Accounts Receivable Loan

A loans receivable asset account lists the amounts a lender has paid out to borrowers.

Accounts receivable loan. Accounts receivable financing can also be structured as a loan agreement. A company may owe money to the bank or even another business at any time during the company s history. Once your customer pays their debt the invoice financing company will forward you the remaining balance minus their fee. As such one institution might have both a loans receivable and account receivable on the same client or customer.

Loans payable is a liability account listing the amount of any loan debt you ve taken out and haven t repaid. Loans can be structured in various ways based on the financier. Funding term up to 24 months. By the same application the loan application is outstanding money that is yet to be paid to the person or institution that lent the money to the borrower.

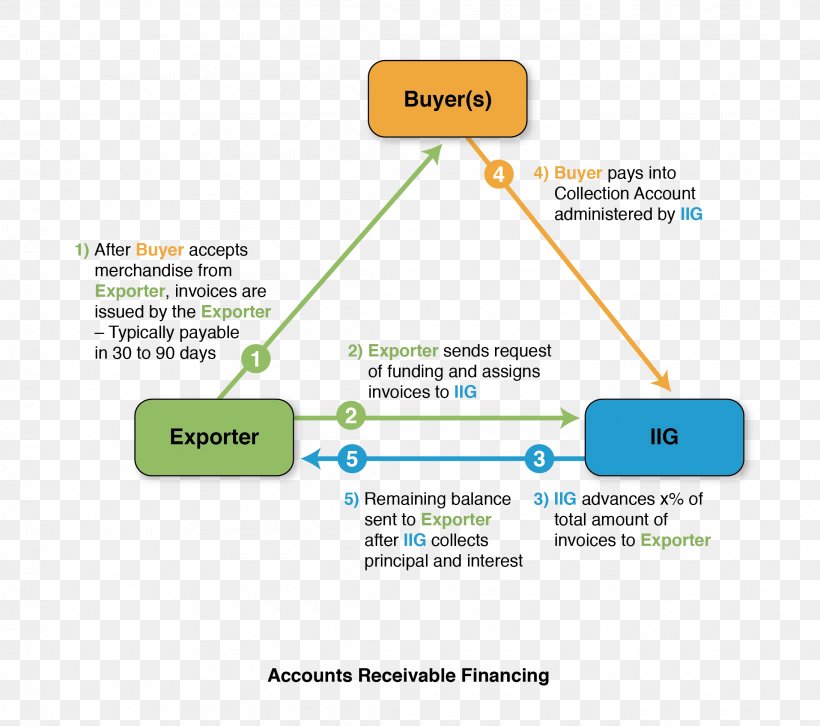

Accounts receivable loans are a solution meant for businesses that experience a long lapse in the time between when a service is rendered and the bill is finally paid. Accounts receivables are created when a company lets a buyer purchase their. The difference between a loan payable and loan receivable is that one is a liability to a company and one is an asset. Accounts receivable financing allows companies to receive early payment on their outstanding invoices.

What is accounts receivable financing. The terms of the loans will determine when the debtor will pay back the money. Receivable financing rates at 0 69 to 1 59. Funding amount 50k 10m.

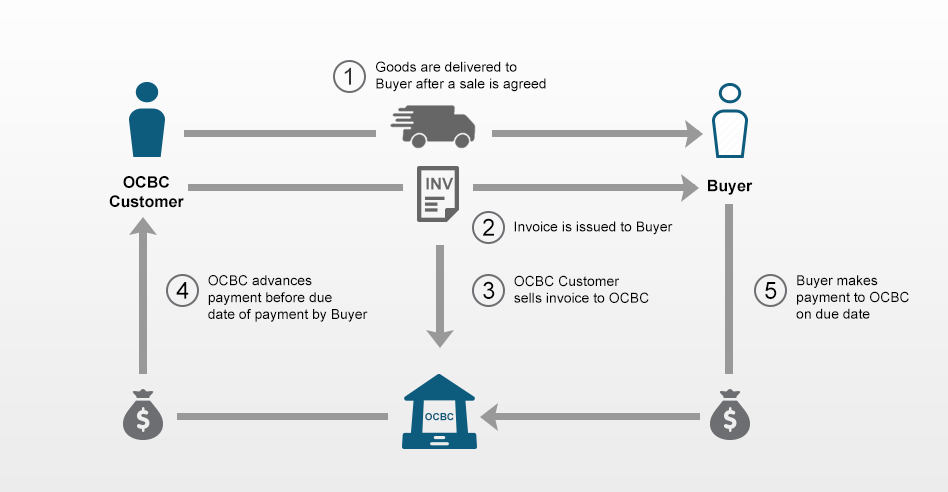

You don t enter interest in loans payable or loans receivable but report interest expense or income when you pay it out or someone pays it to you. Accounts receivable financing is defined as a loan a business owner takes out against unpaid invoices. Accounts receivable lending is not a loan as most people refer it is more like and advance or purchase of the receivable so there is no need to make payments or create debt to your business. In these types of agreements a receivables financing company will advance you a percentage of your invoice s face value.

Easily secure a loan for business with factoring more 703 929 6854. This note can also include lines of credit. An accounts receivable loan borrows against your ar po s and secured future business. This is a liability account.

A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee. One of the biggest advantages of a loan is that accounts.