Auto Insurance Quote California

Get a free california car insurance quote today.

Auto insurance quote california. Drivers convicted of a dui will need to file an sr 22 car insurance form. California requires drivers. Drivers in california must show financial responsibility usually this means drivers must carry proof of car insurance. The best cheap car insurance companies for the average california driver in 2020.

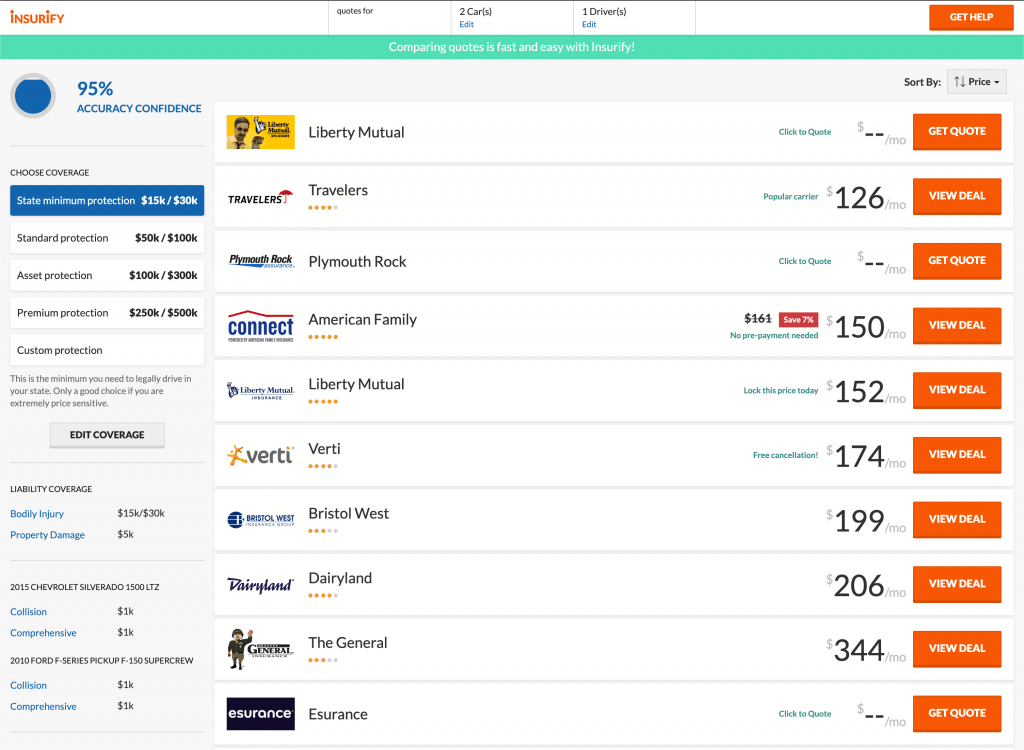

We collected auto insurance quotes for california cities from eight car insurance companies. To totally comprehend the distinction between minimum responsibility insurance coverage as well as the quantity of coverage you actually need call a state farm representative now. The sr 22 form is filed by a driver s car insurance company with the state and verifies that the driver is carrying auto insurance up to an amount required by the state. We work with over 90 per cent of canadian auto insurance providers to find you the best deal the largest network of insurers in the country.

15 000 per person 30 000 per accident. You can get a free car insurance quote with geico online to find out. So how much is car insurance in california for your ride. Minimum california car insurance coverage.

Car insurance quote online that created typical annual rates to spike by 1 000 or even more in some states while others leapt without a doubt less. At kanetix ca we compare quotes from more car insurance companies than anywhere else. Nationwide offers personalized coverage options discounts and auto insurance you can rely on. Typically california drivers mandated to maintain an sr 22 filing must do so for three years.

Most california drivers will be able to choose from california car insurance companies like state farm farmers allstate berkshire hathaway and progressive as well as usaa which offers insurance to members of the military and veterans and their families according to the national association of insurance. Bodily injury liability coverage and property damage liability coverage. California also has some unique car insurance laws that make insuring a vehicle here different than other states so read on to stay up to speed. Our sample driver was a 30 year old man who drives a 2015 honda civic ex.

California law sets minimum liability coverage limits of 15 30 5. In california this proof can also take the form of a 35 000 deposit with the dmv a 35 000 surety bond or a dmv issued self insurance certificate. California drivers must have two types of auto liability coverage on their car insurance policies. Bodily injury to others.

You won t find a better price anywhere else.

/cdn.vox-cdn.com/uploads/chorus_image/image/45826352/Google_Auto_Insurance.0.0.png)