Ar Factoring

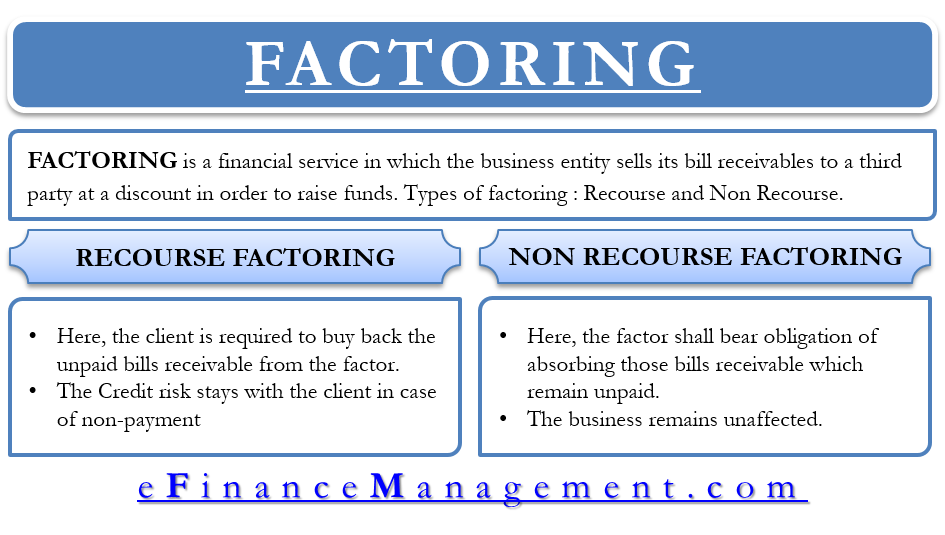

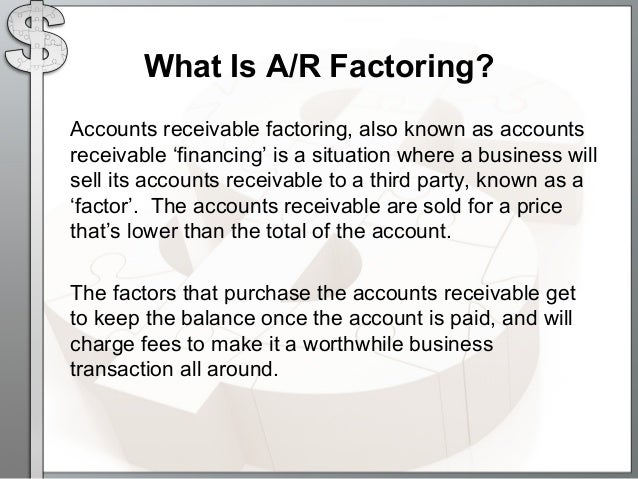

Accounts receivable factoring also known as factoring is a financial transaction in which a company sells its accounts receivable accounts receivable accounts receivable ar represents the credit sales of a business which are not yet fully paid by its customers a current asset on the balance sheet.

Ar factoring. Companies allow their clients to pay at a reasonable. Ar factoring is an ideal tool for small and medium sized businesses that cannot obtain bank financing but have solid paying customers. Introduction to ar factoring. The factoring company then collects payment on those invoices from your customers.

It is a financing procedure where you sell your invoices at a discount to a financial firm called a factor. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Accounts receivable factoring is a solution that allows business owners to quickly turn invoices into working capital.

Other common names for this product are factoring and invoice factoring. Factoring is sometimes referred to as accounts receivable financing. Accounts receivable ar financing is a type of financing arrangement in which a company receives financing capital related to a portion of its accounts receivable. Call 888 400 5930 or use the fast safe secure online funding application.

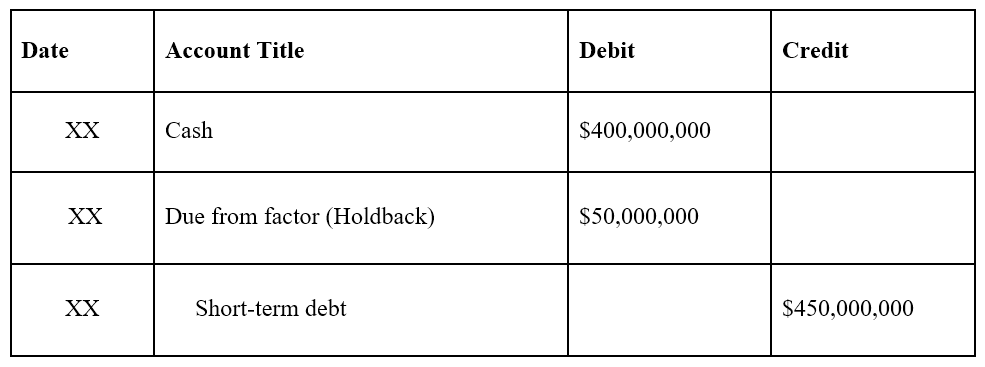

Want to talk more about ar factoring. The discount is usually in the 2 through 5 range. How ar factoring works. Accounts receivable factoring is a form of business funding.

Using accounts receivable factoring you sell your outstanding invoices at a discount to a financial company called a factor. It is not a. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. If your business is struggling to keep up with expenses or pay its taxes or if you need immediate funds to get over a specific hurdle you might want to consider accounts receivable factoring.

It allows companies to finance their accounts receivable from slow paying customers.