Alabama Home Insurance

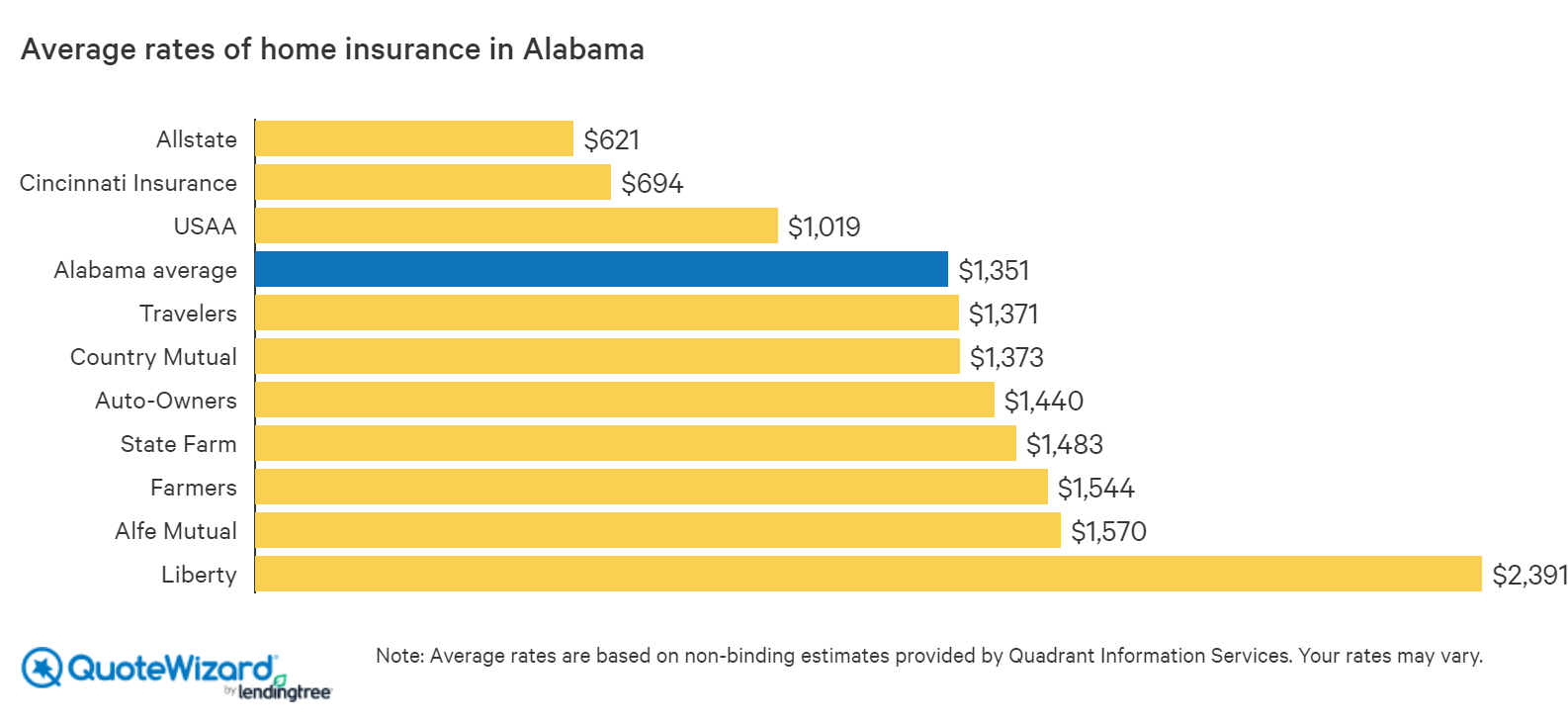

Usaa a military only insurance company has the cheapest average homeowners insurance rates in alabama for a 400k dwelling.

Alabama home insurance. Farmers offers the cheapest homeowners insurance in alabama at only 604 per year. Homeowners insurance rates in alabama can vary based on the insurer you choose. Cheapest home insurance companies in alabama. We also offer homeowners insurance discounts to reward our members even more.

Consumer s guide to homeowners insurance. This guide provides information on how to make decisions that can lower the cost of your home insurance and increase the value you receive. Best homeowners insurance rates in alabama for a 400k dwelling. The average monthly cost of home insurance in auburn is 124.

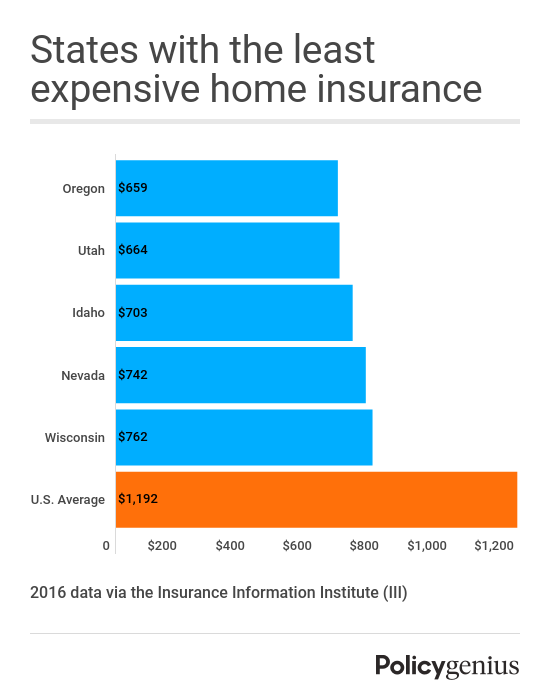

This is one of the highest rates in the state mainly because of the high property values in this city. This compares favorably to the state average cost of 1 705 offering a 1 101 price cut on average statewide home insurance costs. As a resident of alabama learn what a typical allstate homeowners policy could help cover. The average cost of homeowner insurance in the u s.

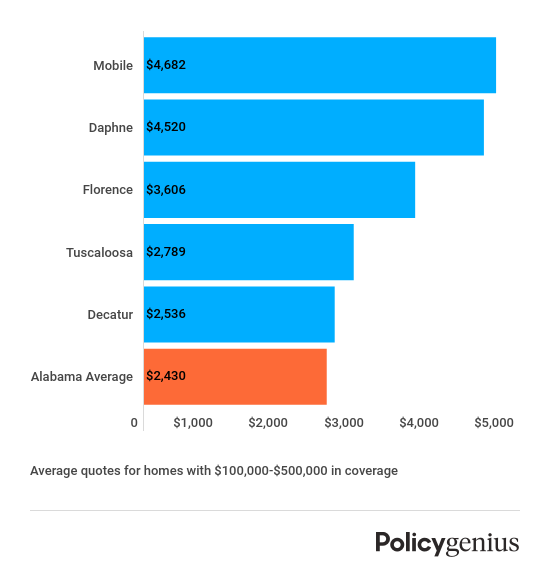

Auburn al home insurance. Best gets 4 out of 5 stars from j d. Alabama home insurance study we completed a study of homeowners insurance rates in 15 alabama cities. Insurance rates in alabama vary quite a bit between different companies.

This works out to an average annual premium of 1739 38. Home insurance is an expensive purchase for many americans. Nationwide offers alabama homeowners insurance that provides reliable protection at rates you can afford. Usaa is backed by an a financial rating from a m.

Home insurance can vary from state to state. Power and boasts a strong history of military values so you know you can trust the service you will receive. The table below shows the average rates for the five largest home insurance companies in alabama. Though the crime rate is low auburn homeowners have to deal with ongoing threats from serious storm systems.

In fact usaa is the fourth largest homeowners insurance writer in alabama with 8 percent of the market share. Is 1 211 but in alabama the average is somewhat higher at 1 754. Rates can be significantly affected by the weather patterns which in alabama includes strong thunderstorms some of the most deadly tornadoes in american history and related weather patterns. Study has found that alabama residents can expect to pay 144 95 per month for their homeowners insurance.

Average cost of homeowners insurance in alabama.