Best Place To Get Preapproved For A Mortgage

After spending over 400 hours reviewing the top lenders nerdwallet has selected some of.

Best place to get preapproved for a mortgage. Estimate your mortgage payments. Should i get preapproved for a mortgage from multiple lenders. Before you apply make sure you can qualify for the best overall mortgage possible. If you re looking to get preapproved for a mortgage rocket mortgage can help.

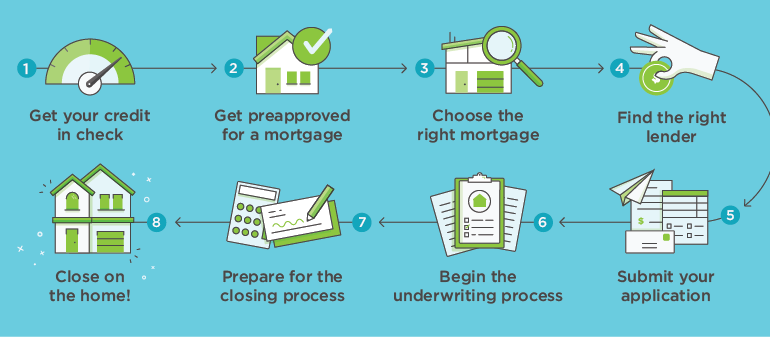

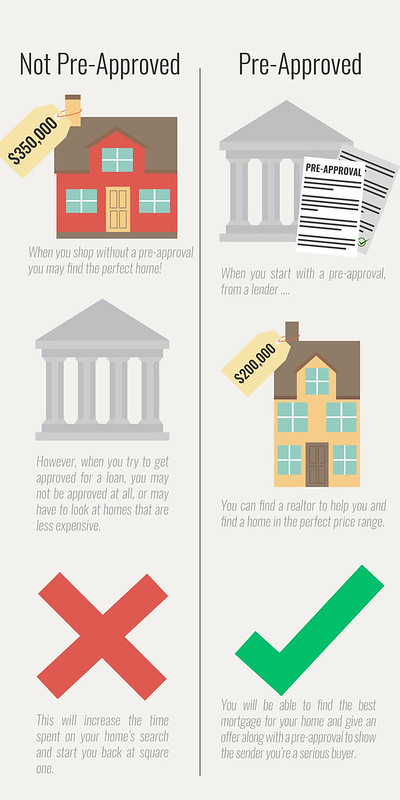

When you decide to buy a home it can be tempting to pull up listings on your computer and schedule appointments to see your favorite houses before filling out a mortgage application. Why get preapproved for a mortgage. You won t be required to provide any documents but you should come prepared with information about. Bundrick cfp november 21 2019.

If your lender preapproves you for a mortgage of 185 000 you won t spend time looking at homes above that price. Rocket mortgage offers a couple of different approval options. With a pre approval you can. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation your lender may require.

Even if you are deemed to have bad credit there are ways to still get pre approved for a mortgage. Check and improve your credit compare mortgage rates and best mortgage lenders get prequalified and then preapproved for a mortgage and plan for your down payment and closing costs. In general a debt to income ratio of 36 percent or less is preferable. Before you buy a home or refinance your mortgage shop around to find the best mortgage lenders of 2020.

Decrease your overall debt and improve your debt to income ratio. Applying for mortgage preapproval with more than one lender allows you to compare loan costs explore program options and test drive. Getting preapproved lets you know how much home you can afford. Know the maximum amount of a mortgage you could qualify for.

But if you don t already have a preapproval letter in your pocket that can be a mistake. A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

.png)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)