Accounts Receivables Financing

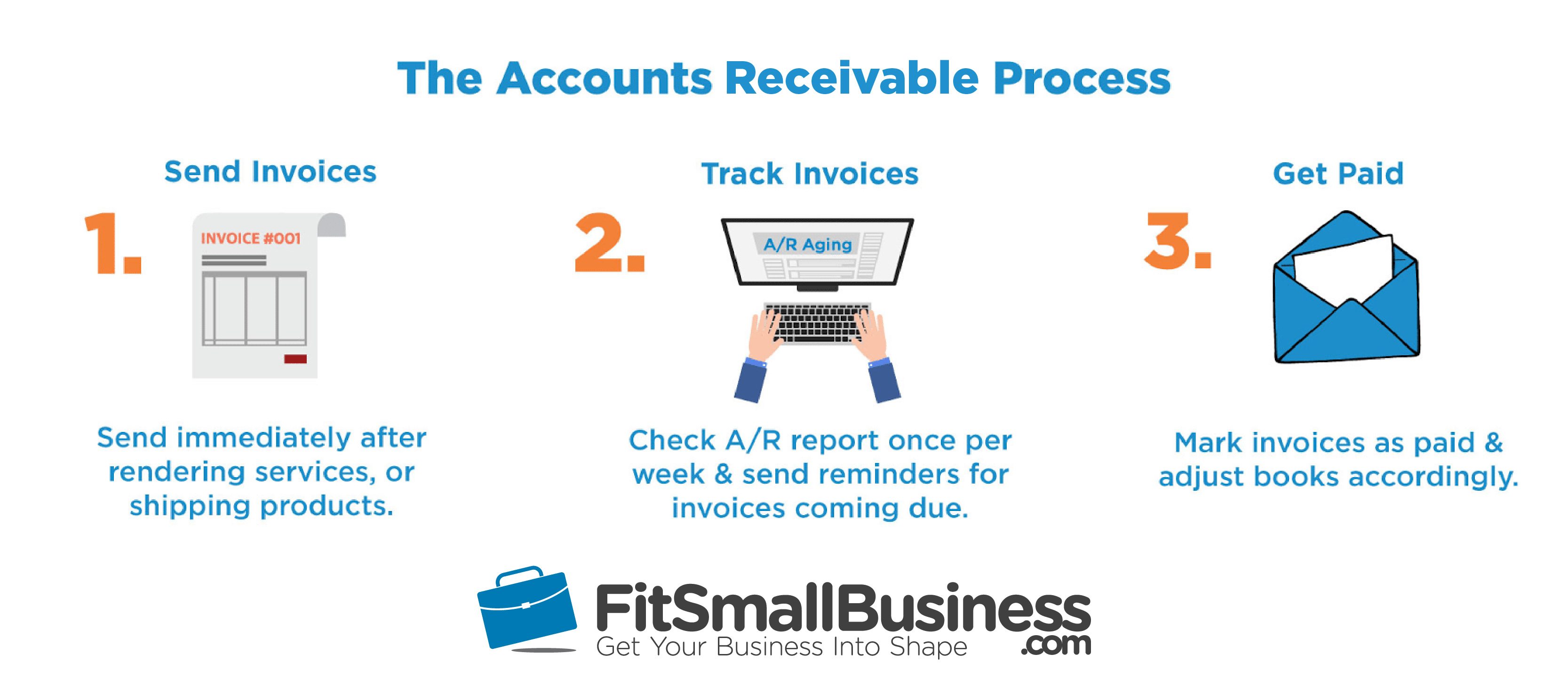

Once your customer pays their debt the invoice financing company will forward you the remaining balance minus their fee.

Accounts receivables financing. Accounts receivable financing is defined as a loan a business owner takes out against unpaid invoices. Understanding how accounts receivable factoring works. Accounts receivable financing is an agreement that involves capital principal in relation to a company s accounts receivables. Accounts receivable are assets equal to the outstanding balances of.

Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. These outstanding invoices can be used as collateral for an immediately available line of credit. Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short term. Accounts receivables are created when a company lets a buyer purchase their.

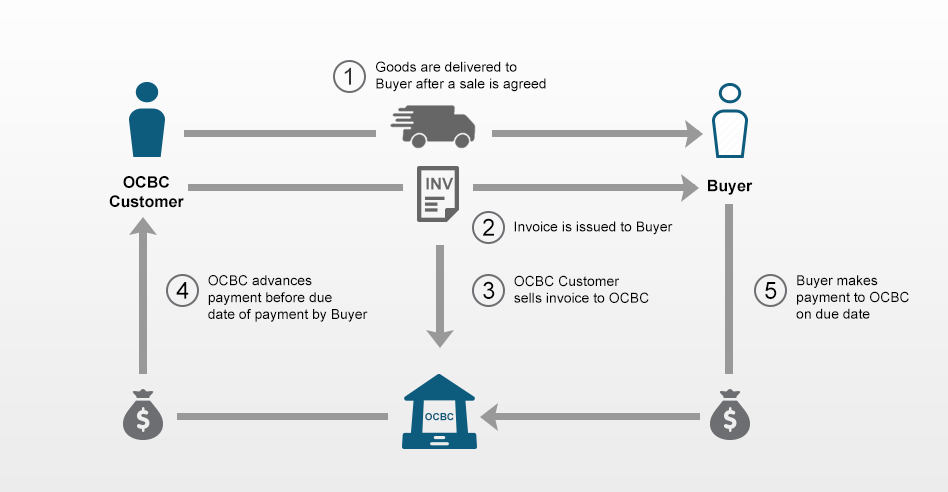

In these types of agreements a receivables financing company will advance you a percentage of your invoice s face value. Accounts receivable financing or ar financing for short is for businesses who need working capital and have outstanding invoices from their clients. As funds will not be paid immediately. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing.

Accounts receivable loans are a source of short term funding where the borrower can use their accounts receivables as collateral to raise funds from a bank. Accounts receivables financing is essentially the process of raising cash against your book s debts so an asset finance product rather than lending. In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. The factor collects payment on the receivables from the company s.

Accounts receivables finance require companies to have receivables or book debts. The factoring company assumes the risks on the receivable and in return issue your business. Selective accounts receivables finance allows companies to pick and choose which receivables to advance for early payment. What is accounts receivable financing.

Factoring is a financial transaction in which a company sells its receivables to a financial company called a factor.