Choosing A Medicare Supplement Plan

/medigap-or-medicare-supplement-insurance-inscription-and-stethoscope--1173091550-4fa9556bc3fe46c1af9e64e1eddb64b8.jpg)

If you take prescription drugs regularly finding the best prescription plan is going to take some.

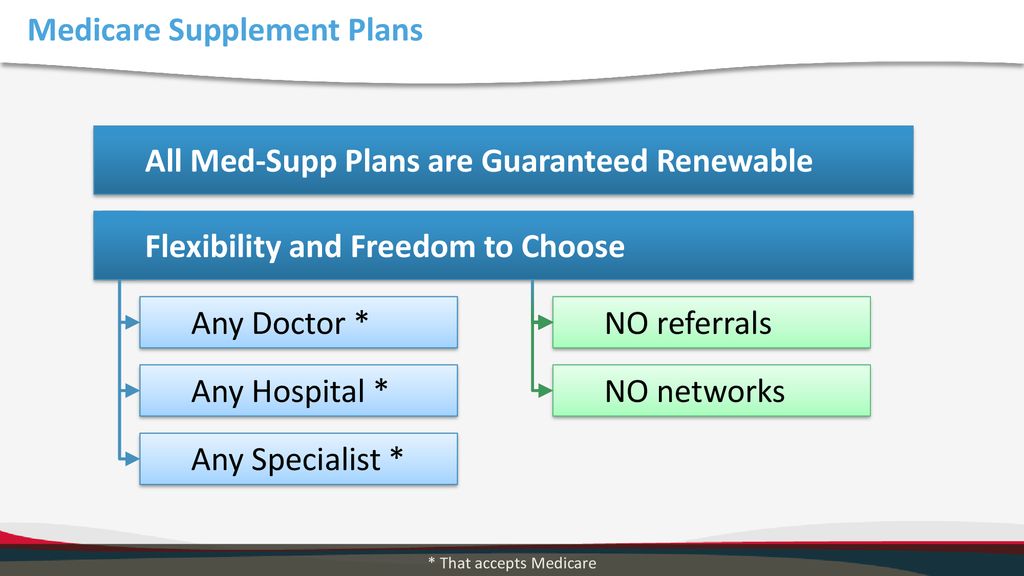

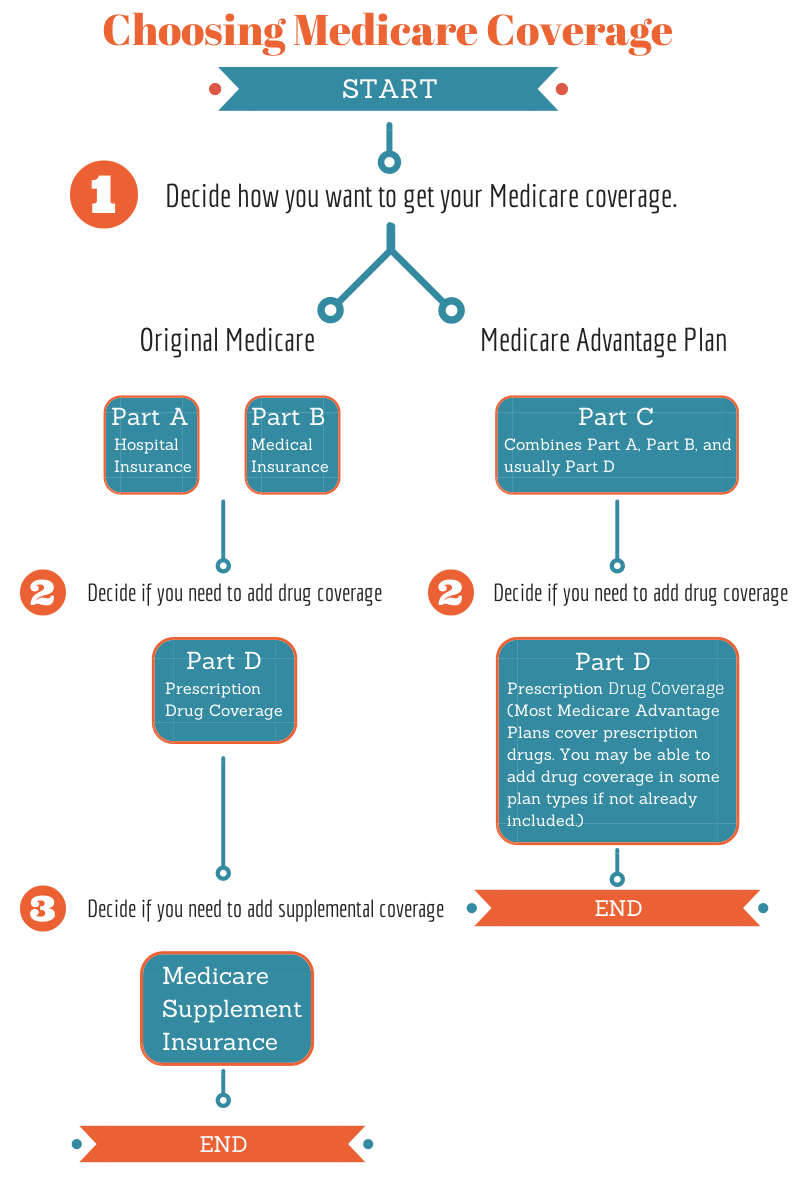

Choosing a medicare supplement plan. Medigap plans pay for costs such as deductibles and copays and other charges that medicare doesn t cover. If you choose original medicare you can also decide to. However you have the option to fill most of the coverage gaps by purchasing a medicare supplement plan also known as medigap. These plans are available for people enrolled in medicare parts a and b not for those who elect a medicare advantage plan.

Remember this guide is about medigap policies. Medigap plans don t cover prescription drugs so you will need to select a standalone part d plan. For more information. Or maybe you been familiar with medicare for some time and are frustrated by the gaps in coverage and the amount you still need to pay out of pocket.

Medicare supplement insurance medigap policies medicare advantage plans or medicare prescription drug coverage part d. How to choose the best medicare supplement plan. Medigap policies are sold by private insurers but they are strictly regulated by states and the federal government. Add supplemental coverage like insurance from a former employer or medicare supplement insurance medigap to help pay your out of pocket costs like your 20 coinsurance.

The other two thirds of recipients choose to go with original medicare parts a and b and typically pair it with a standalone part d prescription plan. While it might initially seem complicated if you follow our five step plan you ll be well on your way to secure the coverage you need. To help you choose use the medigap online search tool at medicare gov and click on supplements other insurance at the top of the page then on how to compare medigap policies this tool will break down what each plan covers along with premium cost ranges and lists the companies that offer them in your area. Original medicare provides decent health insurance coverage for your major medical but it doesn t cover everything.

Next let s review why roughly 35 percent of seniors on original medicare close to 13 5 million people and growing have chosen to buy a medicare supplement. Medicare supplement medicare supplemental insurance medigap medigap plan or medigap policy it s all referring to the same thing. Join a separate medicare drug plan part d if you want drug coverage. It is important for a person to examine all the differences carefully before.

Medigap provides greater flexibility in choosing doctors while medicare advantage often has lower premium costs.