Accounts Receivable Lending

Some of the key benefits to the lender.

Accounts receivable lending. Fund the growth of your business with a wide range of financing solutions. The commercial finance association is the leading trade association of the asset based lending and factoring industries. If you sell your products or services to businesses that pay in 30 60 90 days or more prime commercial has a liquidity solution for you. Ownership and control over the accounts receivable portfolio and cash.

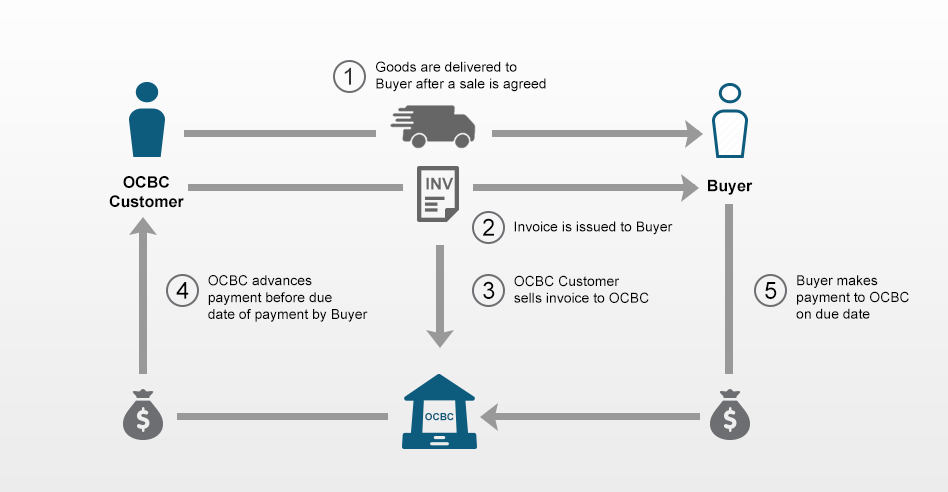

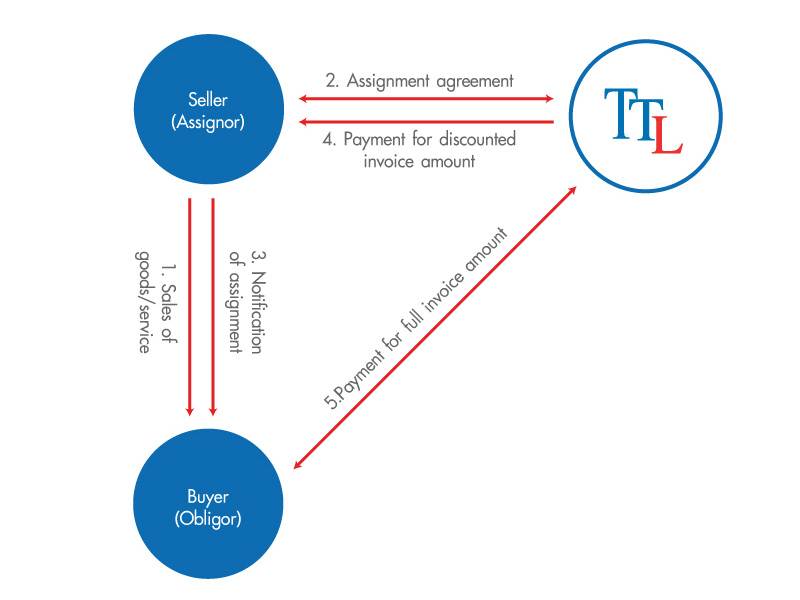

Accounts receivable financing or factoring is the purchase of accounts receivable invoices at a discount. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing. Accounts receivable financing is an agreement that involves capital principal in relation to a company s accounts receivables. Unlock up to 90 of the value of your receivables.

The factoring company assumes the risks on the receivable and in return issue your business. Accounts receivable factoring is sometimes called an accounts receivable loan this can be misleading because technically speaking accounts receivable factoring is not categorized as a loan it does not show up as debt on your balance sheet. Accounts receivable financing allows companies to receive early payment on their outstanding invoices. We begin by verifying the submitted invoice s and advancing up to 90 of the total value of the invoice s.

Once you generate an invoice southstar goes to work for you. How does accounts receivable financing work. Accounts receivable financing a r financing sometimes known as a ledgered line of credit or invoice financing is a great solution for businesses that need more funding that is not available from traditional lenders. Understanding accounts receivable financing.

Southstar is concerned with the credit quality of your clients account debtors and not your personal or business credit scores. Many companies need additional cash flow to support seasonal demands. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee. Accounts receivable financing is a term more accurately used to describe a form of asset based lending against accounts receivable.

Improve business funding with dbs sme accounts receivable purchasing for company s trade.