Best Cheapest Car Insurance Ontario

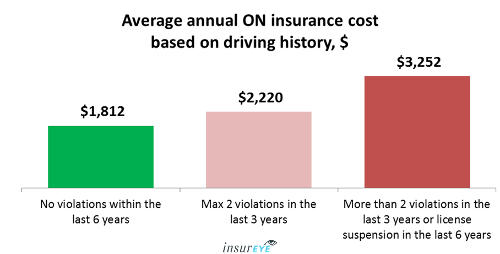

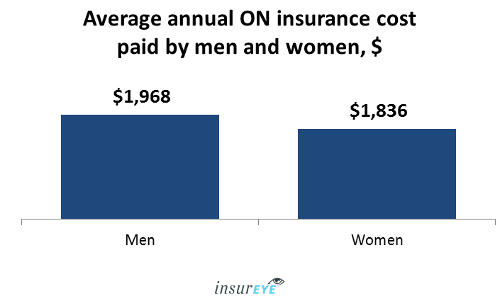

Factors that impact your ontario car insurance rates.

Best cheapest car insurance ontario. Shop around for the best car insurance possible while automobile insurance rates are largely based on the type of car you buy there are personal aspects that come into play. Finding the cheapest car for insurance with 17 and 18 year olds is a bit of a balancing act. Even though an insurance application is fairly standard you will find that different insurance companies offer different rates based on their existing users the number of active claims on their fiscal books and overall risk tolerance calculations. If you re starting on your car purchasing journey this might be a good time to include research on the cost of insuring your dream car.

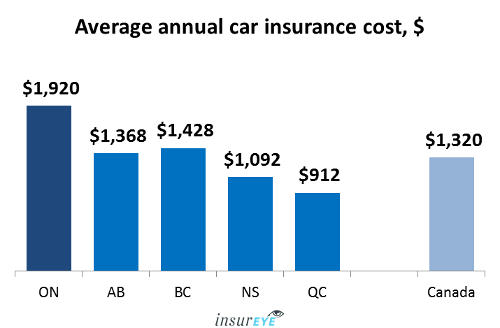

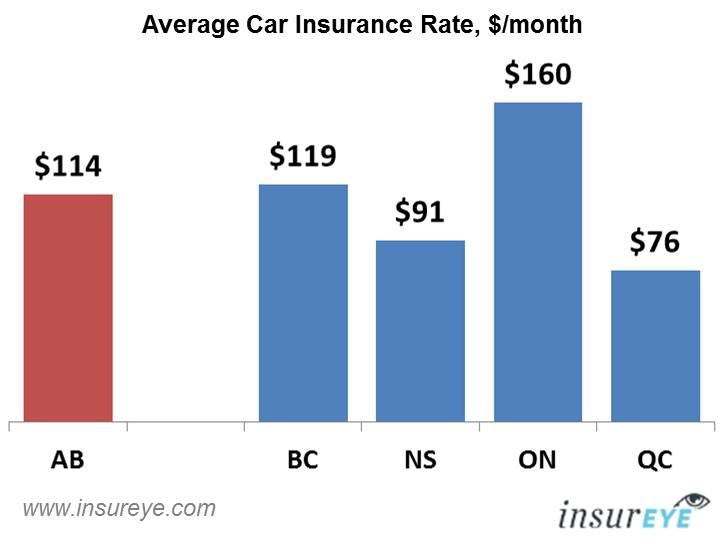

Ontario car insurance premiums are some of the highest in canada due to a greater concern for insurance fraud and different insurance laws. What vehicle has the cheapest insurance. We all want to know the cheapest cars to insure. While the province no longer holds the title of most expensive auto insurance in the country that award now goes to british columbia ontario drivers still face rates higher than the majority of canadians.

Not only does ontario have more drivers than in any other province in canada it also has some of the highest car insurance costs. This has resulted in a huge number of auto insurance providers offering policies at a wide range of prices. But while you might not be able to change your vehicle or be willing to move to another neighbourhood for the sake of car insurance premiums there are ways you can help lower your premiums. Car insurance is required by law for ontario vehicle owners.

The best selling vehicles in canada cover a range of types from trucks suv s vans and of course cars. In canada everyone needs to maintain a mandatory minimum amount of auto insurance to legally drive a vehicle on the roads. It pays to shop around to find cheap car insurance in ontario. It is required by law for car owners to have car insurance coverage to drive on ontario roadways.

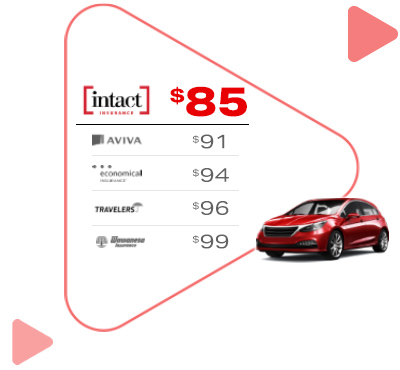

Who has the cheapest car insurance in ontario. When claims costs go up or down typically premiums will follow. There is a minimum amount of mandatory coverage needed which is part of a standard policy that includes third party liability accident benefits dcpd and uninsured motorist coverage. There are other factors too like the introduction of new discounts e g.

According to the insurance bureau of canada ontario drivers pay an average of 1 505 annually for car insurance or 125 each month. When comparing ontario car insurance quotes we often find that trucks and minivans tend to be cheaper to insure than a car with this in mind let s break down why one vehicle may be cheaper to insure than another. The average cost of an insurance policy for an ontario driver is 1 505 according to 2020 estimates from the insurance bureau of canada.