Business Liability Insurance

Public liability insurance only covers claims made against you by third parties.

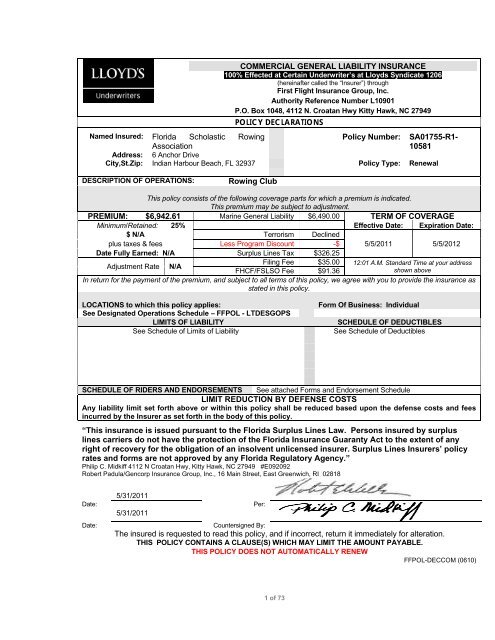

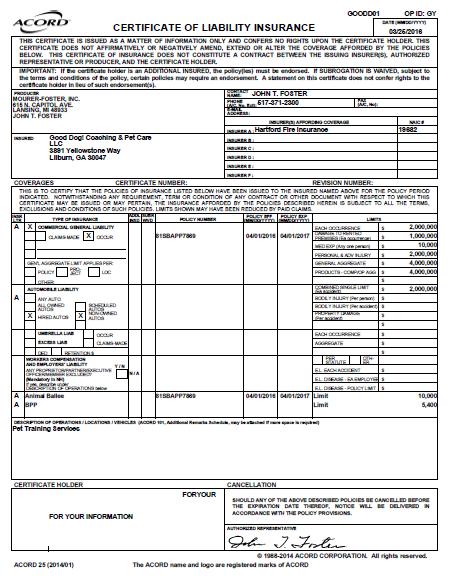

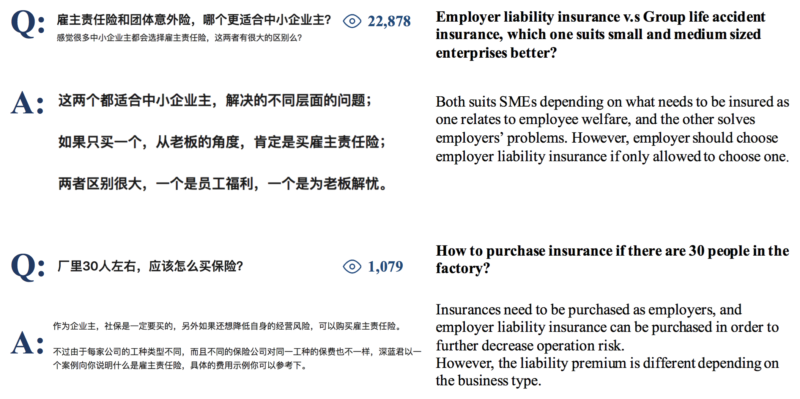

Business liability insurance. It also makes good business sense clients may well want to see your public liability insurance certificate before awarding you a contract or giving you business. Employers liability cover is to protect you against legal costs if an employee is injured gets ill or their property gets damaged as a result of your business. Business liability insurance protects a company s assets and pays for legal obligations such as medical costs incurred by a customer who gets hurt on store property as well as any on the job. Damage to property owned by you such as damage to your car business premises you own or your tools and equipment.

Local government or council contracts will usually ask you to provide proof of public liability insurance with a minimum cover level of 5 million before they do business with you. This includes any injury or damages that occur on a business s property that anyone associated with the business may have caused. It s legally required if your business employs others. Business liability insurance endorsement options.

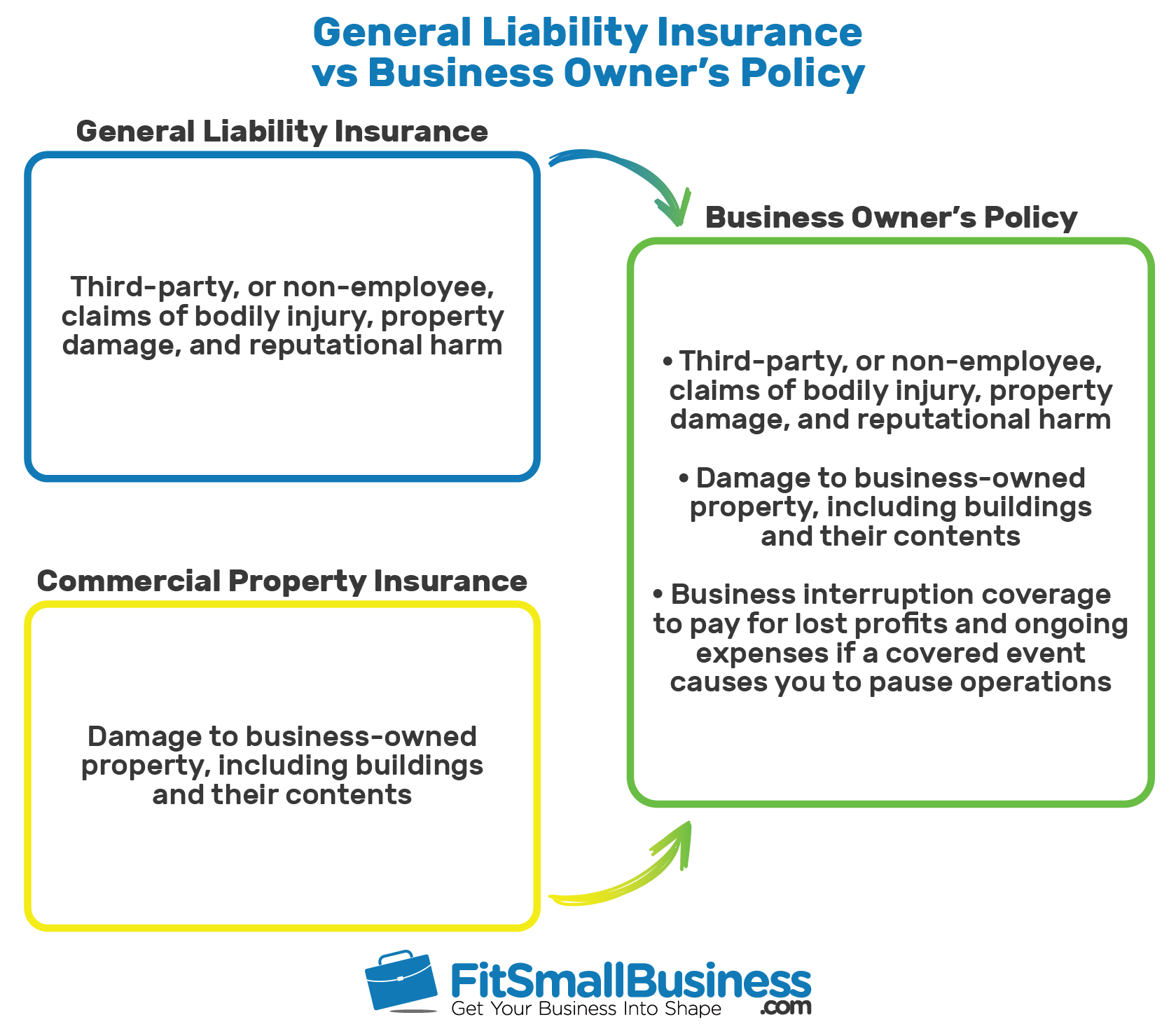

Provides auto liability coverage for short term auto rental or for employees using their personal car for business. The following are some of the exclusions that apply to public and products liability insurance. General liability gl insurance typically provides insurance coverage to small businesses for among other things third party bodily injuries medical payments and advertising injuries. Costs vary depending on your risk but most small businesses pay between 400 and 1 300 per year for coverage.

Business liability insurance also known as commercial general liability insurance provides businesses with a layer of protection from a number of situations. Enhance a basic policy with additional commercial liability insurance options that meet the specific needs of your business. Business or general liability insurance helps protect businesses from claims that happen as a result of normal business operations. General liability insurance is a fundamental business policy because it covers events that may happen to any business owner like injuries and property damage you cause people who aren t your employees.

Hired and non owned auto liability. General liability insurance costs vs average claim costs. Aside from public liability insurance you can also find other types of cover for your business. General liability insurance gl often referred to as business liability insurance is coverage that can protect you from a variety of claims including bodily injury property damage personal injury and others that can arise from your business operations.