Car Insurance Gap Coverage

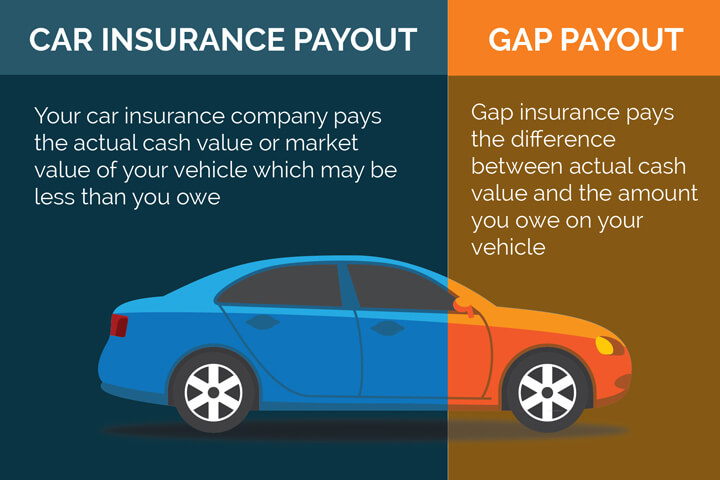

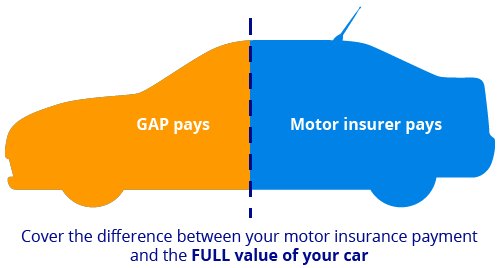

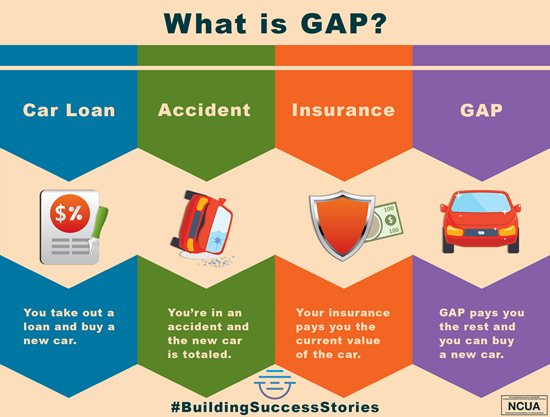

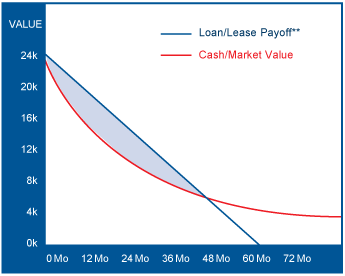

If the amount left on your loan is more than your car is worth gap coverage can pay the difference.

Car insurance gap coverage. You could purchase this coverage from other sources like lenders or credit unions and pay less but the best place to find a great deal on gap insurance is your auto insurance company. Gap car insurance is only needed if you have negative equity in your car owe more than the value of the vehicle since this coverage only pays for the balance of the loan left after the acv is paid out when your car has been found to be a total loss by an insurer. Gap insurance also known as loan lease payoff is an optional auto insurance coverage and applies if your car is totaled or stolen. Gap coverage can help you avoid paying out of pocket.

If you find yourself in this situation the price difference can be steep. Gap coverage is mainly used on new and used small vehicles cars and trucks and heavy trucks. Gap insurance coverage helps indemnify your family in case of a total loss. Essentially you do not need gap insurance if you are certain that your loan to value amount will not leave you with an upside down car loan in the event of a total loss.

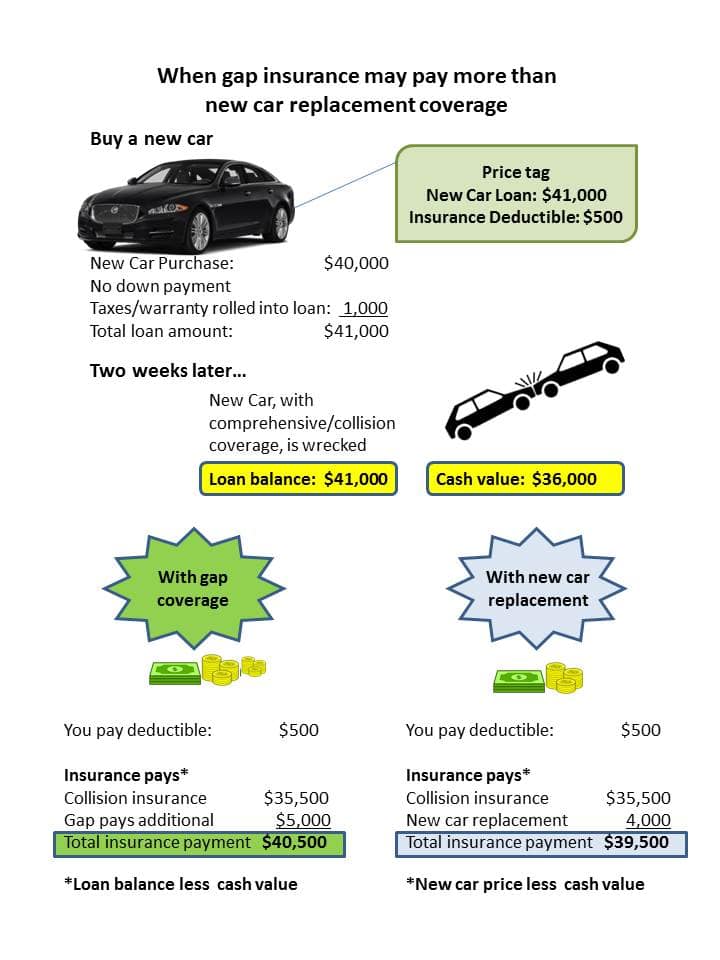

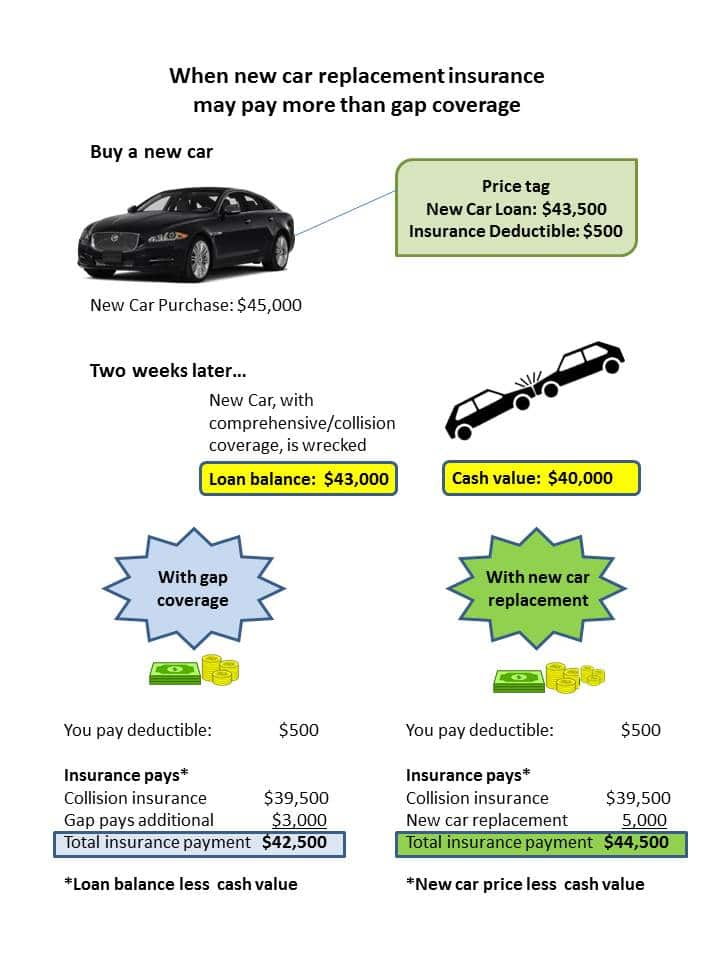

Guaranteed asset protection gap insurance also known as gaps was established in the north american financial industry gap insurance protects the borrower if the car is totaled by paying the remaining difference between the actual cash value of a vehicle and the balance still owed on the financing. Gap insurance may also be called loan lease gap coverage this type of coverage is only available if you re the original loan or leaseholder on a new vehicle. However he still owes a total of 20 000 worth of car payments. It may pay the difference between the balance of a lease or loan due on a vehicle and what your insurance company pays if the car is considered a covered total loss.

If you have a car loan gap coverage gap insurance will cover the remaining amount you owe on the car in the event that it s totaled. Local agents can find a price that is significantly less because they shop around for the best price which can sometimes be as little as 20 per year. Gap guaranteed asset protection insurance is optional coverage. Gap insurance is an optional insurance coverage for newer cars that can be added to your collision insurance policy.

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car s depreciated value. Gap insurance is an optional type of car insurance coverage that provides supplemental coverage for the difference. To understand gap insurance you first need to understand that on a standard car insurance policy your car is covered for the actual cash value or depreciated value at the time of a claim. As an example of gap insurance at work consider john s car which is worth 15 000.