Bank Loan For New Business

Or read below to get details on the business growth loan benefits you can enjoy with hdfc bank.

Bank loan for new business. Keeping this in mind we at icici bank have designed a package of loans to best suit their business requirements. If you re new to barclays call us on 0800 515 462 3. Their small business loan is designed with small businesses in mind and offers fixed rate loans from 1 000 to 50 000 that can be repaid over 1 to 10 years. Commercial fixed rate loans booked before this date and those 1m can subject to market conditions incur a break cost which could be substantial.

You can use our business loan calculator to view your indicative monthly instalments based on the principal amount tenor and effective interest rate. A loan with flexible options designed for customers seeking more than 250 000. If the loan is repaid early the bank is entitled to deduct interest of 1 calendar month and 28 days. Business loans up to 100 000.

A three year business loan of up to 250 000 with a six month deferral on repayments with interest capitalised. When you bank with us and as we get to know your business. 1 new commercial fixed rate loans less than or equal to 1m booked after 11th july 2016 will have defined break costs set out in the loan schedule and loan agreement. You can reach out to us via sms chat or phone banking to know more about the features of our business growth loans.

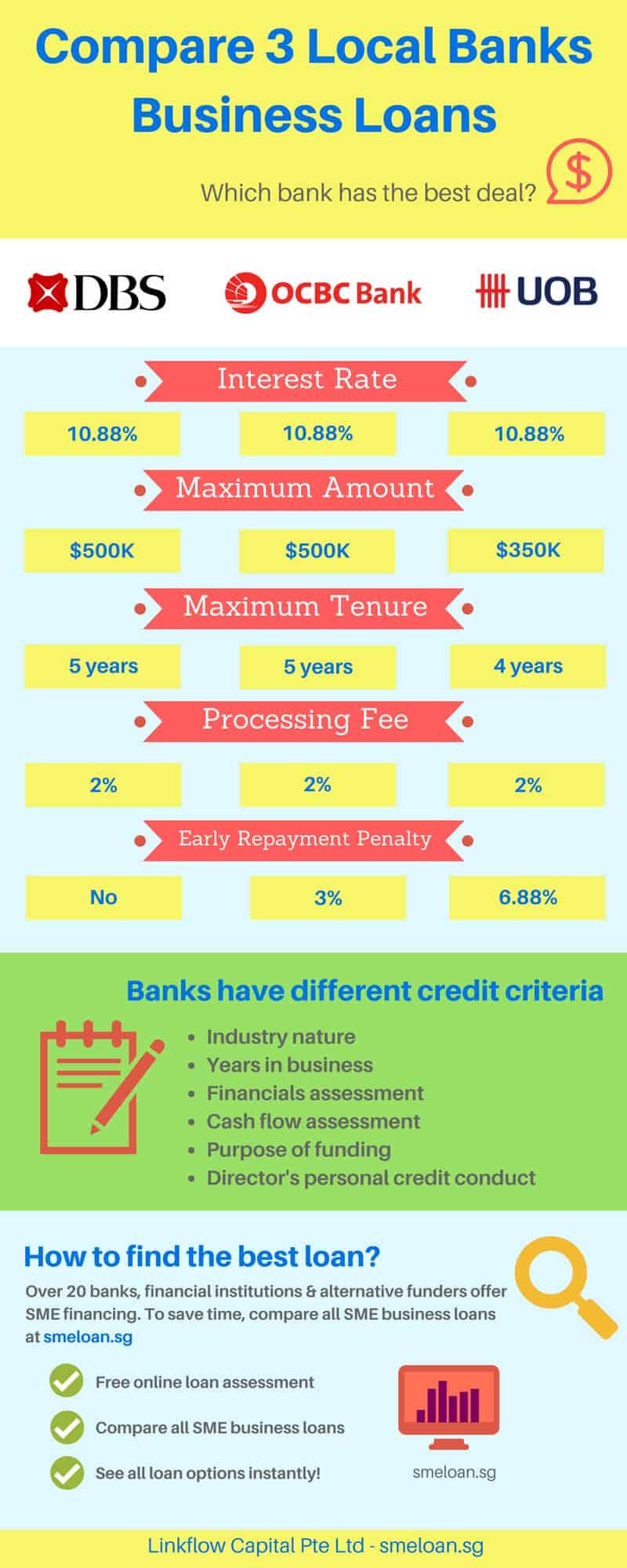

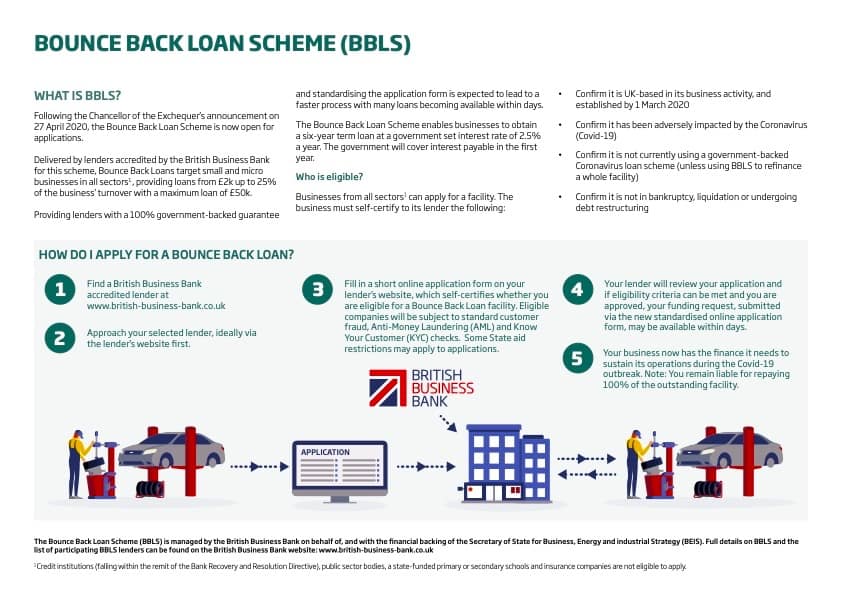

State lawmakers this week approved a new bank of north dakota program for coronavirus business aid. Borrow from 20 000 and choose between a fixed rate or variable rate with flexible repayments. How long does the application process take. For smes timely finance is the key to making the most of business opportunities.

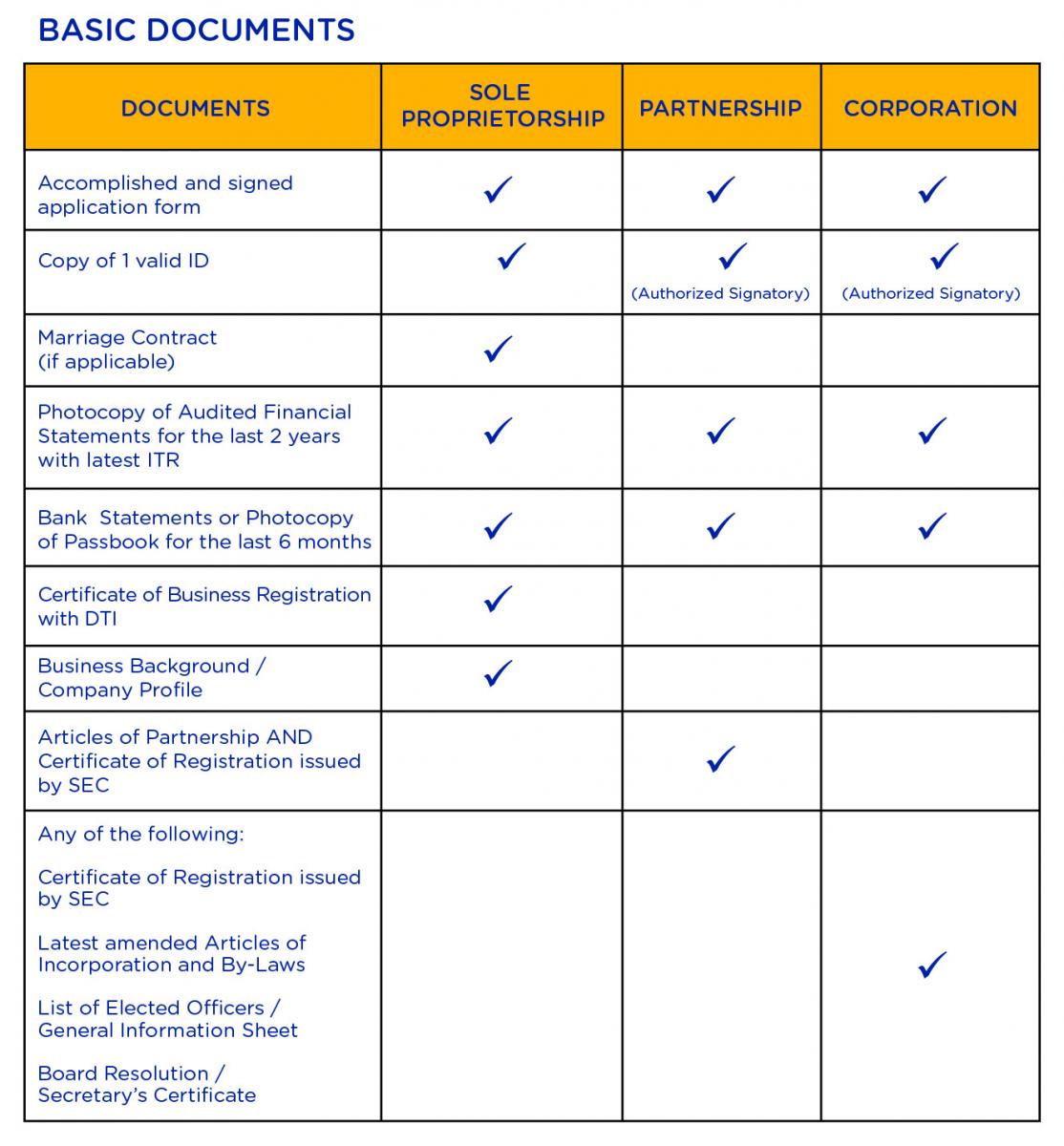

This is automatically included in the calculation of the rebate of interest to give the loan settlement figure. The legislature s budget section on thursday approved the new program in a 40 2 vote. Apply for this unsecured loan if you need a quick and straightforward way to finance your business. For a new business this may be set out in a business plan and cash flow forecasts.

Royal bank of scotland provides a range of banking and lending solutions to new businesses which include bank accounts loans overdrafts asset finance and commercial mortgages. Innovative financing designed to fuel your business. Enjoy our customer friendly business growth loan features such as eligibility checks in just 60 seconds and our credit protect plan. Bank bill business loan.