Best Small Business Line Of Credit

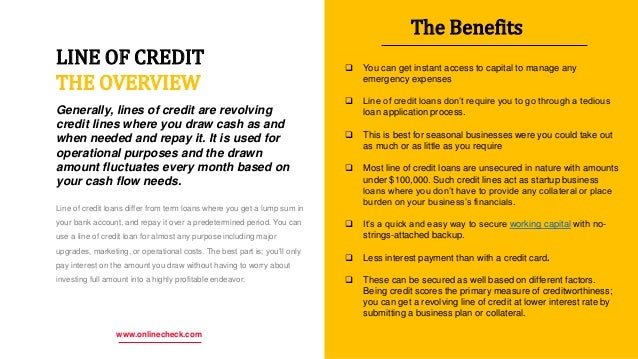

The best small business line of credit lenders base the credit limit on various factors including a business owner s credit score time in business annual revenues liquidity and cash flow coverage.

Best small business line of credit. Best unsecured business line of credit. Ondeck if you have a credit score of at least 600 you could qualify for a small business line of credit. A business line of credit is a possible option for a small or start up business to get the capital needed to manage cash flow fund day to day operations and take advantage of new opportunities. Credit cards should be used for small daily purchases as lines of credit typically aren t very liquid.

It s kind of like a business credit card but lines of credit usually work better for large working capital expenses. Our two cents the best small business line of credit for debt commitment phobes you ll need to pay back what you borrowed in 12 or 24 weeks. The best thing about a business line of credit is that you can get approved in as quick as 24 hours. Best for fair credit ondeck.

Our picks for the best business lines of credit come with limits ranging from 10 000 to 3 million. You can even use your business line of credit to build your credit score. Some interest rates are variable and fluctuate with the economy. Lines of credit are usually smaller than term loans.

Even better even if you have a low credit score you have the chance to get approved for a business line of credit.

/how-letters-of-credit-work-315201-final-5b51ed66c9e77c0037974e85.png)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)