Best Way To Get Pre Approved For A Mortgage

Lee nelson contributor.

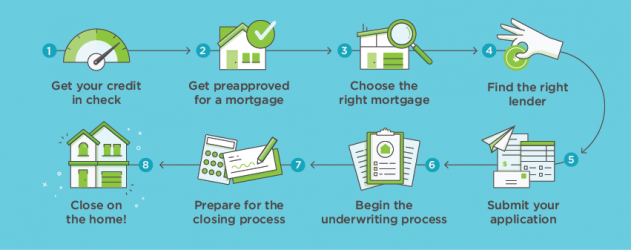

Best way to get pre approved for a mortgage. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation your lender may require. 43 percent is the maximum ratio allowed. You may want to hold off on a preapproval if you re not quite ready to begin the homebuying process. Get pre approved for a mortgage.

There are ways to tip the odds in your favor when looking for a mortgage preapproval. Staying safe before you apply online read through the. Learn more about home loan. The best time to apply for a mortgage preapproval is before you start house hunting.

What to provide to your lender to get pre approved. By checking the box that says i want to get pre approved by a lender you ll be connected with up to three lenders right away. Even if you are deemed to have bad credit there are ways to still get pre approved for a mortgage. A borrower could have the income but something on their credit is preventing them from being able to move forward with the mortgage wendland says.

April 28 2020. On one hand you know what you can spend before bidding on properties. A mortgage preapproval is an offer from a lender indicating the type and amount of loan you can qualify for and is based on an evaluation of your financial history. You ll need to provide your lender or mortgage broker with the following.

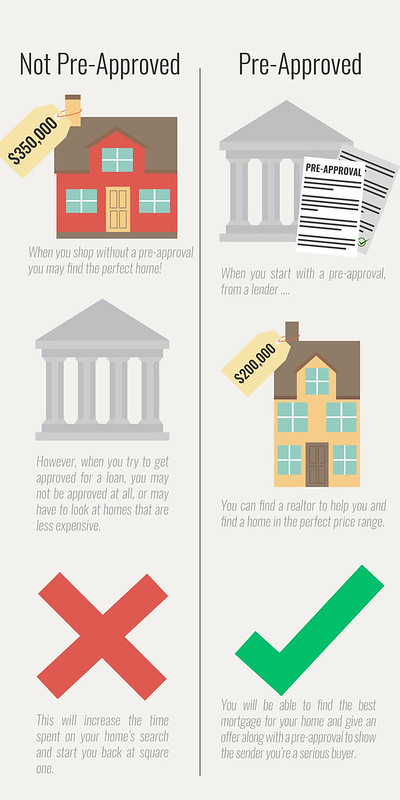

If they get that out of the way first it gives them a clear path to purchasing their home. Best ways to get pre approved quickly and efficiently for a mortgage. In the world of homebuying think of a mortgage pre qualification as a learner s permit while a preapproval letter is a license to drive. Proof you can pay for the down payment and closing costs.

The documents to get pre approved are the same documents that you would need to get a mortgage. Decrease your overall debt and improve your debt to income ratio. In general a debt to income ratio of 36 percent or less is preferable. Getting pre approved for a mortgage loan before looking at houses is emotionally and financially responsible.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)