Additional Short Term Disability Insurance

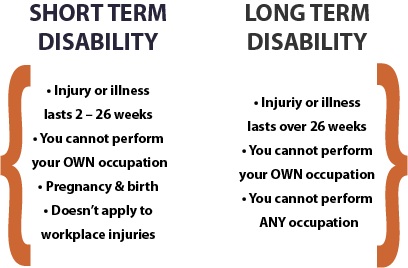

The difference is when it kicks in and for how long.

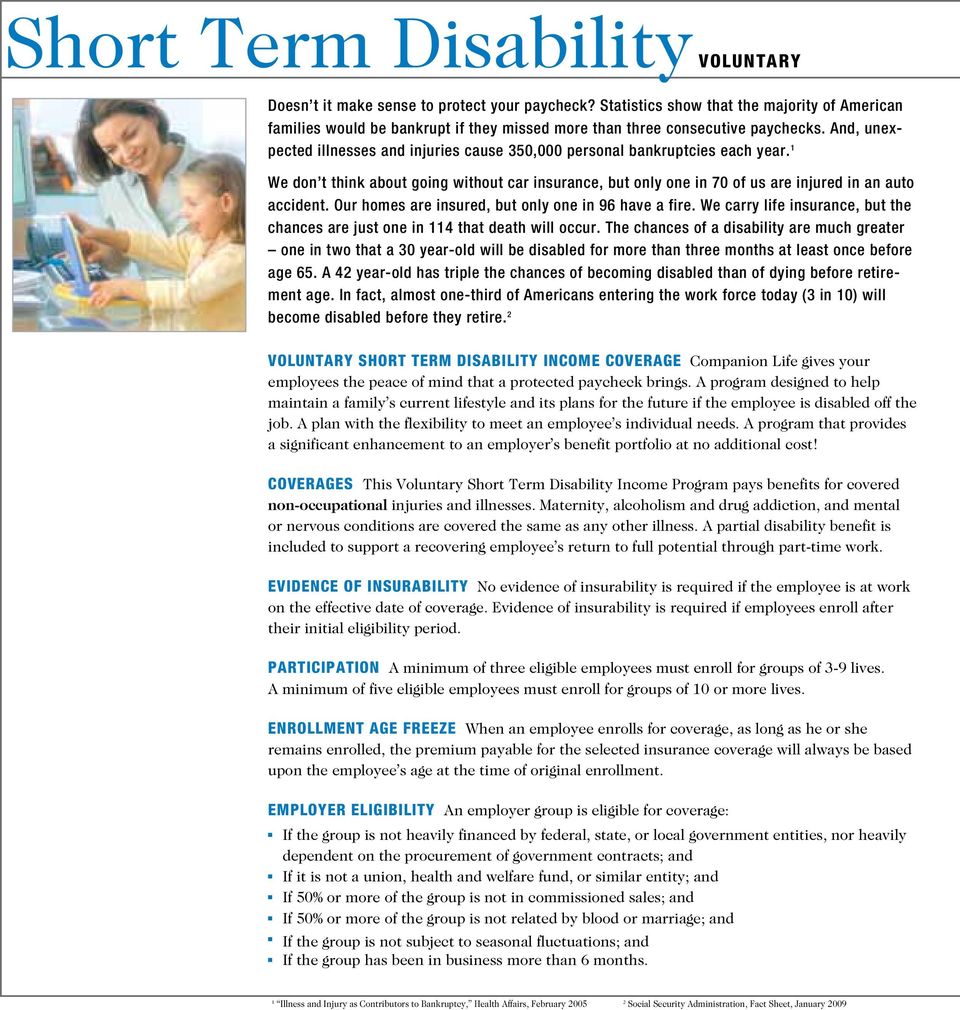

Additional short term disability insurance. The benefit period and monthly amount choices allow you to choose the right coverage for you. Single policy issue and participation individual or group long term disability coverage has gone up to 30 000 with some hospitals. Coverage is portable meaning that you own your policy and it is not related to your current job. With high limit disability insurance benefits can be anywhere from an additional 2 000 to 100 000 per month.

Short term disability insurance can provide funds for whatever you need to protect. Ages 18 49 employed full time at the time disability began 2 000 monthly disability benefit amount 40 000 annual salary elimination period 0 7 days 3 month benefit period benefits based on policy premiums being paid with after tax dollars. 3 the above example is based on a scenario for aflac short term disability domicile state that includes the following benefit conditions. The definition for disability under a long term plan is typically subtly different than the definition for short term disability.

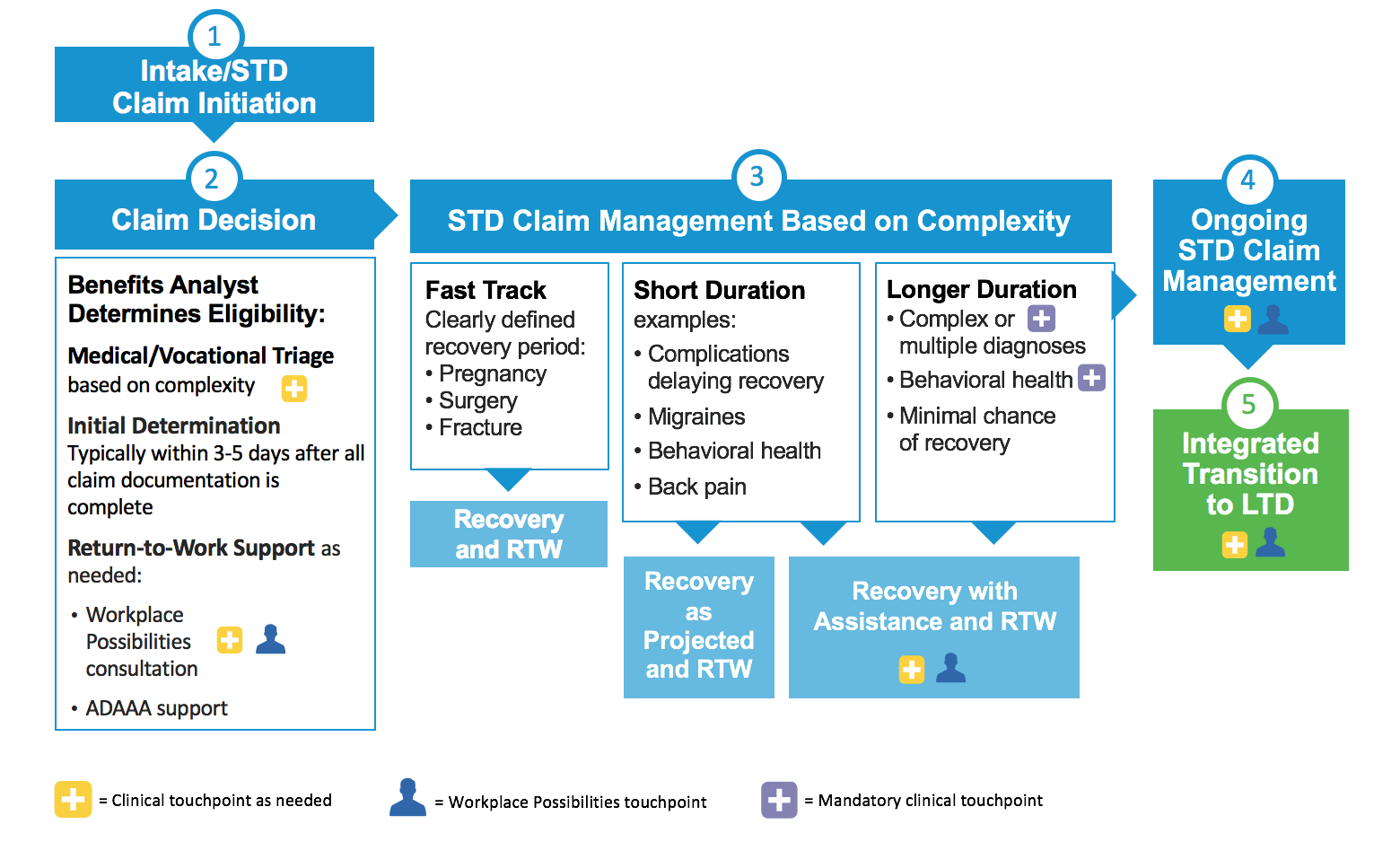

You may also need to provide additional medical records concerning the details of your disability. If you re suddenly unable to earn a paycheck due to illness or an accident short term disability insurance through your employer can replace a portion of your income during the initial weeks of your disability. Your job may provide both or neither. Some insurers require new paperwork from the claimant and new medical records before they will begin paying a long term disability benefit says mcdonald.

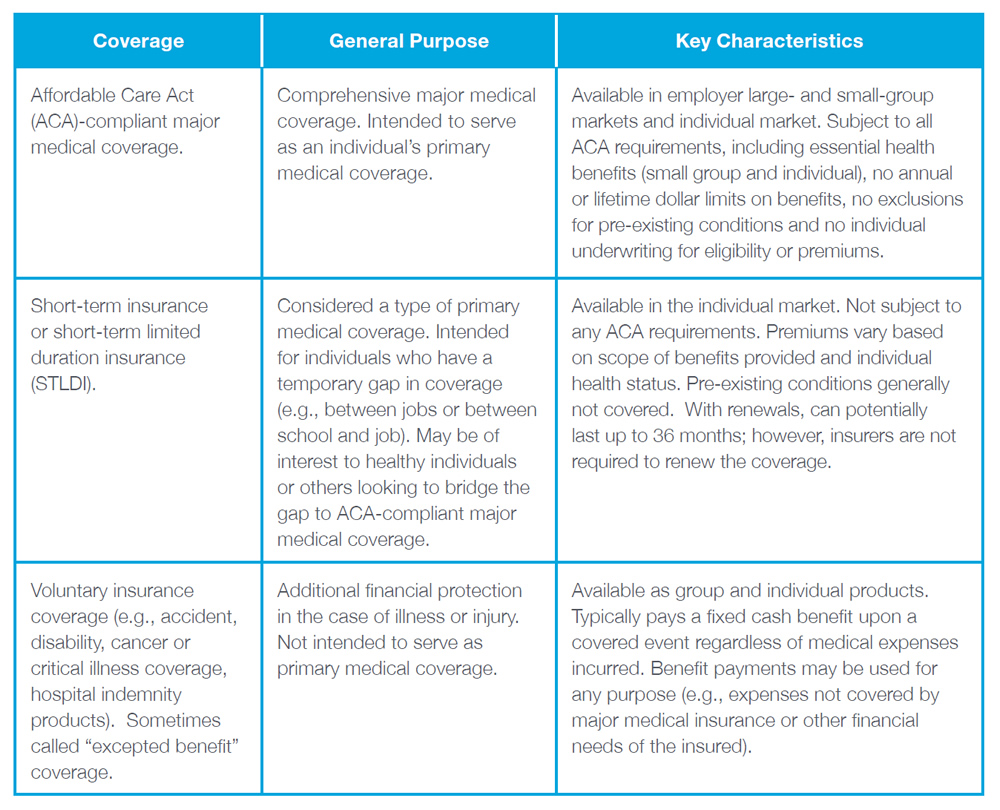

Get a fast easy online quote and view monthly premium costs coverage and more. Mortgage rent or a car loan are just some of the monthly expenses that can be funded. Short term disability insurance vs. Short term disability insurance provides immediate coverage that can help protect you in the case of unexpected sickness or injury.

Group short term disability insurance policies are guaranteed issue meaning you do not have to take a medical exam to buy coverage. Short term disability insurance which is most often purchased as part of a group at work can be paid by either the employer or the employee. Employers provide some long term disability coverage and in some states employers are required to provide short term disability insurance. Long term disability insurance or ltd insurance has the same purpose as short term disability insurance.

According to the insurance information institute about half of large and mid size u s.

/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png)