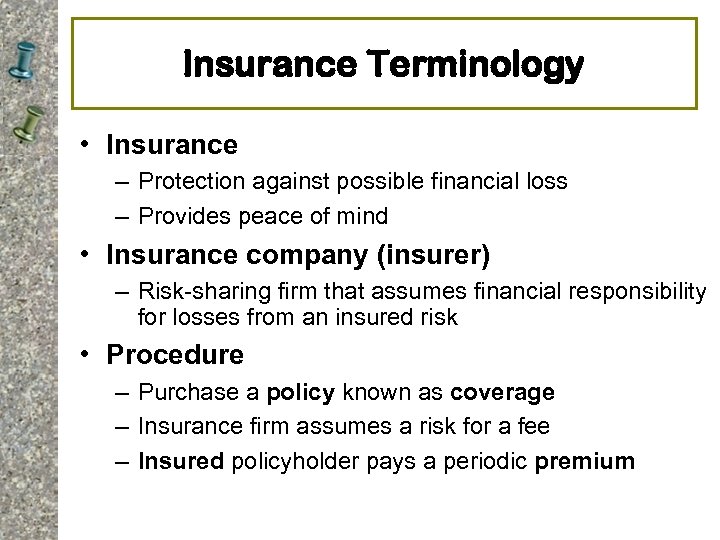

Automobile Insurance Terminology

The insurance covers losses to the insured s property and losses for which the insured is liable as a result of owning or operating an auto.

Automobile insurance terminology. For example a state might require all drivers to have liability. Each state sets a minimum for how much liability coverage a motorist must carry. Policy documents contain a number of insurance terms because they typically define the limitations of risk and liability on the insured and any exclusions of coverage. A glossary of auto insurance terms can really help you understand your policy as you deal with a claim.

It can also help you compare car insurance rates accurately as you re shopping for car. Third party person other than the insured or insurer who has incurred losses or is entitled to receive payment due to acts or omissions of the. If you want to pay the lowest rates and have the right amount and types of auto insurance coverage you need to know these commonly used words. The termination of a home or auto insurance policy during the policy term.

The name for assigned risk plans. Requirements for liability car insurance. Term period of time for which policy is in effect. These are plans set up and monitored by the state.

An insurance company can only cancel an insurance policy for reasons stated in the policy and permitted under the law of the state in which the policyholder resides. In most states proof of insurance takes the form of a minimum amount of automobile liability insurance but some states permit self insurance or a financial responsibility bond. Term insurance life insurance payable only if death of insured occurs within a specified time such as 5 or 10 years or before a specified age. While you don t need an auto insurance terms glossary to understand the meaning of a limit it has a specific meaning in the context of your vehicle coverage.

A policyholder s request for reimbursement from an insurance company for a loss of property. Auto insurance provides protection from losses resulting from owning and operating an auto. Free look period an insurer may cancel an auto insurance policy for any reason during the free look period which is usually the first 30 days of the policy. Updated on monday february 12 2018 by steve bowen.

Our insurance terms glossary is divided alphabetically by insurance terms in a quick reference guide to assist understanding the language commonly used by insurance companies. Terms used in the claims process. 10 common car insurance terms.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

/GettyImages-1012103542-a527d1f380024d5b87c02b255c1d4049.jpg)