Auto Insurance Score 810

Membership in the 800 credit score club is quite exclusive with fewer than 1 in 6 people boasting a score that high according to wallethub data.

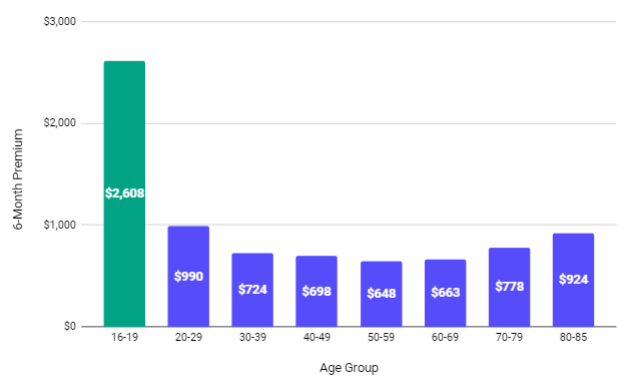

Auto insurance score 810. If you have a score of 500 or less you re going to pay higher insurance rates. It s mostly calculated from your claims history and your credit score so it s also referred to as a credit insurance score. It s important to again stress the connection between auto insurance scores and credit scores. Depending on the company that is issuing the insurance score an insurance score range can go as low as 200 and as high as 997.

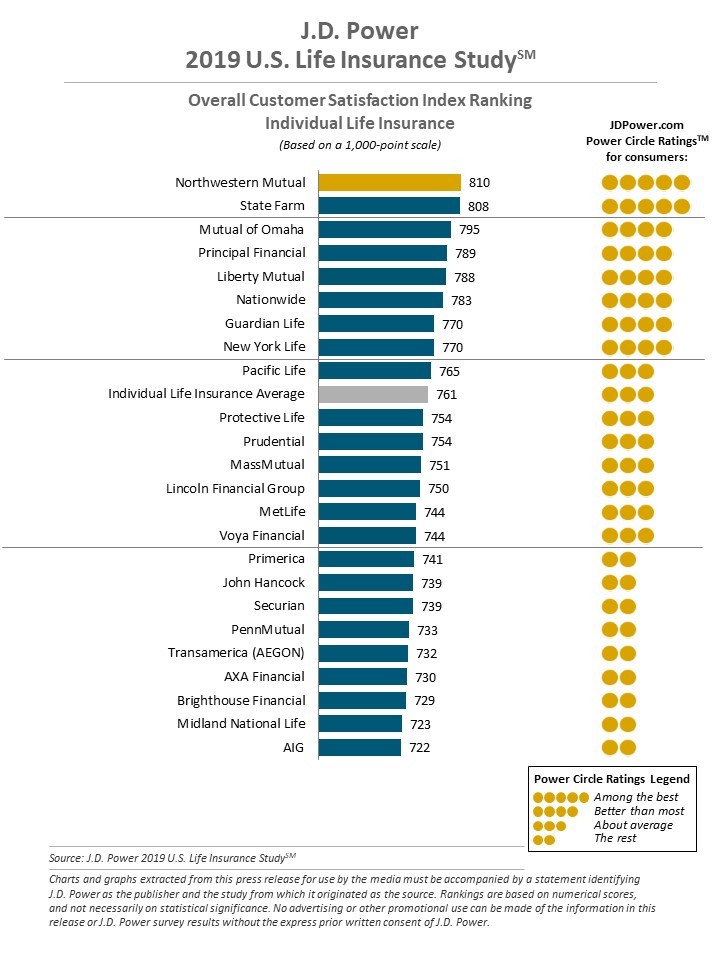

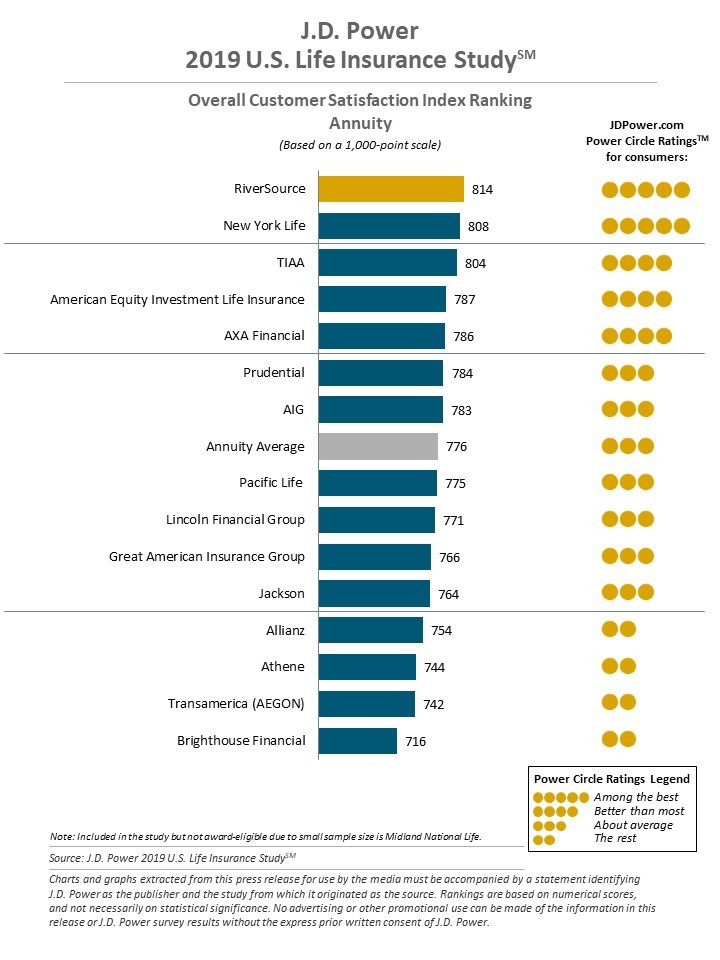

A good score is usually around 770 or higher. Even more than your driving record studies have shown that drivers with the worst insurance scores are twice as likely to have an insurance claim as those with the best scores. But transunion has a page about insurance scores where they say a 770 or above is good. If you have an insurance score of 770 or more you re considered to have a good insurance score and so you ll get lower rates.

How to improve your auto insurance score. Although insurance scoring typically only applies to home and auto insurance it would not be unrealistic for some insurance companies to use insurance scoring for health insurance or life insurance. Despite being just shy of the highest credit score possible 850 a credit score of 810 qualifies as perfect because improving your score further is unlikely to save you money on loans lines of credit car insurance etc. An insurance score is a score calculated from information on your credit report.

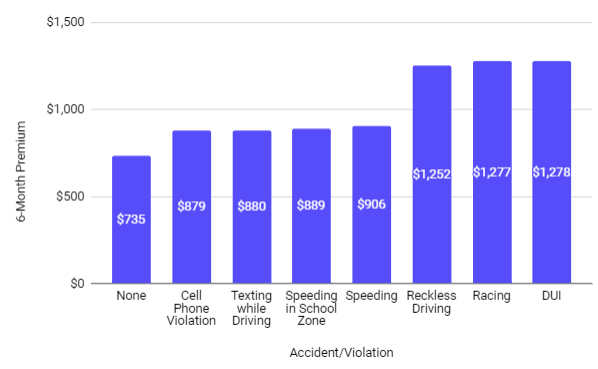

What you should know what is an insurance score. A low insurance score can be costly especially for auto insurance coverage which is legally required for car drivers in 49 of the 50 states in america for example if an individual s insurance. Even if you did not file a claim through your current insurance company your insurer may be able to find your past claims history while you were insured by other companies through a private database that the major insurance companies subscribe to. Credit information is very predictive of future accidents or insurance claims which is why progressive and most insurers uses this information to help develop more accurate rates.

An auto insurance score or home insurance score is a three digit number used to predict your odds of filing a claim. I m inclined to believe you about that 810 cbis score since mine is already 820 with only 1yr 4mos of credit history and only 4 months of revolving credit history. What determines your insurance score. In general your car insurance score is based on your credit score and your claims history report.

When your credit score goes up your auto insurance score usually does too. For example people with no credit pay an average of 65 more for car insurance than those with excellent credit. How good or bad your credit is factors into your insurance score.

:max_bytes(150000):strip_icc()/GettyImages-1041512942-a2f1ac7907a5458ea2f3bef5f98cb887.jpg)