Average Insurance Rate For New Drivers

The profiles also have a clean driving record insurance coverage for 12 000 miles per year and a good credit score.

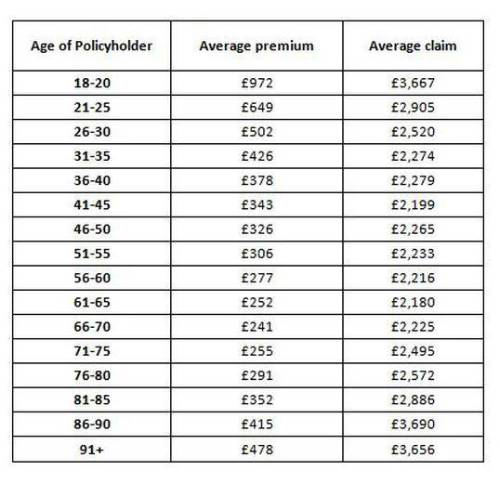

Average insurance rate for new drivers. National average car insurance rates. Unlike say life insurance which gets more expensive the older you are when you apply car insurance tends to trend down until 25 and then stay relatively unaffected by age until rates start to go up again for drivers 65 and older. Drivers can select the autoplan insurance quote according to their choice. It is very expensive to insure a 16 year old driver premium costs decrease significantly after young drivers turn 20 they still pay nearly 100 more than do the average driver in the u s.

Continue reading for some important considerations to keep in mind when comparing your car insurance. Yet despite the eu directive which prohibits insurers from assessing a driver s risk based on their gender male drivers are still paying more on average than female drivers. There are icbc insurance rates for new drivers. Drivers with a g1 driver s license will pay more than a driver with a g2 or a g driver s license.

Icbc insurance rates for new drivers. If you live in california hawaii or massachusetts your credit score cannot be considered as a rating factor. In 2018 there were 6 3 motor vehicle related deaths for every 100 000. Below you ll find average car insurance cost by age for several common coverage sets for the time when your teen years are in the rear view mirror but much cheaper rates are still a bit further down the road.

To find the average rates in our study for high insurance coverage we created driver profiles for males and females in each of the following ages. Average car insurance rates in ontario for a new driver new drivers especially if you are under 25 years of age will pay some of the highest insurance premiums in ontario. According to the insurance institute for highway safety iihs new jersey residents are among the safest drivers in the u s. 25 years 35 years and 60 years.

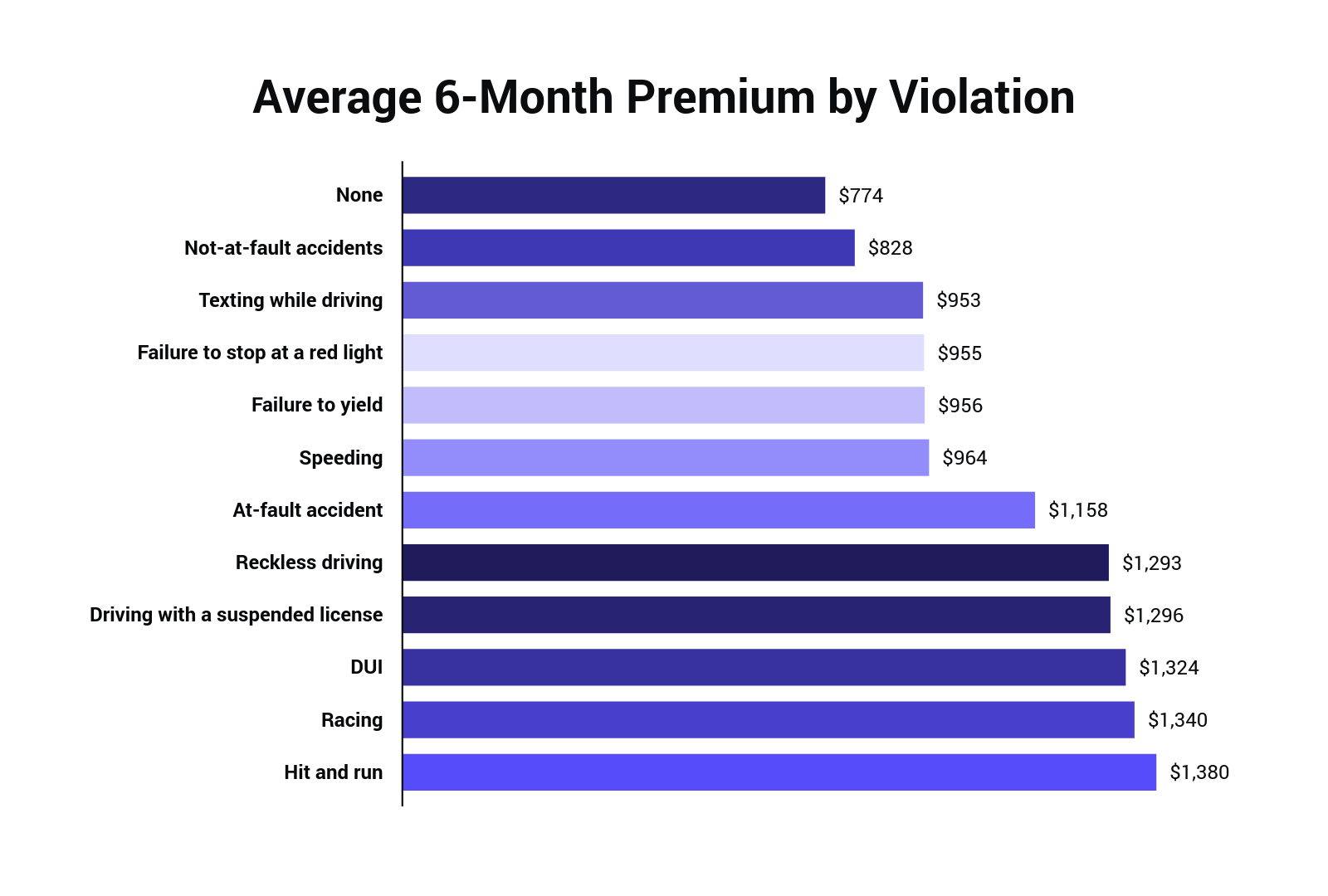

The young driver is the alluring things in the car insurance industry. These type drivers should pay more for the higher risks and related claims costs they represent on our roads.

/what-is-the-average-cost-of-motorcycle-insurance-527362_FINAL-50c0673de76a4d478a4040b170acadb3.png)