaction which involves selling receivables to a factoring company.

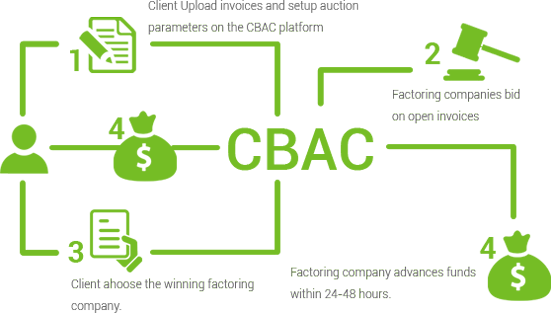

Accounts receivable factoring is a solution that allows business owners to quickly turn invoices into working capital. The factoring company is then responsible for collecting the accounts receivable in return for which it charges you a commission normally based on the value of the invoices factored. Perform your work or service as normal. Factoring companies will usually focus substantially on the business of accounts receivable financing but factoring in general may be a product of any financier.

Then the factor is paid by your customer. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. The process for accounts receivable factoring is quick and easy. What is accounts receivable factoring.

The institution to whom receivables are sold is known as factor. Factoring is a common practice among small companies. Accounts receivable factoring is sometimes called invoice factoring it refers to the process of selling your unpaid invoices accounts receivables to a business lender or a factor for a discount price. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their.

Work with the best factoring companies to improve your cash flow today. The factoring company initiates a same day advance on a percentage of your invoice total directly into your bank account. Accounts receivable factoring works for any business. Factoring accounts receivable allows you to obtain cash advances from the factoring company which frees up cash from working capital.