Account Receivable Factoring Example

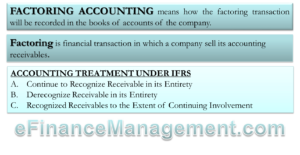

When accounts receivable are factored without recourse the factor purchasing institution bears the loss resulting from bad debts.

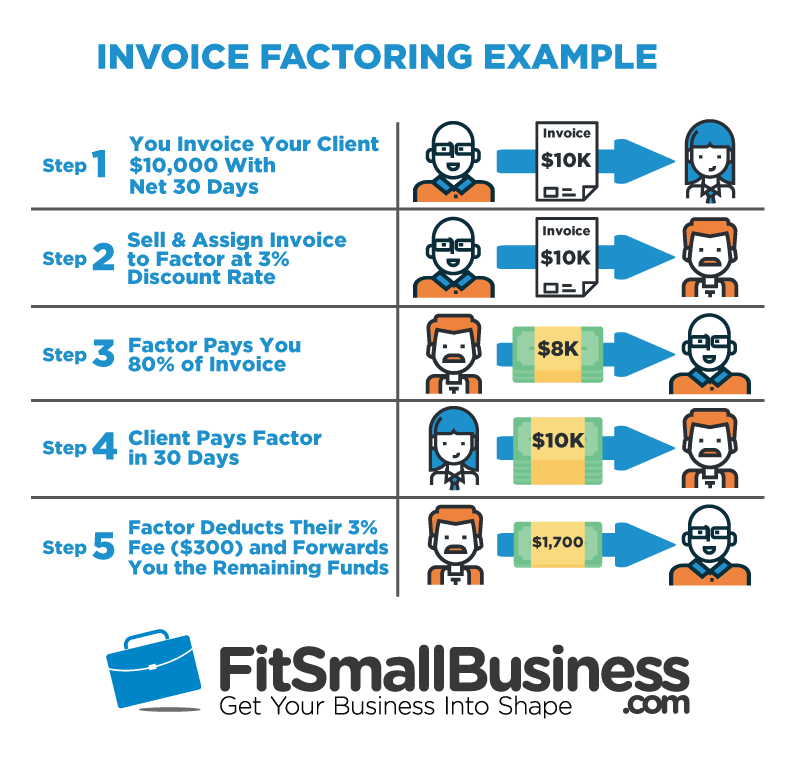

Account receivable factoring example. Company a sends rs 10000 invoice to its customers to be paid in six months and a copy to its factor m s x in return for the sum of rs 8500. The financing company which buys the receivables is called a factor. As without recourse factoring passes the liability for the uncollectible accounts on to the factor the fees tend to be higher than those paid on with recourse factoring. Accounts receivable factoring also known as factoring is a financial transaction in which a company sells its accounts receivable accounts receivable accounts receivable ar represents the credit sales of a business which are not yet fully paid by its customers a current asset on the balance sheet.

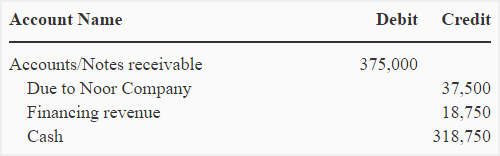

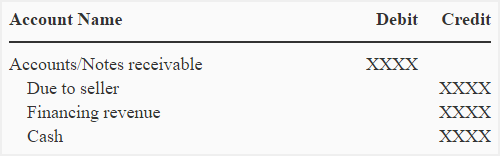

What is accounts receivable factoring. Factoring accounts receivable journal entries without recourse journal entries. Many manufacturing and service businesses need capital outlays in order to render their services or products. Let s understand the same as factoring of accounts receivable example.

Factoring is the sale of accounts receivable of a company to a financing company at discount. Factor offered an 80 cash advance and a 3 fee provided that it would pay any excess of the retained amount over uncollected accounts receivable on november 15 20x8. Factoring helps a business convert its receivables immediately into cash instead of waiting for due dates of payment by customers. For example if a receivable whose account has been factored becomes bankrupt and the amount due from him cannot be collected the factor will have to bear the loss.

On october 16 20x8 retailx ltd sold 250 000 of accounts receivable to factoring company on a recourse basis. Companies allow their clients to pay at a reasonable.