Actual Cash Value Home Insurance

To give you an idea of why actual cash value insurance costs less it might help to explain what this type of insurance settlement means and why it is set up the way it is.

Actual cash value home insurance. Actual cash value leaves you in a tough position because you won t be able to go out and buy a similar item new at least not without some of the money to replace it coming out of your pocket. Actual cash value acv is one way insurance carriers determine how much your property is worth. Depending on if you have a replacement cost or an actual cash value acv home insurance policy your payout after a claim varies a lot. Home insurance claims may be paid in one of two ways actual cash value or full replacement cost.

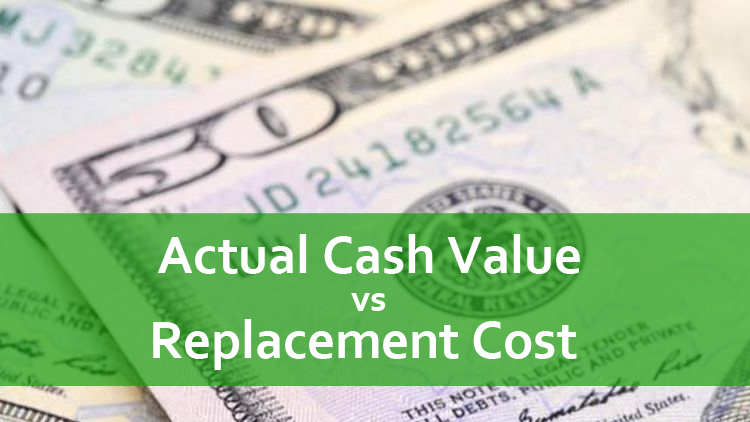

Ultimately if you suffer a property loss the insurer will pay the cost to repair or replace your damaged property or its depreciated value whichever is less. The actual cash value in a homeowners insurance policy is based on the market value or the initial cost of your home and personal property with depreciation considered. The replacement cost is simply the price of replacing property or a belonging. While both types of coverage help with the costs of rebuilding your home or replacing damaged items after a covered loss actual cash value policies are based on the items depreciated value while replacement cost coverage does not.

Of the two actual cash value has the lowest premiums but full replacement cost provides a more accurate settlement. Actual cash value coverage. Actual cash value and replacement cost are two different methods insurance companies use to value your personal belongings in your home. How actual cash value works.

Actual cash value acv is a loss settlement method designed to pay no more than the depreciated value of your home and likely your personal belongings in the event of a loss claim. Sometimes insurance companies use actual cash value to determine the amount to be paid to a policyholder after loss or damage to the insured property or vehicle. The other primary valuation method is actual cash value acv. Most standard homeowners insurance policies cover the replacement cost of your home s physical structure and the actual cash value of the insured s personal property.

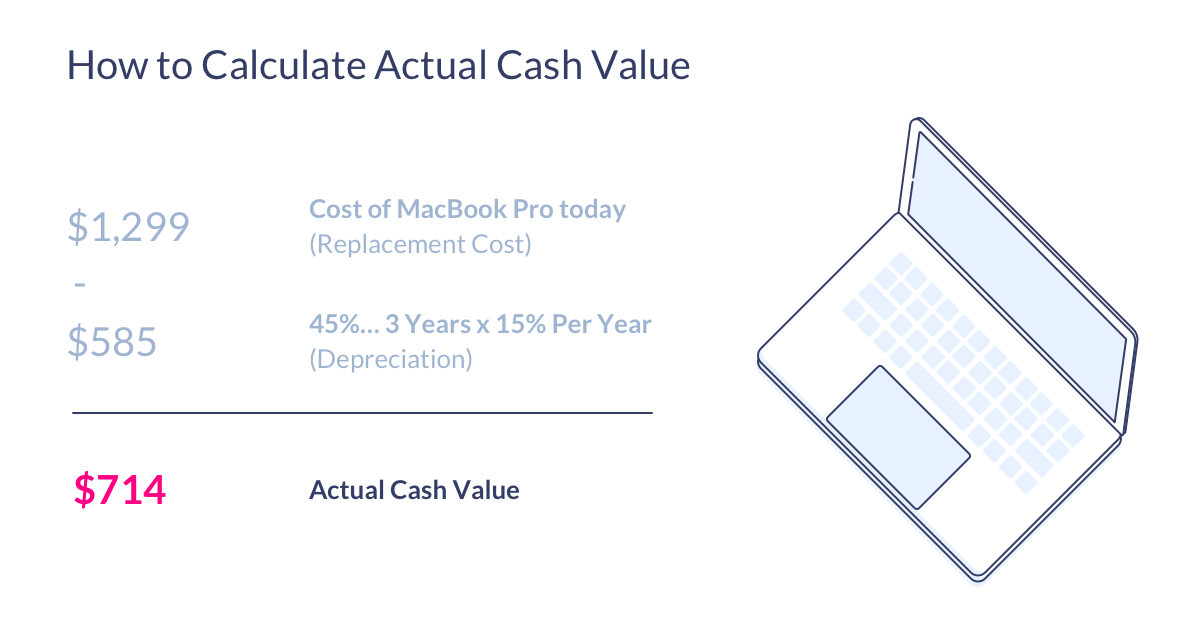

Replacement cost and actual cash value refer to how your homeowners insurance policy reimburses you for property damage after a covered loss. The actual cash value of your home or personal property is calculated by subtracting depreciation from the replacement cost. On homeowners renters or condo policies your property and belongings may be insured for the actual cash value acv or replacement cost rcv. The actual cash value is the current value with depreciation.

/commercial-property.tmb-.png?sfvrsn=8)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Understandingreplacementvalueandactualcashvalueacvinaclaim-59f7bf26845b3400118dc827.jpg)