Business Credit Card Cash Advance

A cash advance on your credit card is an amount of cash borrowed against your credit limit.

Business credit card cash advance. That means you have to pay it back with interest. This can prove a great alternative to business credit card cash advances. With a cash advance you re essentially borrowing against the value of future credit and debit card transactions. Using your company credit card to withdraw cash is known as a cash advance and it s generally a bad idea.

Some issuers may restrict the amount of your available credit that you can use for cash. Interest rates on cash advances are higher than those on regular purchases for the first year only and there is a foreign transaction fee of 1. A small percentage of your future sales will be used to repay the cash advance. Similar to a traditional bank check such as for a checking account a credit card convenience check can be used to deposit cash advance funds directly into your bank account.

That s because card issuers usually charge a cash advance fee of around 3. A 0 intro apr business credit card. Once a pin has been established obtaining a cash advance from a credit card can be performed at any participating atm. It s like withdrawing money from the atm with your debit card except the cash comes from your credit limit rather than your bank account balance.

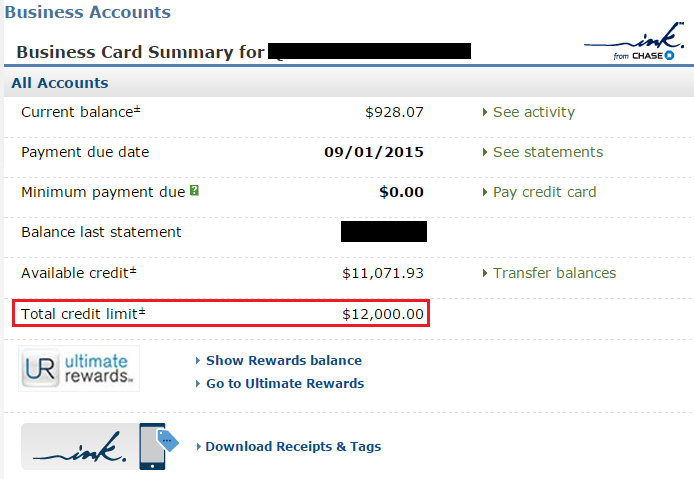

To get a cash advance you will need a credit card that has available credit. As you might figure out from the name 0 intro apr credit cards start off with a period of no interest on your card so you can go month to month without paying off your balance in full. A cash advance from your business credit card allows you to immediately get cash by drawing from your credit card s line of credit. What is a business credit card cash advance.