Banks Going Out Of Business

C only european and middle eastern equities and investment banking operations were acquired.

Banks going out of business. List of bank failures in the united states 2008 present notes a acquired a nearly 80 share in exchange for a us 85 billion loan b only trading assets trading liabilities and head offices were acquired. Bankruptcy happens when a firm a bank included is unable to meet its debt payments at that moment. Bank of america s vast network of branches fell to 4 411 at the end of. That means the lender can also go after the business owner s personal assets cars bank accounts investments and personal tax refunds for example to secure outstanding debt.

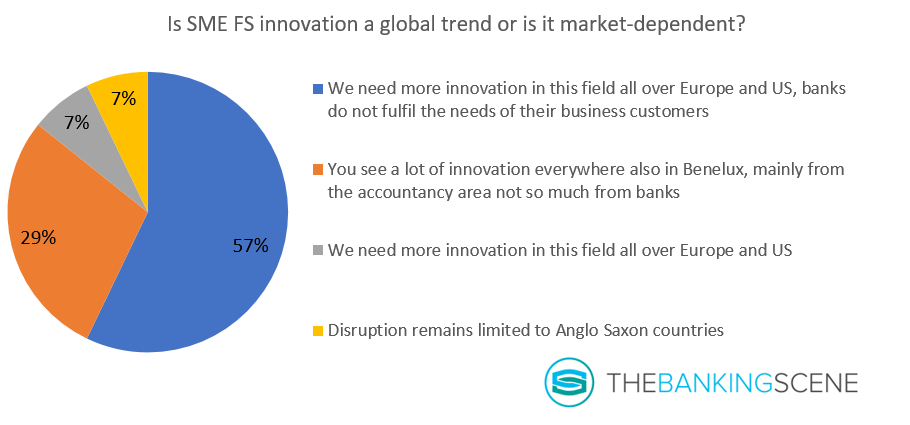

Usually bankruptcy happens not because the firm bank is no longer valuable but because their long term values aren t being converted to cash fast. This page contains useful information for the customers and vendors of these banks. Within 12 years time 80 of financial firms will either go out of business or be rendered irrelevant by new competition changing customer behaviour and advancements in technology according to. The smaller banks have nowhere to go because their local markets are shrinking and because information technology is going to dominate the financial industry going forward.

The rapid adoption of mobile banking has allowed big banks to massively shrink the number of expensive branches they operate. This includes information on the acquiring bank if applicable how your accounts and loans are affected and how vendors can file claims against the receivership.