Accounts Receivable Financial Statement

Accounts receivable billing and collections training guide page 88.

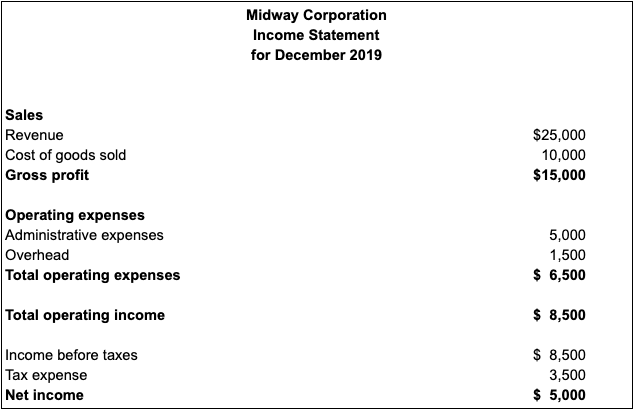

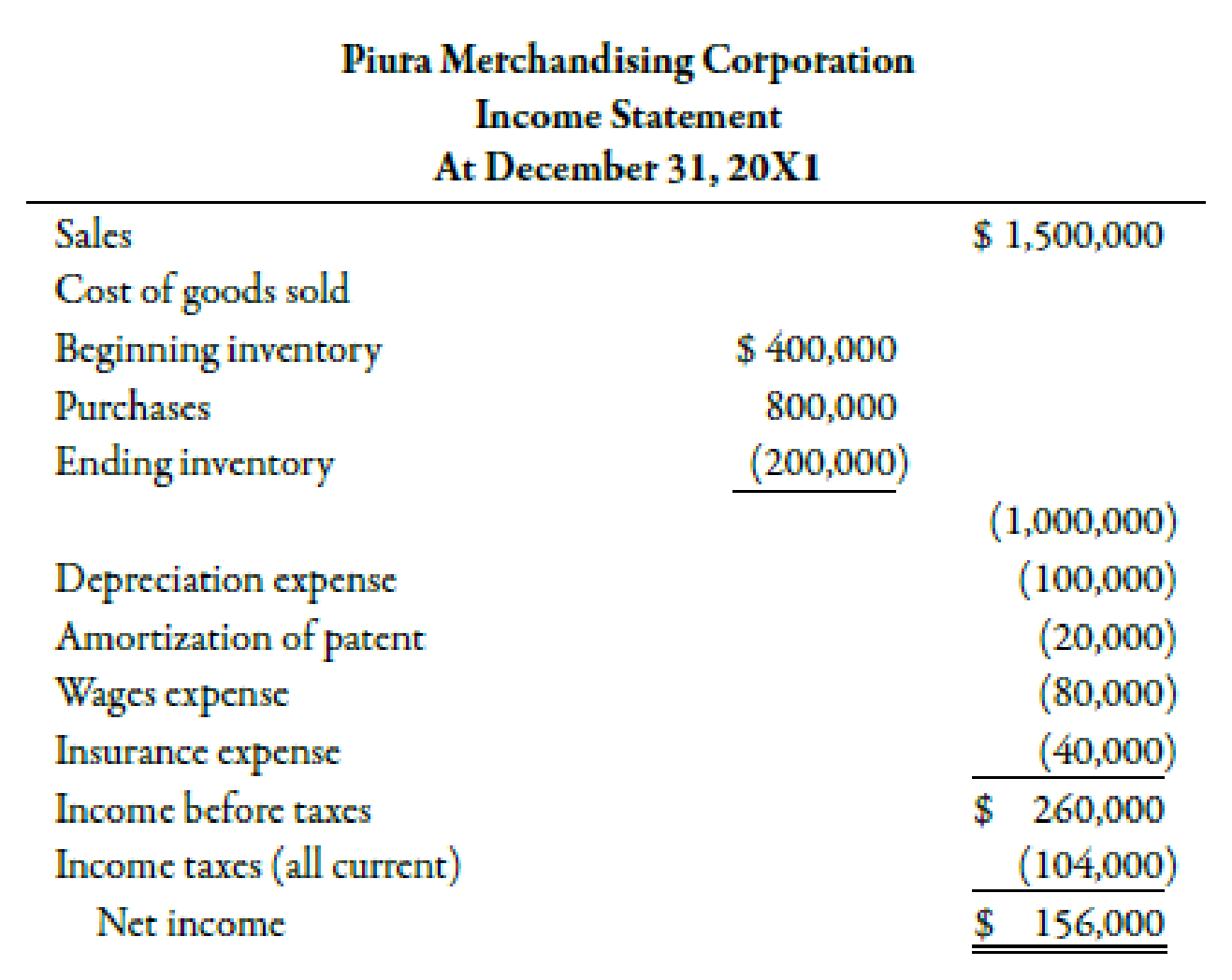

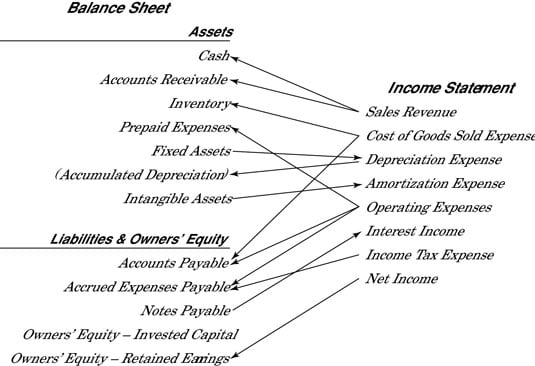

Accounts receivable financial statement. On the income statement several accounts affected by accounts receivable are reported as shown below. First you must record the correct balance in the first place. Accounts receivable also known as customer receivables don t go on an income statement which is what finance people often call a statement of profit and loss or p l. Accounts receivable accessed feb.

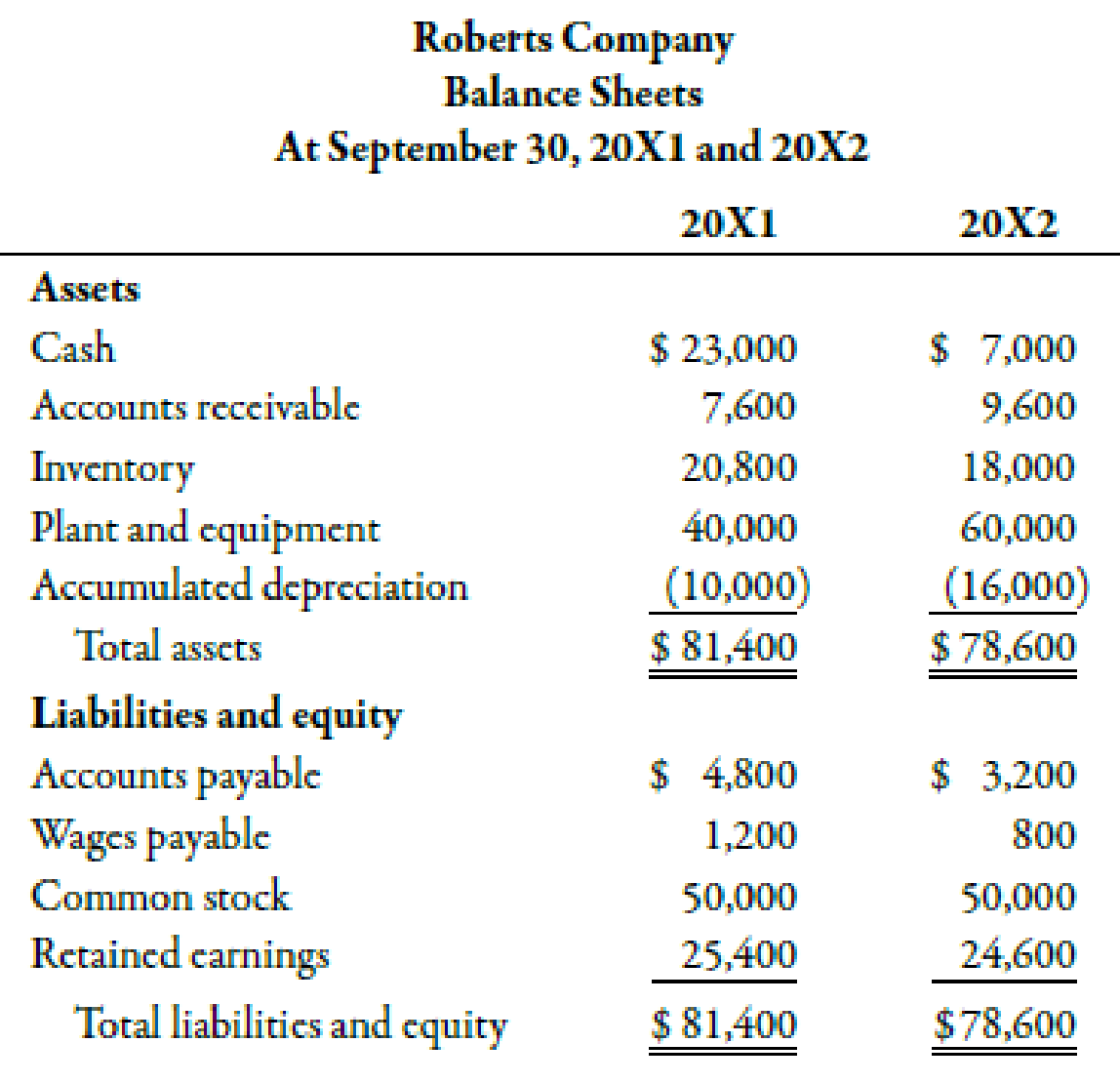

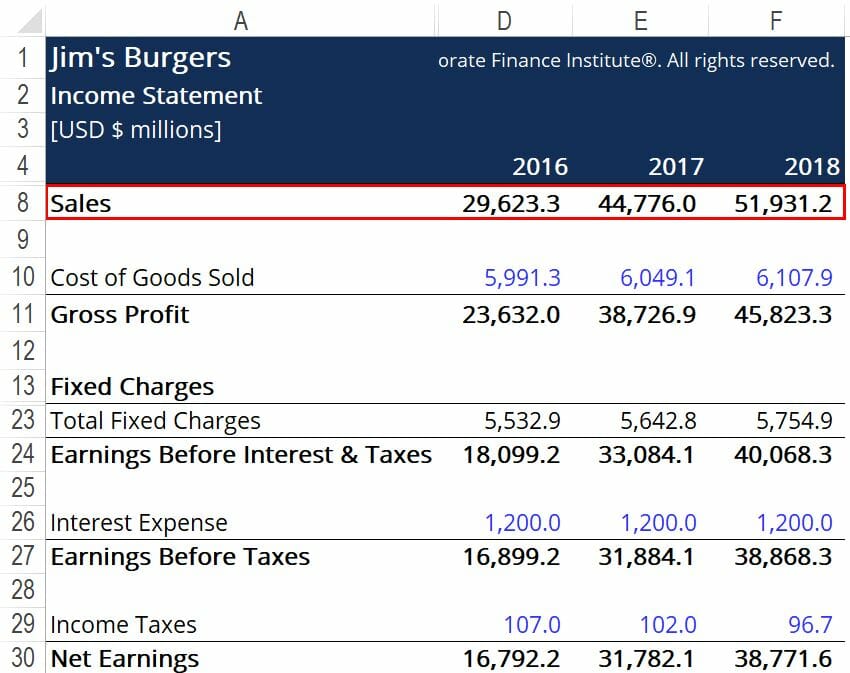

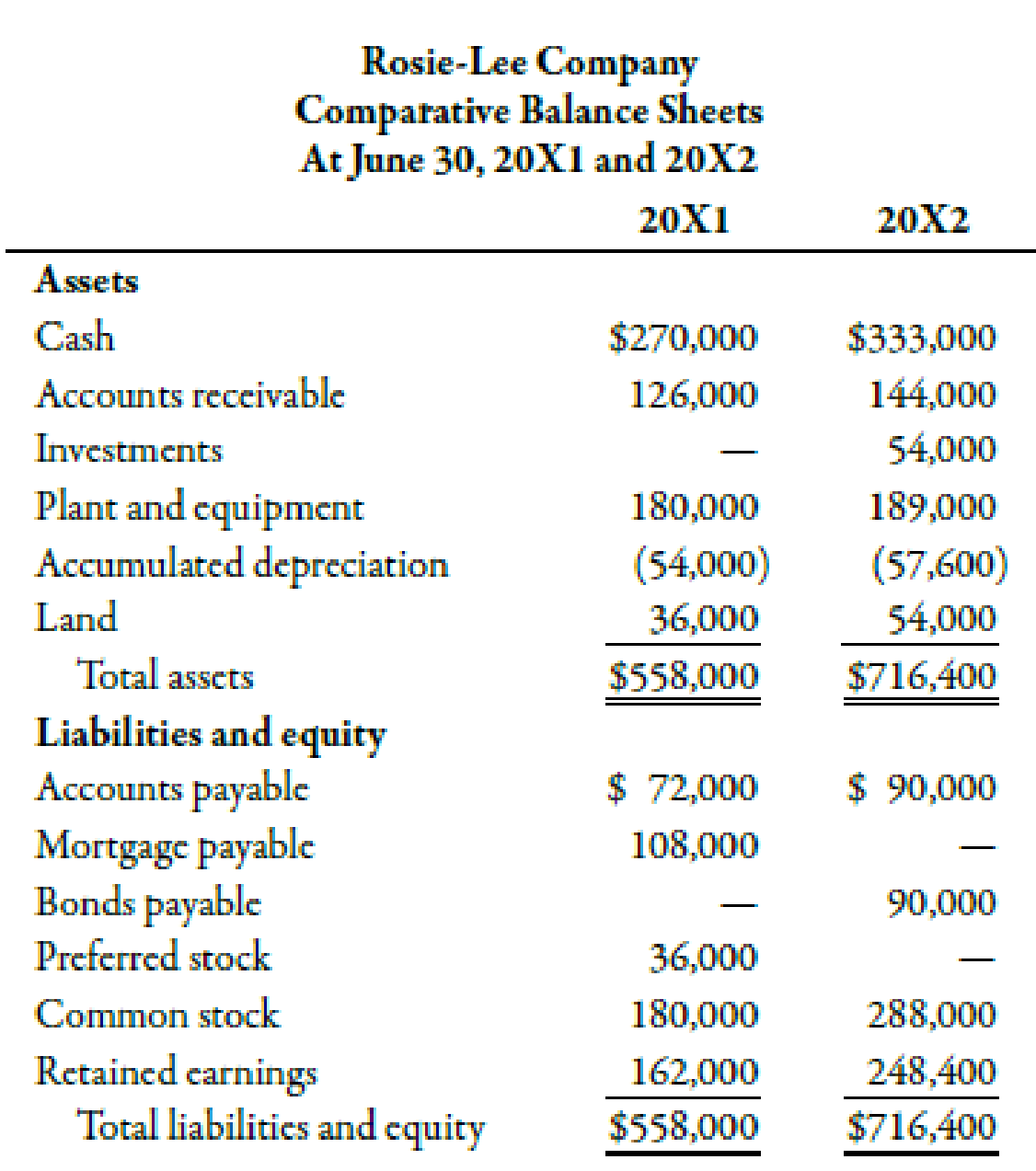

Accounts receivable is a current asset account in which a company records the amounts it has a right to collect from customers who received. Net sales include cash sales and credit sales less sales returns and allowances resulting from products sold being returned by customers. The accounts receivable turnover ratio is an efficiency ratio and is an indicator of a company s financial and operational performance analysis of financial statements how to perform analysis of financial statements. Accounts receivables are created when a company lets a buyer purchase their.

If the receivable amount only converts to cash in more than one year it is instead recorded as a long term asset on the. The two types of accounts are very similar in the way they are recorded but it is important to differentiate between accounts payable vs accounts receivable because one of them is an asset account and the other is a. Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short term. Finally the uncollectible accounts expense is reported as an operating expense.

Texas comptroller of public accounts. This guide will teach you to perform financial statement analysis of the income statement balance sheet and cash flow. Accounts receivable have two main valuation concerns. In accounting accounts payable and accounts receivable are sometimes confused with the other.

The valuation assertion tells financial statement users that the numbers on the front of the statement are correct. That is the correct numeric value is stated. Definition of accounts receivable. Accounts receivable is the amount owed to a seller by a customer as such it is an asset since it is convertible to cash on a future date accounts receivable is listed as a current asset in the balance sheet since it is usually convertible into cash in less than one year.

This estimate for bad debt losses is recorded as both a bad debt expense on the income statement and displayed in a contra account below accounts receivable on the balance sheet often called the. What does net 30 mean on an invoice. Money that customers owe a company flows through the statement of financial position also referred to as a balance sheet or report on financial condition. Arizona financial information system.