Business Insurance Deductible

Costs you pay for most kinds of business insurance are deductible for tax purposes on your business income tax forms.

Business insurance deductible. The policyholder can then invest the savings in the business. In most cases you choose the deductible from a range of options. According to the irs business expenses guide you can deduct the ordinary and necessary cost of insurance as a business expense that could include. General liability insurance this policy covers legal expenses when your business is sued over third party bodily injuries on your property property damage your business causes and advertising injuries.

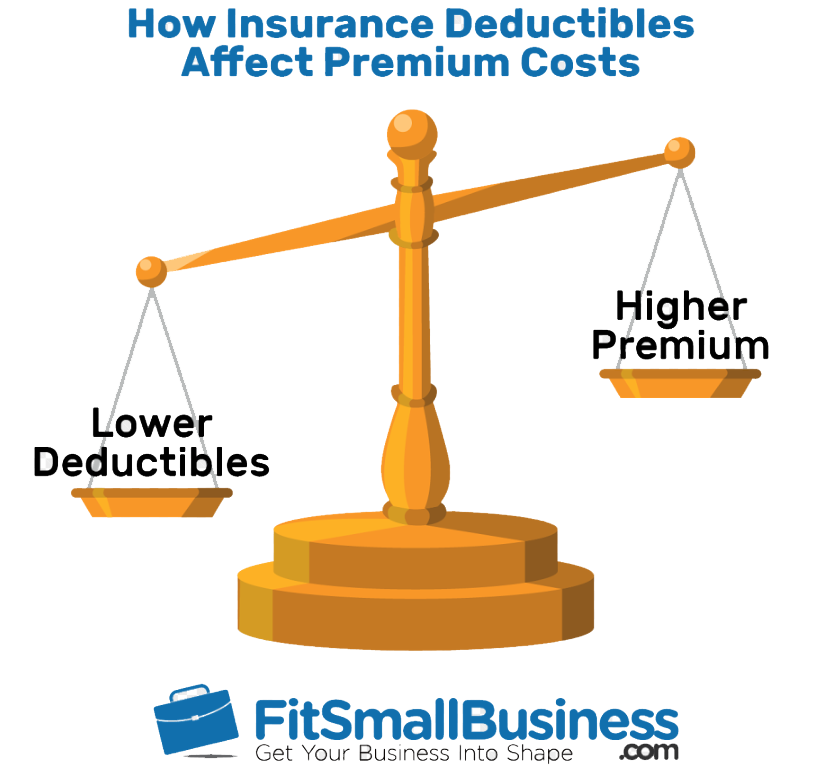

A deductible is a type of self insurance a policyholder that accepts some risk in the form of a higher deductible will pay a lower premium. For health insurance special rules apply part of the premiums may be a tax credit rather than a deduction. Self employed health insurance is not a business expense but rather a deductible. Insurance for work injury compensation.

A higher deductible usually means a lower insurance premium. Refer to home office deduction and publication 587 business use of your home for more information. The amount of any deductible will be shown on your policy declarations. Business interruption insurance premiums or at least the additional cost of the rider are tax deductible as ordinary business expenses this type.

Keyman insurance to cover loss of profit due to the demise or incapacity of a keyman of the business. For more details see e tax guide on deductibility of keyman insurance premiums pdf 56kb. The availability of deductibles gives policyholders some choice in how they utilize their premium dollars. If you use part of your home for business you may be able to deduct expenses for the business use of your home.

These expenses may include mortgage interest insurance utilities repairs and depreciation. This includes personal expenses such as travel or entertainment not related to the running of the business and capital expenses such as expenses incurred to incorporate a company and purchase of fixed assets. However a deductible will always apply to allstate s building and business personal property coverages. Is your small business insurance tax deductible.

Business use of your car. Expenditure is incurred for the purpose of insuring against statutory liability under the work injury compensation act as an employer. Understanding business interruption insurance. Not all coverages have a deductible.

Non deductible business expenses non deductible business expenses are activities you or your employees pay for that do not fulfil the conditions above. Below is a look at the various types of business insurance and their deductibility and info where to deduct these business insurance expenses depending on your business type and tax form.