American Tax Releif

The act made many tax cuts introduced between 2001 and 2010 permanent and extended.

American tax releif. Find out how quickly you could free yourself from the burden of high interest debt. Government is cracking down on undisclosed foreign accounts and assets held overseas. 2313 enacted january 2 2013 was passed by the united states congress on january 1 2013 and was signed into law by us president barack obama the next day. General extensions sec.

The chart below includes recent ftc cases that resulted in refunds. If you d like to know more about how the refund program works visit this page about the ftc s process. In the final hour of january 1 2013 congress passed the american taxpayer relief act of 2012 act which in part addressed the dramatic sunset of favorable federal estate gift and generation skipping tax exemption limits. The company was founded in 1999 and offers tax relief services to individuals and businesses in state across the usa.

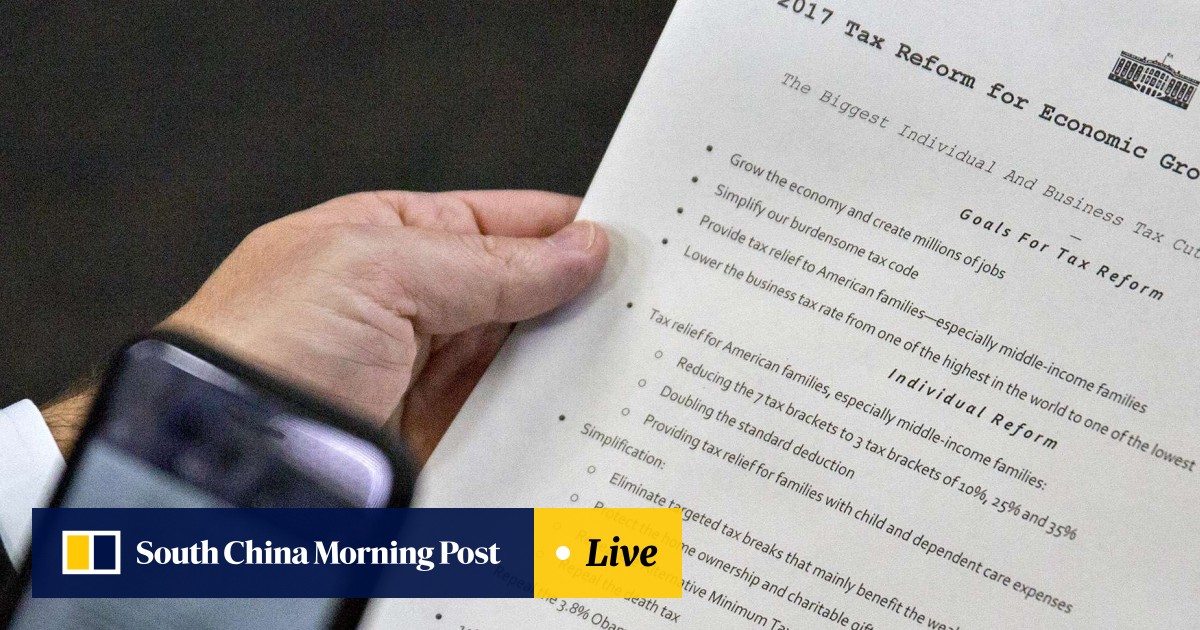

The act centers on a partial resolution to the us fiscal cliff by addressing the expiration of certain provisions of the economic growth and tax relief. The ftc enforces consumer protection laws to stop illegal business practices and get refunds to people who lost money. American tax group is committed to ensuring you are in compliance with the tax laws of the united states. 101 makes permanent the economic growth and tax relief reconciliation act of 2001 for individual taxpayers whose taxable income is at or below a 400 000 threshold amount 450 000 for married couples filing a joint return.

The american taxpayer relief act of 2012 atra. Numerous tax cuts enacted between 2001 and 2010 were scheduled to expire after 2012 part of the fiscal cliff that threatened to cut short nascent recovery from the great recession. American tax relief is a tax relief company based in beverly hills ca. American taxpayer relief act of 2012 title i.

American tax relief llc d b a american tax relief alexander seung hahn a k a alex hahn individually and as an officer or director of american tax relief llc joo hyun park a k a joo park individually and as an officer or director of american tax relief llc defendants and young soon park a k a young s. Our proven program provides the relief you need without taking on another loan or declaring bankruptcy. At american debt relief we help people just like you get debt free in as few as 24 months. The american taxpayer relief act of 2012 made permanent most of the income tax cuts enacted between 2001 and 2010 and extended other temporary tax provisions for between one and five years.

During 2012 these exemptions indexed for inflation were set at 5 120 000 each up from 5 000 000 in 2011. Federal trade commission plaintiff v. The american taxpayer relief act of 2012 is a bill signed into law by president barack obama in jan.