Accounts Receivable Finance

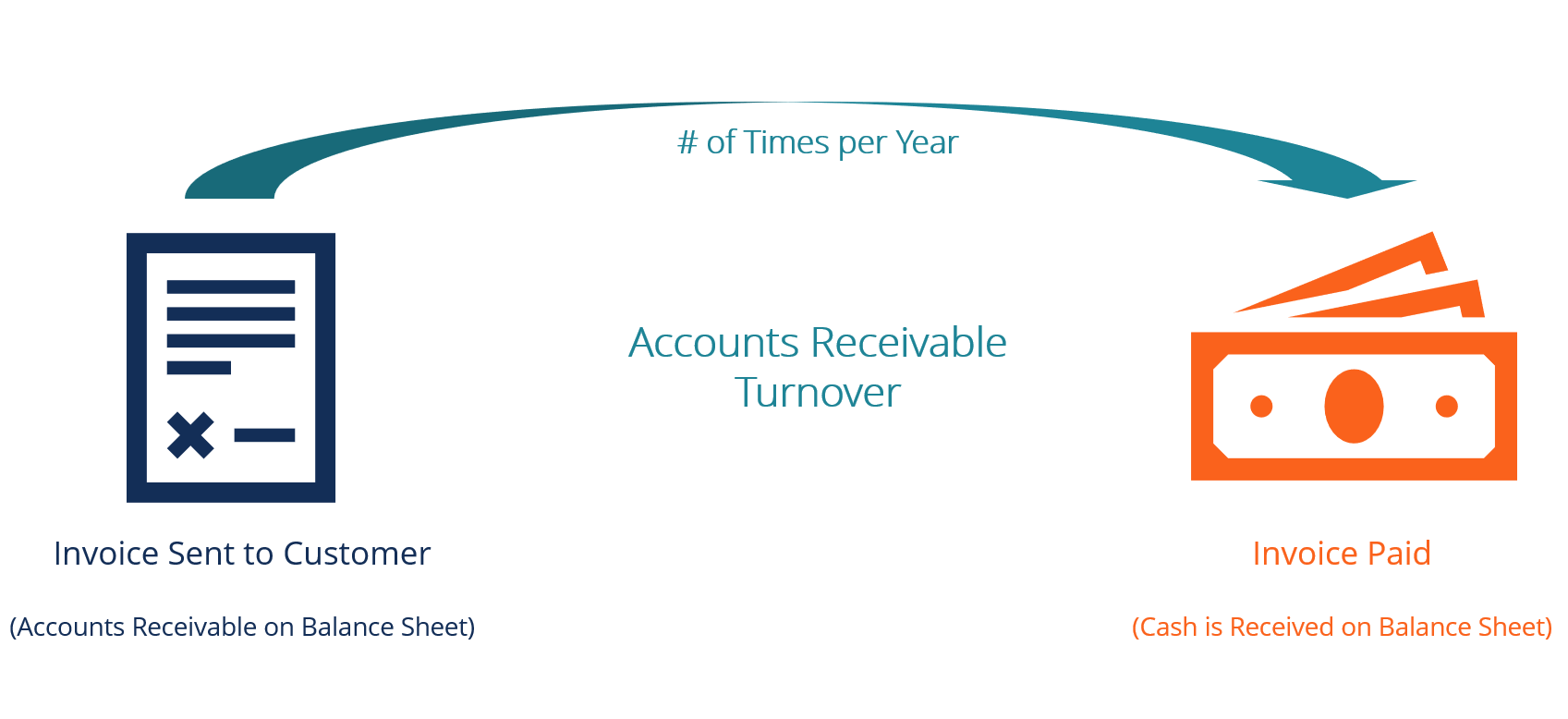

Money that a customer owes a company for a good or service purchased on credit.

Accounts receivable finance. Accounts receivable are assets equal to the outstanding balances of. Use accounts receivable to track customer invoices and payments that you receive from customers. A key for any business to run smoothly and successfully. Accounts receivable is a current asset account that keeps track of money that third parties owe to you.

What is accounts receivable ar financing. Accounts receivable financing is a means of short term funding that a business can draw on using its receivables. Accounts receivable financing is an agreement that involves capital principal in relation to a company s accounts receivables. Whether you are an established business or just getting started insufficient cash flow can cripple your operations and growth capabilities.

Accounts receivable financing allows companies to receive early payment on their outstanding invoices. Accounts receivable are current assets for a company and are expected to be paid within a short amount of time often 10 30 or 90 days. Again these third parties can be banks companies or even people who borrowed money from you. Ar financing can take various forms but the three major types are.

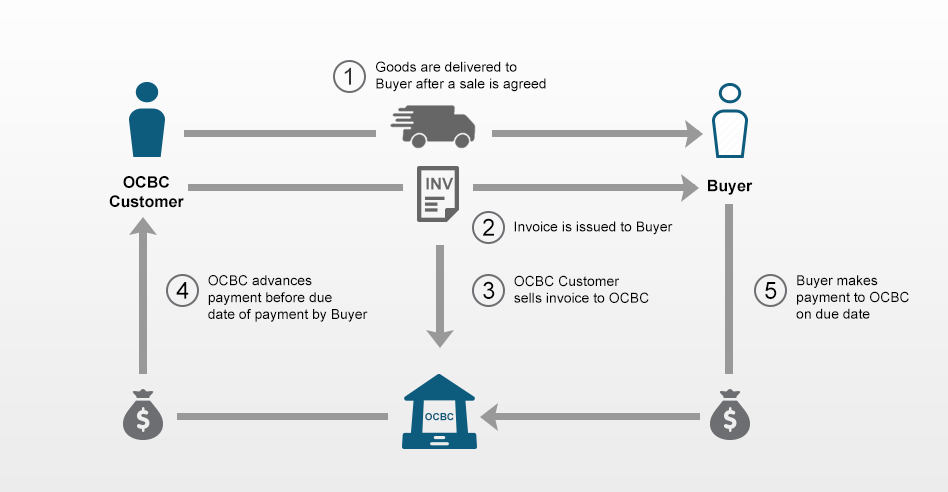

It is very useful if a timing mismatch exists between the cash inflows and outflows of the business. Traditional institutions often do not view your company s accounts receivable for what they are an asset. Accounts receivable purchase arp is an arrangement whereby ocbc purchases invoices from our customers to unlock working capital for them. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee.

In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. Accounts receivables are created when a company lets a buyer purchase their. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing. Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short term.

A common example of accounts receivable is interest receivable that individuals usually get from making investments or putting money into an interest bearing savings account.

/open-book-with-figures-and-paper-with-words--accounts-receivable--613785056-c6a530e62e164acf899fc612ab80b528.jpg)