Best Student Loans Refinance

Here s how it works.

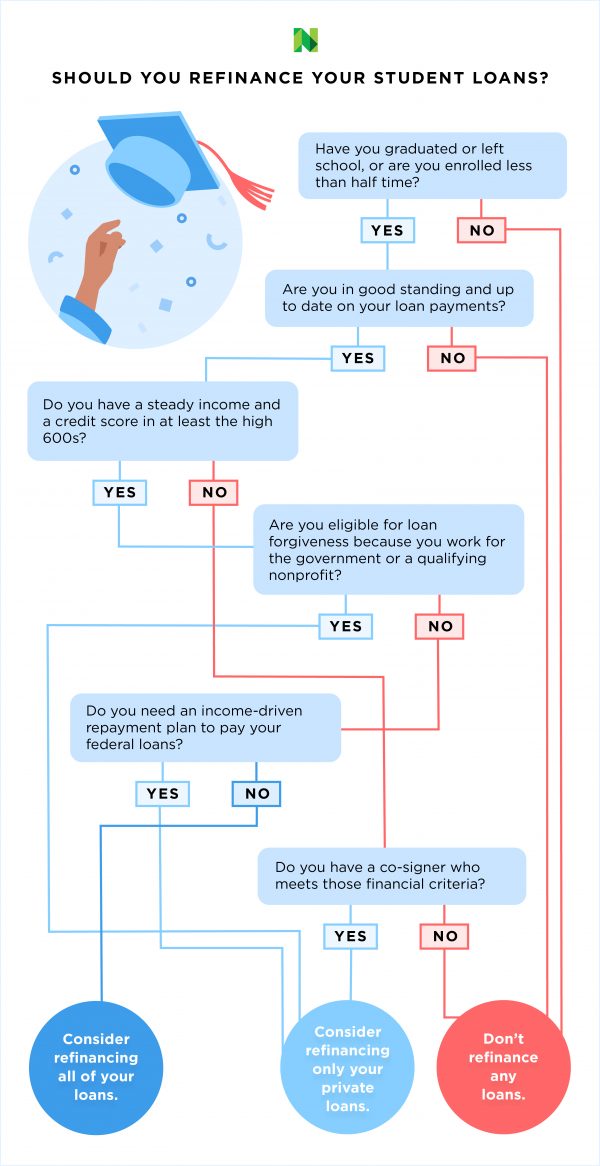

Best student loans refinance. Its undergraduate student loan. Refinancing my student loans through laurel road is the best thing that could have happened. The requirements to refinance student loans are a bit different than when you took out your loans. Loan refinance rate loan amount and repayment or hardship options were the top factors student loan borrowers considered when choosing a refinancing lender.

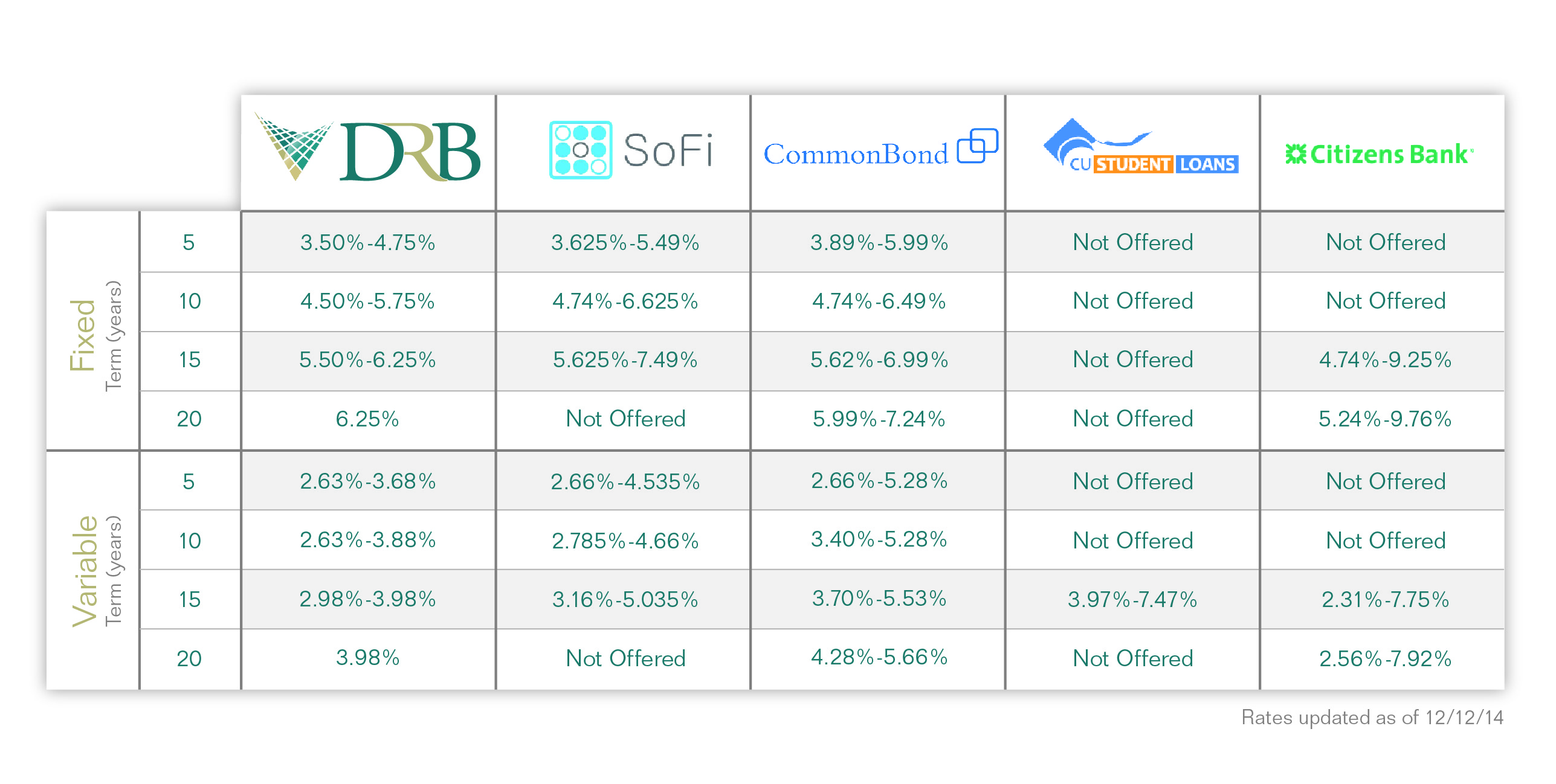

When you refinance student loans you lower your payments by consolidating your private or federal student debt into a new loan with a lower rate. For federal loans you simply had to fill out the fafsa. But certain lenders excel at serving certain types of customers. Laurel road is a lender with low rates a variety of repayment terms and a robust online experience.

The requirements to refinance student loans. To be eligible to refinance at an attractive interest rate you ll typically need a history of earnings and a credit score that gives lenders the confidence that you ll be able to repay your student debt. Sofi is perhaps best known as a student loan refinance lender but it also makes loans to undergraduates graduate students law and business students and parents. The best student loan refinance company is the one that can reduce your rate the most.

Compare the best student loan refinance companies so that you can find the lowest refinance rate reduce your monthly payment or pay off your loans early. Right now the best student loan refinancing rates are 1 95 9 24 apr. Student loan refinancing can mean big savings in the right circumstances. Bethany whittier dds dentist.

Most student loan borrowers surveyed took out less than 50 000 in loans. The best time to refinance your student loans is typically after graduation when you ve landed a job and established strong credit. A new private company typically a bank credit union or online lender pays off the student.