Checking Account Beneficiary

Accounts with a payable on death beneficiary probably the simplest way to leave a bank account to someone is to name that person or more than one as the payable on death or pod beneficiary.

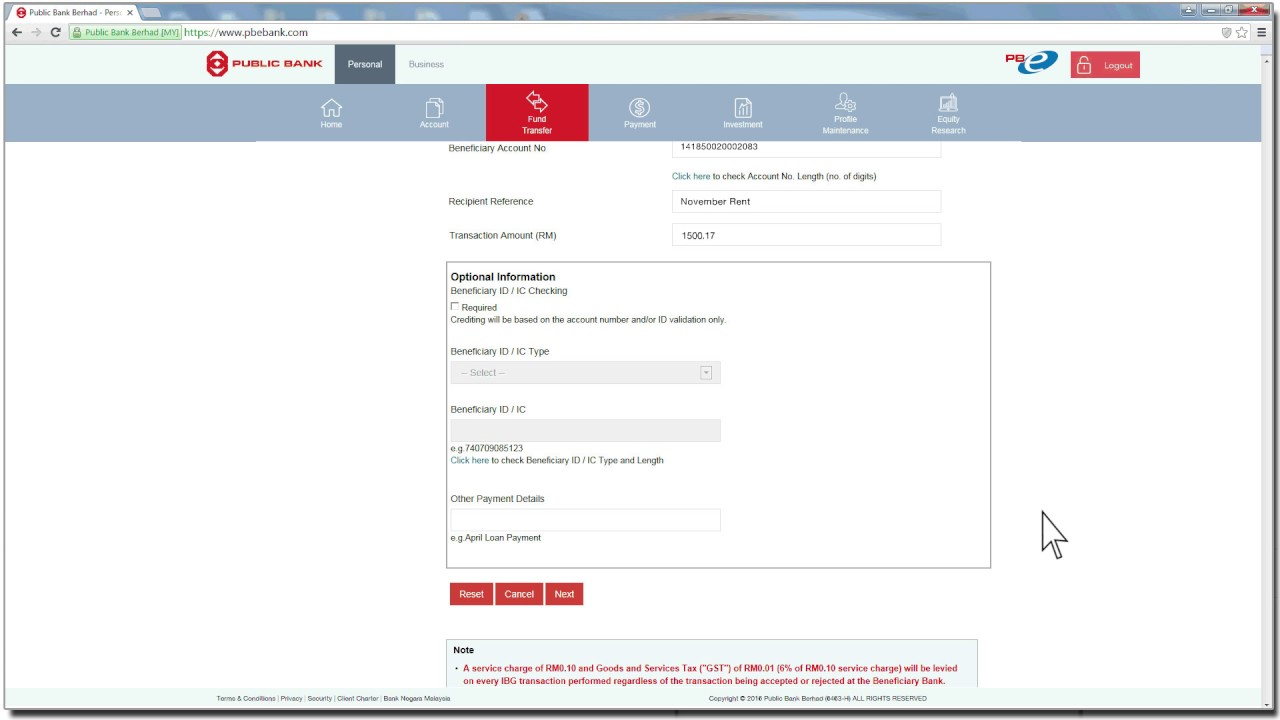

Checking account beneficiary. While the practice has advantages and disadvantages it is not mandatory. A pay on death account makes sure your bank account transfers to someone else when you die. After your death the beneficiary has a right to collect any money remaining in your account. Once you ve identified the right person you ll need to visit your bank.

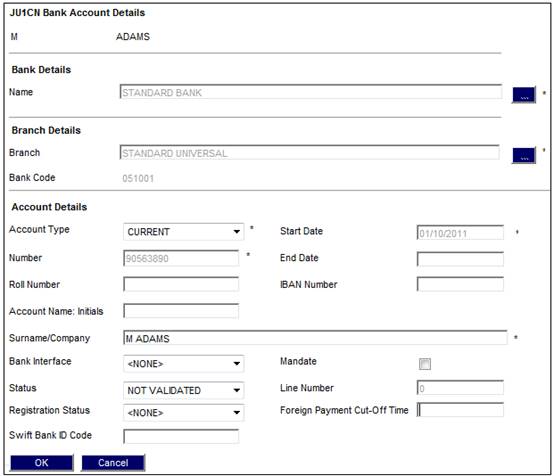

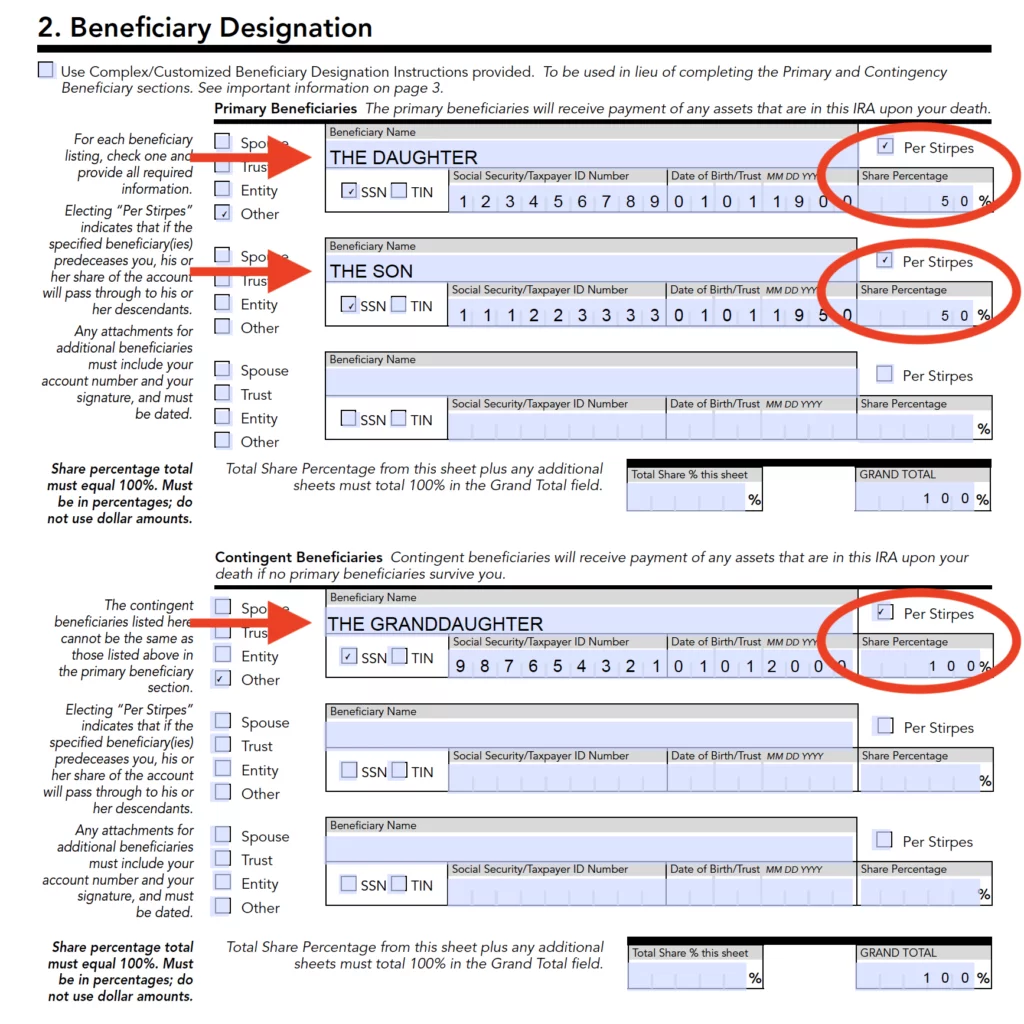

Sometimes your bank will ask for this information when you re opening a new account but they don t always. A pod account allows for the money remaining in the account when the account owner dies to pass to directly to the beneficiaries named by the account owner. A beneficiary designation however is different. An existing checking account can be converted into a pod account which instructs the bank to pass on all the client s assets to the named beneficiary.

Pod accounts for beneficiaries. Pod accounts can be set up for checking accounts savings accounts money markets and certificates of deposit as well as u s. But it s important to make sure you choose the right beneficiary since most banks won t transfer the funds to a minor. In recent years many banks and other financial institutions have begun to offer depositors the chance to transform a checking account into a payable on death pod account by naming a beneficiary.

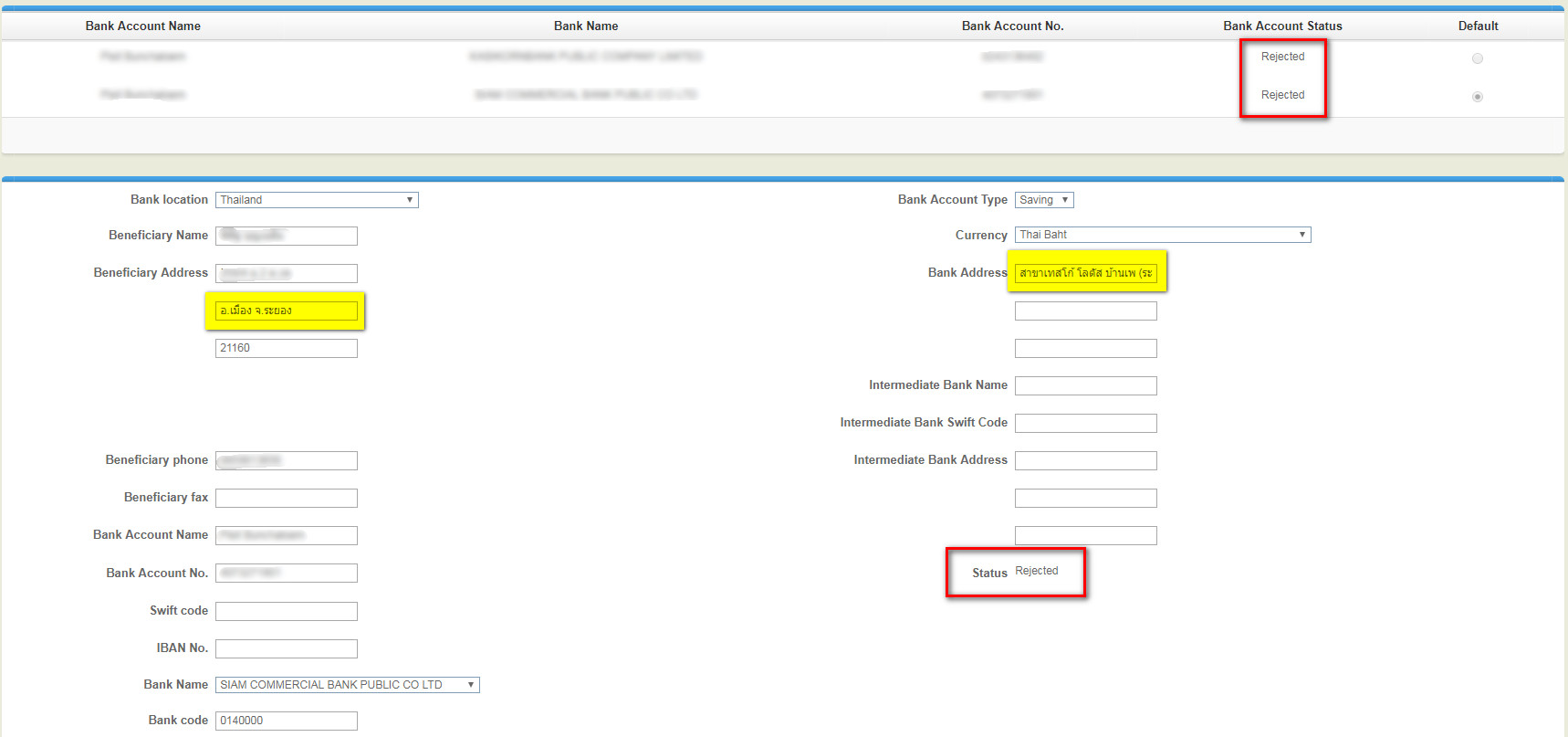

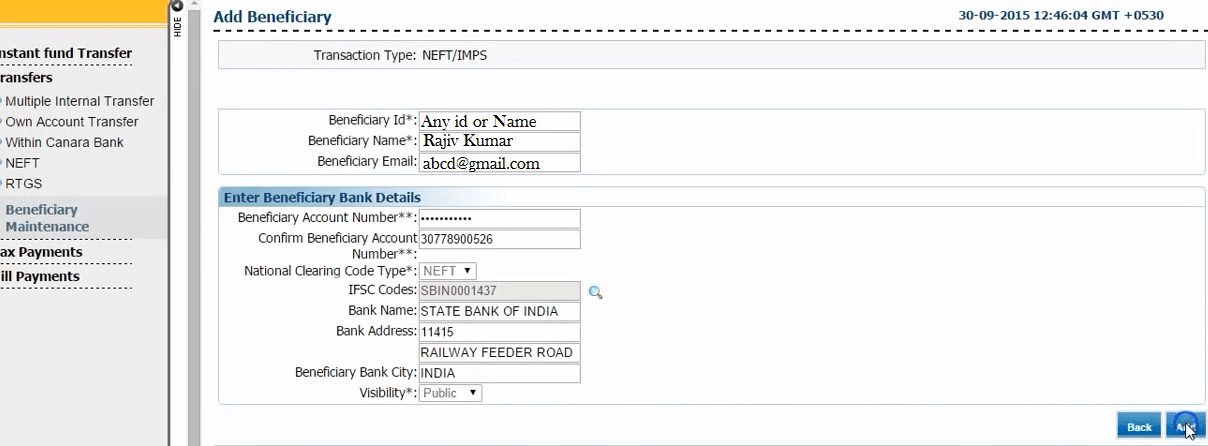

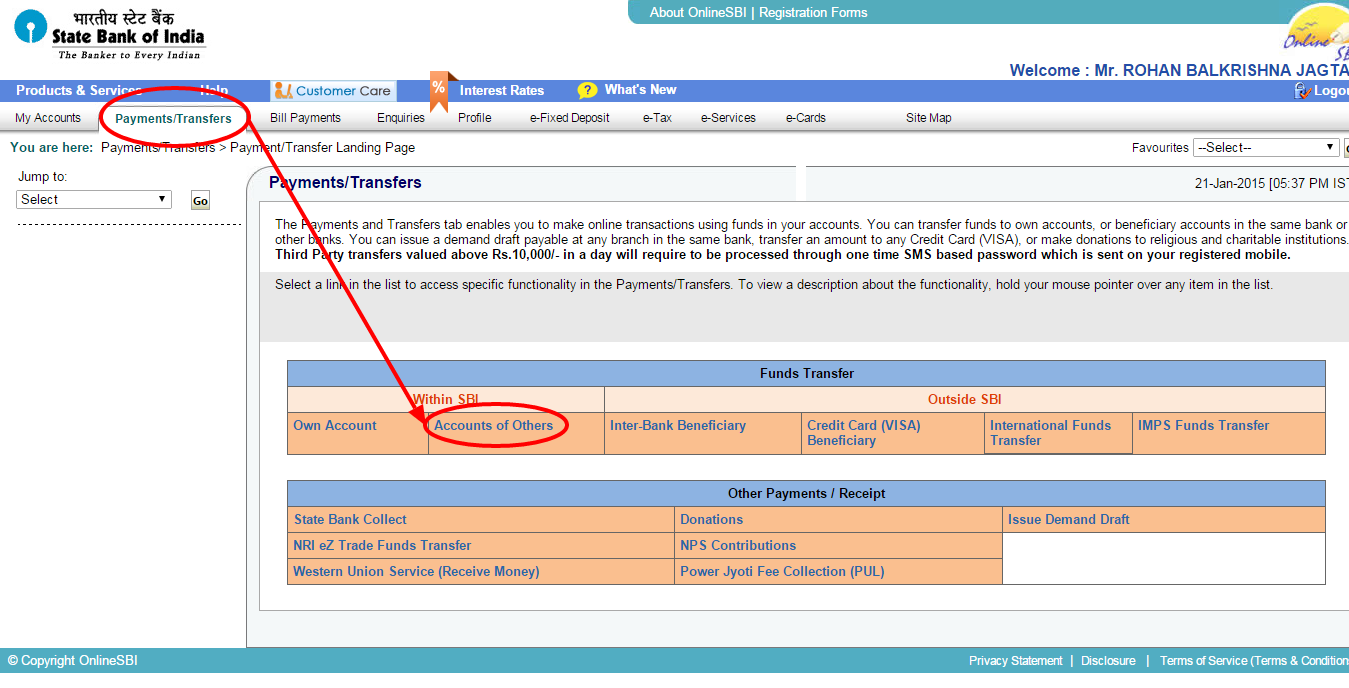

They simply need to go to the bank with proper identification and a certified copy of the death certificate. You can do it by filling out and submitting a form that the bank supplies. And sometimes you can t add or change beneficiaries online. Naming a beneficiary does not grant the beneficiary access to any of the funds or services associated with the account while you are still alive.

When can an account beneficiary claim account assets. Once beneficiaries are named a bank account is referred to a payable on death account and is classified as a revocable trust account by the federal deposit insurance corp. Payable on death pod accounts allow you as the holder to name a beneficiary to receive the assets in the account at your death. One type of pod is a personal bank account including checking savings money market and certificates of deposit and you may name either an individual or individuals or a revocable trust as your beneficiary.

Adding beneficiaries to a checking or savings account.