Car Insurance Married Vs Single

Insurance rates for married couples may be lowered by insurance companies under the theory that married people are typically more mature and responsible and are less likely to drive recklessly.

Car insurance married vs single. Car insurance married vs single. It may feel incredibly unfair to the consumer that married people can get much lower rates for car insurance but for many insurers the decision makes perfect sense. Let s explore car insurance rates by marital status and tips to save no matter your marital status. Insurance companies always have profits and risks in mind and often operate under the assumption that married people are safer drivers and get into fewer accidents.

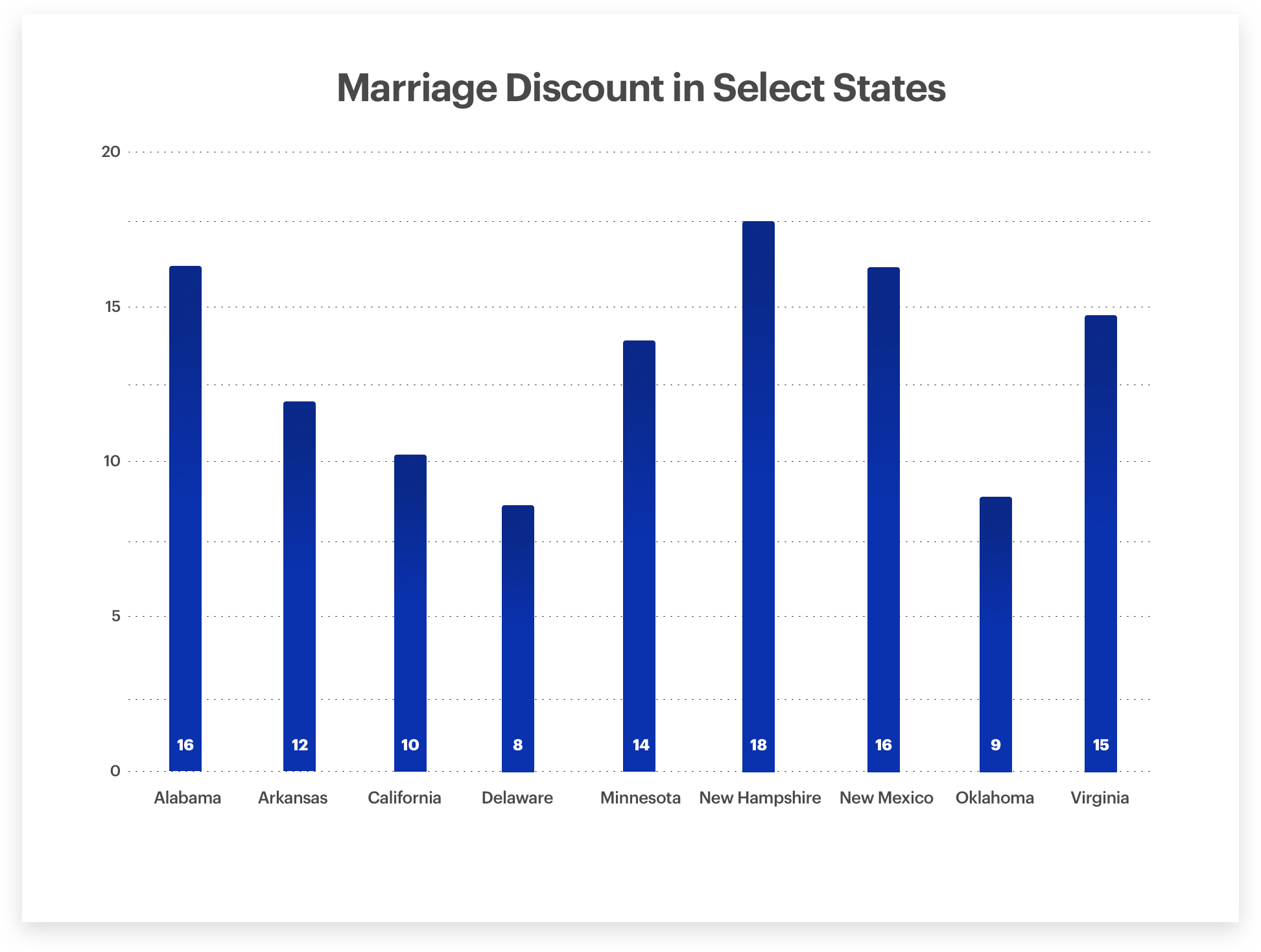

Car insurance rates for married over 30 year olds only falls about 2 percent the study found. Still it s common practice for auto insurance companies to offer discounts to married couples which may appear as an unfair advantage for someone who might be single separated or divorced. But it isn t just males who are charged higher rates if they are single. Like it or not the general perception among insurance providers is that married couples are more stable in all areas of their life and therefore tend to be safer drivers.

In terms of married car insurance and single car insurance married couples have a decided advantage when it comes to cost. Single drivers on average a married driver pays 160 less per year for car insurance than does a single unmarried driver. Married vs single car insurance comparison when you purchase your car insurance it is an agreement between you and your insurer that is legally binding. Car insurance for married vs.

If you just got married you should call your insurance company because you might get a discount. Because married drivers are seen as more financially stable and safer drivers they typically pay less for car insurance. This is if both married drivers have good driving records. In general a married couple will receive lower insurance rates than single individuals.

As per this agreement you disclose all relevant details to your insurer about your driving and your personal information. Your marital status could influence your car insurance rates. There are two other factors significantly affecting drivers auto insurance quotes the study said. Regardless of your marital status you want the best auto insurance rates available.

A married male of the same age can pay as much as 25 percent less for their car insurance than their single counterpart for the exact same type of policy.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-72470826-5b821f5046e0fb002c2cce13.jpg)