Builders Liability Insurance What Does It Cover

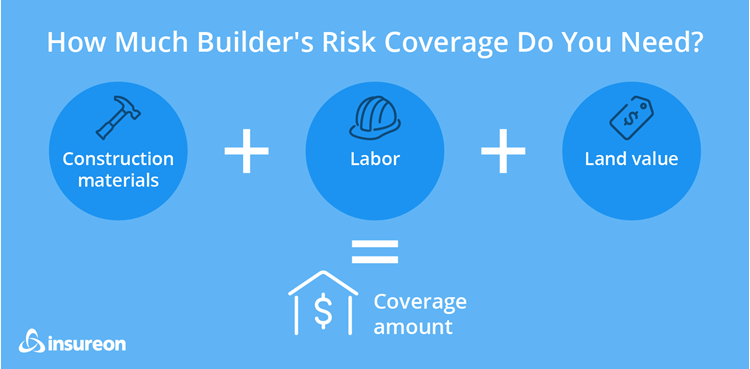

Builders risk insurance also known as course of construction coc insurance or sometimes construction all risk insurance is insurance coverage for buildings and other structures while they are under construction.

Builders liability insurance what does it cover. What does builder s public liability insurance cover. What is public liability insurance for builders. Included with your builders public liability insurance you ll automatically get 1 000 of 24 hour tools insurance if you choose classic or plus level. This insurance protects the contractor s interest in the equipment the value of the property and the materials while they are being used in the construction.

Homeowners insurance will also provide coverage in case of a fire or storm damage. It s a form of insurance that covers a building where the building or insured area is presently being constructed. But you get much more than this as part of your policy. If your construction work puts third parties like pedestrians and bystanders at risk or has the potential for their possessions to be harmed by your work activity or equipment then a public liability policy has you covered.

Whether it s just you or you have others working with you it s protection for your business and your customers. While you can t stop them from happening you can make sure you re covered. Homebuyers should purchase a home insurance policy with liability coverage in addition to the builders risk insurance policy says brunetto. If someone makes a claim against you public liability insurance offers you protection that could cover your legal costs and any compensation you might need to pay.

Builders risk insurance also known as course of construction or inland marine coverage is defined as insurance that protects a person s or organization s insurable interest in materials fixtures and or equipment awaiting installation or after installation during the construction or renovation of a building or structure should those items sustain physical loss or damage from a covered loss. Liability coverage is critical for a construction site because of the risk that someone working on the site or a child or a visitor to the site could be injured she says. Builders insurance protects you against the cost of accidents and mistakes at work. If this is your first home review insurance for new homeowners for tips before you purchase.

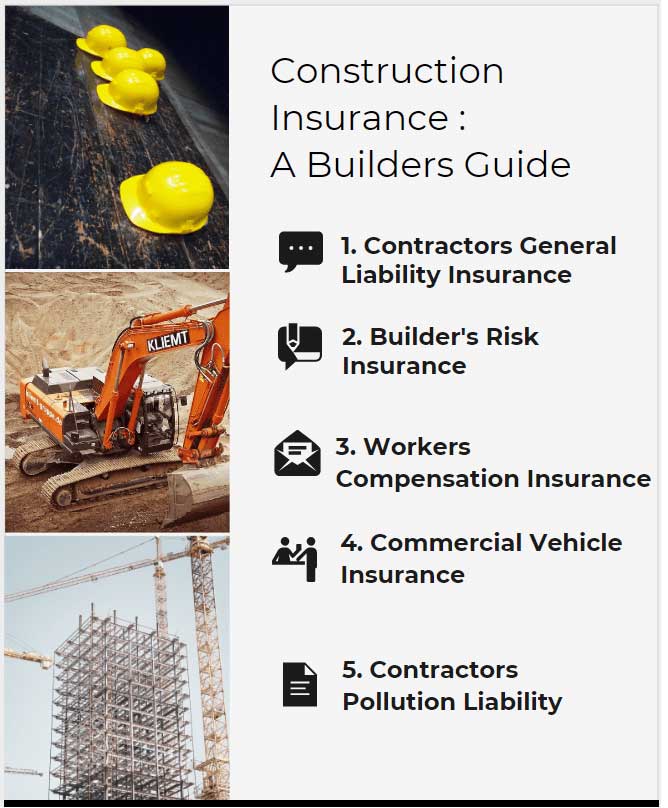

More specifically the insurance policies will usually have options to cover the following types of property. When you take out builders construction insurance with us choose public liability cover of 1 million 2 million or 5 million to protect you against claims. Builders insurance or construction and public liability insurance or contract works protects builders in the building professional against accident or damage caused by negligence or unforeseen occurrences. Builders risk covers the contractor s materials equipment and property related to the building being constructed.

Protection from big claims like accidental injury or damage.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/122497422_506fd5e9e9_o-57a7cfb53df78cf4597444fd.jpg)