Back Tax Relief

You can only reclaim ppi tax going back four tax years as well as the current one.

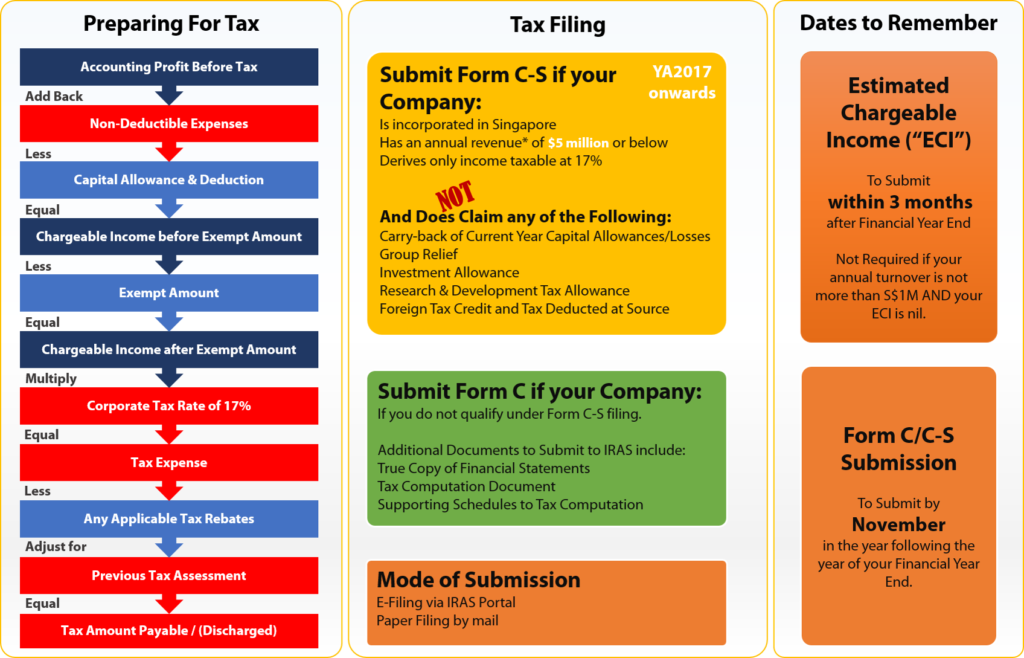

Back tax relief. Lifeback tax is the fastest easiest irs tax debt relief solution. You ll get tax relief based on what you ve spent and the rate at which you pay tax. You ll need to gather tax documents for the year you re filing your tax return for e g you ll need your w 2 1099s or other documents from 2018 if you re filing your 2018 tax return. Please refer to the e tax guide on enhanced carry back relief system pdf 533kb for more information on the loss carry back relief for ya 2020.

Scammers use the promise of help to steal your money and legitimate tax settlement companies rarely do anything you can t do yourself. The tax crisis institute and its back tax relief services can help you take the necessary steps you need to find relief. Tax relief companies use the radio television and the internet to advertise help for taxpayers in distress. So as the 2020 21 tax year has kicked in that means the furthest you can go back is the 2016 17 tax year.

The relief cap is fundamentally a change in the personal income tax system. The government is not rolling back the focus on marriage and parenthood. Therefore tax reclaims can t be made on any ppi payouts received on or before 5 april 2016. You cannot claim tax relief if you choose to work from home.

For female taxpayers who are claiming working mother s child relief wmcr with the relief cap 9 in 10 of them claiming wmcr are not affected as stated in budget 2016 statement. If you pay them an upfront fee which can be thousands of dollars these companies claim they can reduce or even eliminate your tax debts and stop back tax collection by applying for legitimate irs hardship programs. In a nutshell if you re struggling to pay current or back taxes you may wonder if tax debt relief is the answer. Contact us to see if you qualify for our help.

Example if you spent 60 and pay tax at a rate of 20 in that year the tax relief you can claim is 12. Businesses may elect for the current or enhanced carry back relief based on an estimate of the current year unutilised cas and trade losses for ya 2020.

/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg)